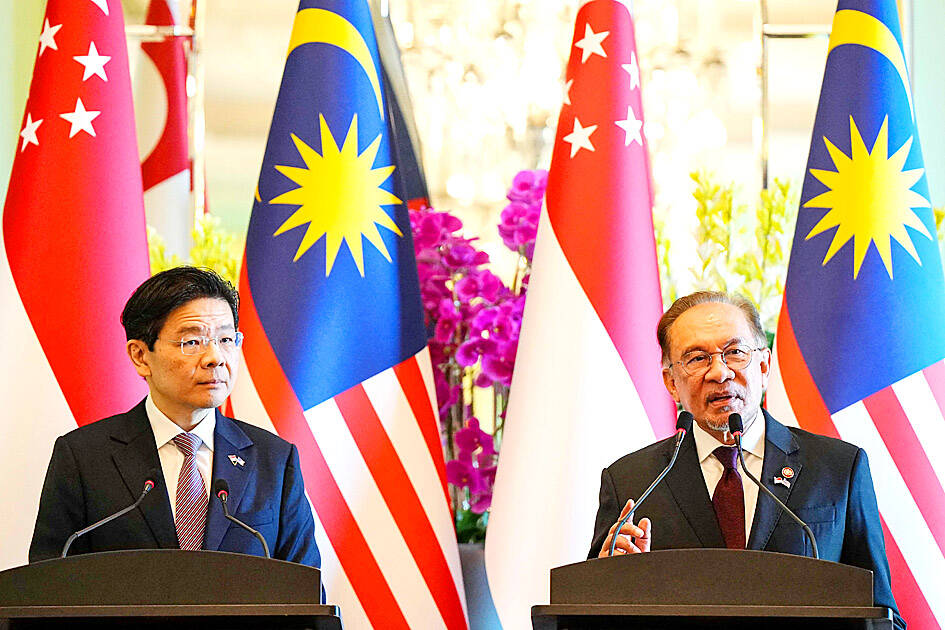

Malaysian and Singaporean leaders yesterday signed an agreement to create a special economic zone to attract global investment, and ease the cross-border flow of goods and people.

Malaysian Prime Minister Anwar Ibrahim called the Johor-Singapore special economic zone a “unique initiative” that harnesses each other’s strengths and deepens linkages in a world that is becoming more polarized.

“Very rarely you find two countries working together as a team,” he told a joint news conference after the signing ceremony. “These two countries have a common strategy, to assist one another, to work and benefit from each other’s strengths... This is the new attitude we must have other than talking always in terms of rivalry and unnecessary conflicts.”

Photo: AFP

The zone, in Malaysia’s southernmost Johor state, is to offer tax breaks and include several flagship areas for various sectors, from manufacturing and aerospace to tourism, energy and healthcare.

Officials are targeting attracting 50 projects within the economic zone in the first five years, creating 20,000 skilled jobs. The move is a boon to Singapore, a global financial hub with scarce natural resources and land.

Singaporean Prime Minister Lawrence Wong (黃循財) said its neighbor’s strong linkages are an important foundation and building block for an integrated region. Malaysia is chair this year of 10-member ASEAN.

“Where ASEAN is concerned, we are talking about not just more trade and investment linkages, but infrastructure linkages, including the ASEAN power grid. These are all good projects that Singapore will support and we hope under Malaysia’s leadership, we can make good progress,” Wong said.

“The greater competition we face is not among ourselves within ASEAN, it’s outside of the region ... so ASEAN has to come together, look at ways in which we can enhance our value proposition and be competitive together,” he said.

Separately, the Indian government is considering fresh subsidies for makers of electronic components and cutting tariffs on imports to help boost local manufacturing, especially of smartphones made by companies such as Apple Inc.

The Indian Ministry of Electronics and Information Technology proposed giving manufacturers of components such as batteries and camera parts at least 230 billion rupees (US$2.7 billion) in support, said people familiar with the matter, who asked not to be identified as the discussions are private.

The ministry also recommended reducing tariffs on some electronic components, an industry demand that would help bring down production costs, one of the people said.

A final decision on the proposals is to be made by the Cabinet, and if approved, details could be announced next month in the government’s upcoming budget, the people said.

Some of the components being targeted by the proposed subsidy include microprocessors, memory, storage, multilayered printed circuit boards, camera components such as lens, and lithium-ion cells, one of the people said.

The subsidies are likely to differ depending on the component, another person said.

India’s current tariffs on electronic components — ranging from zero to 20 percent — is about 5 percent to 6 percent higher than nations such as China and Malaysia, according to research by government think tank Niti Aayog.

Niti Aayog in a report last year said that the government should rationalize its tariffs and provide fiscal incentives to bolster the production of electronic components in India. The South Asian nation faces tough competition from rivals such as Vietnam in luring foreign businesses looking to diversify their supply chains from China.

Additional reporting by Bloomberg

Intel Corp chief executive officer Lip-Bu Tan (陳立武) is expected to meet with Taiwanese suppliers next month in conjunction with the opening of the Computex Taipei trade show, supply chain sources said on Monday. The visit, the first for Tan to Taiwan since assuming his new post last month, would be aimed at enhancing Intel’s ties with suppliers in Taiwan as he attempts to help turn around the struggling US chipmaker, the sources said. Tan is to hold a banquet to celebrate Intel’s 40-year presence in Taiwan before Computex opens on May 20 and invite dozens of Taiwanese suppliers to exchange views

Application-specific integrated circuit designer Faraday Technology Corp (智原) yesterday said that although revenue this quarter would decline 30 percent from last quarter, it retained its full-year forecast of revenue growth of 100 percent. The company attributed the quarterly drop to a slowdown in customers’ production of chips using Faraday’s advanced packaging technology. The company is still confident about its revenue growth this year, given its strong “design-win” — or the projects it won to help customers design their chips, Faraday president Steve Wang (王國雍) told an online earnings conference. “The design-win this year is better than we expected. We believe we will win

Chizuko Kimura has become the first female sushi chef in the world to win a Michelin star, fulfilling a promise she made to her dying husband to continue his legacy. The 54-year-old Japanese chef regained the Michelin star her late husband, Shunei Kimura, won three years ago for their Sushi Shunei restaurant in Paris. For Shunei Kimura, the star was a dream come true. However, the joy was short-lived. He died from cancer just three months later in June 2022. He was 65. The following year, the restaurant in the heart of Montmartre lost its star rating. Chizuko Kimura insisted that the new star is still down

While China’s leaders use their economic and political might to fight US President Donald Trump’s trade war “to the end,” its army of social media soldiers are embarking on a more humorous campaign online. Trump’s tariff blitz has seen Washington and Beijing impose eye-watering duties on imports from the other, fanning a standoff between the economic superpowers that has sparked global recession fears and sent markets into a tailspin. Trump says his policy is a response to years of being “ripped off” by other countries and aims to bring manufacturing to the US, forcing companies to employ US workers. However, China’s online warriors