The downward trend of DRAM chip prices is expected to accelerate this quarter at a quarterly pace of 13 percent at the steepest amid weakness in demand for products such as PCs and server DRAM chips, TrendForce Corp (集邦科技) said on Monday.

The Taipei-based researcher attributed the industry-wide slump to a seasonal downcycle for consumer electronics, primarily smartphones, and sagging demand for PCs, as notebook computer vendors have prebuilt DRAM inventory to cope with the possibility that the US would impose new tariffs after US president-elect Donald Trump takes office on Jan. 20.

Prices of standard DRAM chips, mostly for PCs, are expected to slide 8 to 13 percent sequentially this quarter, deeper than last quarter’s drop, which would be 5 to 10 percent, TrendForce said.

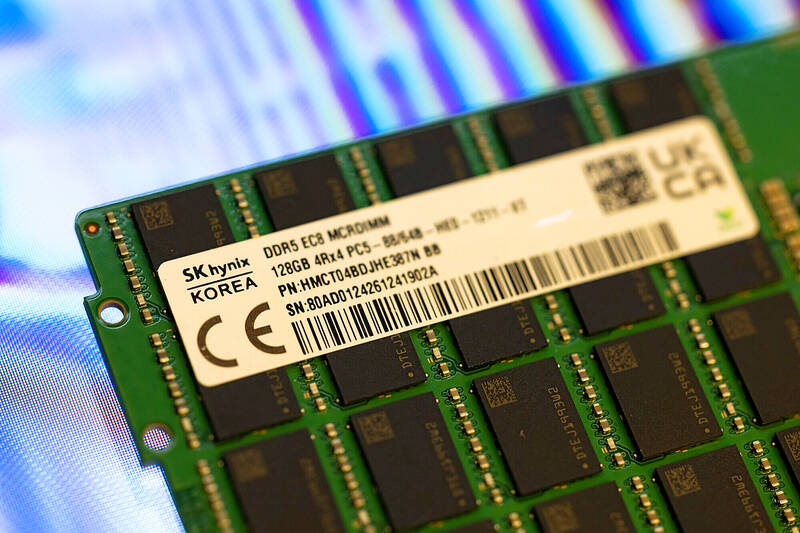

Photo: Bloomberg

Including high-bandwidth memory chips used for servers, standard DRAM prices would be flat or fall at a milder pace of 5 percent quarter-on-quarter this quarter, it said.

Among standard PC DRAM chips, DDR4 chips are to suffer the brunt of demand weakness amid overcapacity in China, with prices likely to plunge 10 to 15 percent this quarter, faster than a quarterly decline of 8 to 13 percent last quarter, TrendForce said.

Nanya Technology Corp (南亞科技), the nation’s biggest DRAM chipmaker, mainly produces DDR4 memory chips and a few older-generation DDR3 memory chips.

The company said it is in the process of migrating part of its DDR4 capacity to the production of DDR5 memory chips, which are used in a wider range of electronic devices than DDR4 chips.

The memorychip maker has reported losses for the past eight quarters.

Server DRAM chip prices would fall 5 to 10 percent this quarter from this quarter due to seasonal weakness, TrendForce said, adding that they are expected to have risen 5 percent at most last quarter.

Prices of DDR4 server DRAM chips are to tumble 10 to 15 percent this quarter, more drastic than last quarter’s decline of 8 to 13 percent amid high inventories on supply chains and increased supply from China, the researcher said.

The prices of DDR5 server DRAM chips are to fall 3 to 8 percent sequentially this quarter, the same as last quarter, it said.

Prices of mobile DRAM chip prices are to dip 3 to 13 percent quarter-on-quarter this quarter, as smartphone makers tend to take a conservative approach to chip sourcing after their inventory returns to healthy levels, TrendForce said.

Prices for DRAM chips used in consumer electronics plummeted 3 to 15 percent, a slide from a quarterly decrease of 5 to 10 percent last quarter, the researcher said.

Sagging demand for consumer electronics and scant room for growth in DRAM content per box are bad news for consumer electronics DRAM chips, TrendForce said.

CHIP WAR: Tariffs on Taiwanese chips would prompt companies to move their factories, but not necessarily to the US, unleashing a ‘global cross-sector tariff war’ US President Donald Trump would “shoot himself in the foot” if he follows through on his recent pledge to impose higher tariffs on Taiwanese and other foreign semiconductors entering the US, analysts said. Trump’s plans to raise tariffs on chips manufactured in Taiwan to as high as 100 percent would backfire, macroeconomist Henry Wu (吳嘉隆) said. He would “shoot himself in the foot,” Wu said on Saturday, as such economic measures would lead Taiwanese chip suppliers to pass on additional costs to their US clients and consumers, and ultimately cause another wave of inflation. Trump has claimed that Taiwan took up to

A start-up in Mexico is trying to help get a handle on one coastal city’s plastic waste problem by converting it into gasoline, diesel and other fuels. With less than 10 percent of the world’s plastics being recycled, Petgas’ idea is that rather than letting discarded plastic become waste, it can become productive again as fuel. Petgas developed a machine in the port city of Boca del Rio that uses pyrolysis, a thermodynamic process that heats plastics in the absence of oxygen, breaking it down to produce gasoline, diesel, kerosene, paraffin and coke. Petgas chief technology officer Carlos Parraguirre Diaz said that in

Japan intends to closely monitor the impact on its currency of US President Donald Trump’s new tariffs and is worried about the international fallout from the trade imposts, Japanese Minister of Finance Katsunobu Kato said. “We need to carefully see how the exchange rate and other factors will be affected and what form US monetary policy will take in the future,” Kato said yesterday in an interview with Fuji Television. Japan is very concerned about how the tariffs might impact the global economy, he added. Kato spoke as nations and firms brace for potential repercussions after Trump unleashed the first salvo of

SUPPORT: The government said it would help firms deal with supply disruptions, after Trump signed orders imposing tariffs of 25 percent on imports from Canada and Mexico The government pledged to help companies with operations in Mexico, such as iPhone assembler Hon Hai Precision Industry Co (鴻海精密), also known as Foxconn Technology Group (富士康科技集團), shift production lines and investment if needed to deal with higher US tariffs. The Ministry of Economic Affairs yesterday announced measures to help local firms cope with the US tariff increases on Canada, Mexico, China and other potential areas. The ministry said that it would establish an investment and trade service center in the US to help Taiwanese firms assess the investment environment in different US states, plan supply chain relocation strategies and