US President Joe Biden’s administration plans to raise tariffs on solar wafers, polysilicon and some tungsten products from China to protect US clean energy businesses.

The notice from the Office of US Trade Representative (USTR) said tariffs on Chinese-made solar wafers and polysilicon would rise to 50 percent from 25 percent and duties on certain tungsten products would increase from zero to 25 percent, effective on Jan. 1, following a review of Chinese trade practices under Section 301 of the US Trade Act of 1974.

The decision followed a public comment period after the USTR said in September that it was considering such actions.

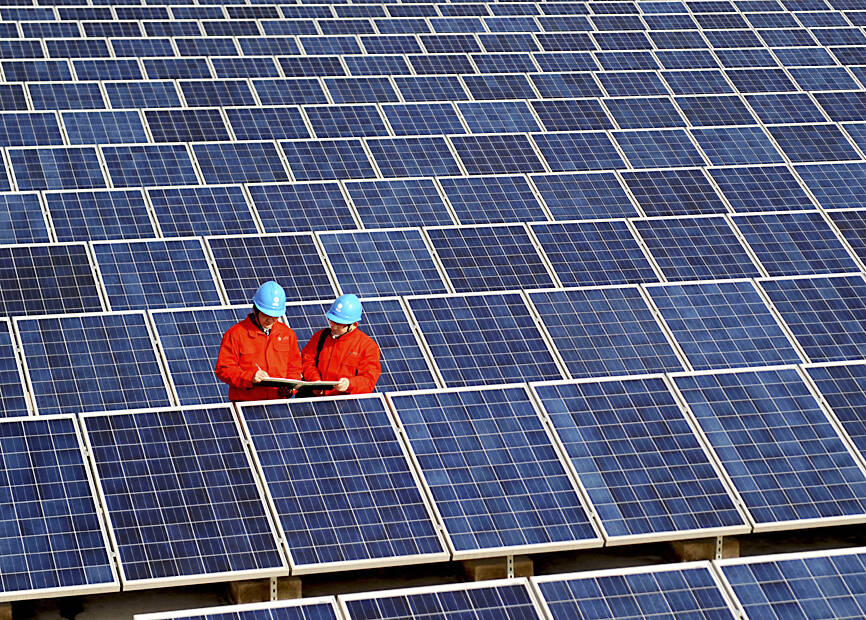

Photo: AP

“The tariff increases announced today will further blunt the harmful policies and practices by the People’s Republic of China,” US Trade Representative Katharine Tai (戴琪) said in a statement. “These actions will complement the domestic investments made under the Biden-Harris Administration to promote a clean energy economy, while increasing the resilience of critical supply chains.”

Last week, Washington tightened restrictions on Chinese access to advanced semiconductor technology. Beijing responded by banning exports to the US of certain critical minerals needed to make computer chips, such as gallium, germanium and antimony. It also stepped up its controls on graphite exports to the US.

China provides a very large share of most of those materials, and the US has been working to secure alternative sources in Africa and other parts of the world.

Tungsten is another strategically vital metal whose production is dominated by China. The US does not produce it, but South Korea is a potential big supplier. It is used to make armaments and is also used in X-ray tubes and light bulb filaments, among other industrial applications.

US imports of the metal from China fell to US$10.9 million last year from US$19.5 million the year before.

Trade frictions have been escalating ahead of the inauguration of US president-elect Donald Trump, who has vowed to impose 60 percent tariffs on Chinese goods, among other threats. Biden’s administration has kept in place tariffs that Trump imposed during his first term in office, but says it has a more targeted approach.

China has sharply ramped up production of cheap electric vehicles (EVs), solar panels and batteries at a time when the Biden administration has championed moves to support those industries in the US.

The US and other trading partners say China improperly subsidizes exports, giving exporters of solar panels and other products an unfair advantage in overseas markets, where its manufacturers charge lower prices thanks to government support.

China accounts for more than 80 percent of the market for solar panels at all stages of production, according to the International Energy Agency, which is more than double its domestic demand for those products. Its huge economies of scale have made solar power more affordable, but also concentrated the supply chain inside China.

The agency has urged other countries to assess their solar panel supply chains and develop strategies to address any risks.

GREAT SUCCESS: Republican Senator Todd Young expressed surprise at Trump’s comments and said he expects the administration to keep the program running US lawmakers who helped secure billions of dollars in subsidies for domestic semiconductor manufacturing rejected US President Donald Trump’s call to revoke the 2022 CHIPS and Science Act, signaling that any repeal effort in the US Congress would fall short. US Senate Minority Leader Chuck Schumer, who negotiated the law, on Wednesday said that Trump’s demand would fail, while a top Republican proponent, US Senator Todd Young, expressed surprise at the president’s comments and said he expects the administration to keep the program running. The CHIPS Act is “essential for America leading the world in tech, leading the world in AI [artificial

DOMESTIC SUPPLY: The probe comes as Donald Trump has called for the repeal of the US$52.7 billion CHIPS and Science Act, which the US Congress passed in 2022 The Office of the US Trade Representative is to hold a hearing tomorrow into older Chinese-made “legacy” semiconductors that could heap more US tariffs on chips from China that power everyday goods from cars to washing machines to telecoms equipment. The probe, which began during former US president Joe Biden’s tenure in December last year, aims to protect US and other semiconductor producers from China’s massive state-driven buildup of domestic chip supply. A 50 percent US tariff on Chinese semiconductors began on Jan. 1. Legacy chips use older manufacturing processes introduced more than a decade ago and are often far simpler than

Hon Hai Precision Industry Co (鴻海精密) yesterday said that its research institute has launched its first advanced artificial intelligence (AI) large language model (LLM) using traditional Chinese, with technology assistance from Nvidia Corp. Hon Hai, also known as Foxconn Technology Group (富士康科技集團), said the LLM, FoxBrain, is expected to improve its data analysis capabilities for smart manufacturing, and electric vehicle and smart city development. An LLM is a type of AI trained on vast amounts of text data and uses deep learning techniques, particularly neural networks, to process and generate language. They are essential for building and improving AI-powered servers. Nvidia provided assistance

Gasoline and diesel prices this week are to decrease NT$0.5 and NT$1 per liter respectively as international crude prices continued to fall last week, CPC Corp, Taiwan (CPC, 台灣中油) and Formosa Petrochemical Corp (台塑石化) said yesterday. Effective today, gasoline prices at CPC and Formosa stations are to decrease to NT$29.2, NT$30.7 and NT$32.7 per liter for 92, 95 and 98-octane unleaded gasoline respectively, while premium diesel is to cost NT$27.9 per liter at CPC stations and NT$27.7 at Formosa pumps, the companies said in separate statements. Global crude oil prices dropped last week after the eight OPEC+ members said they would