Machinery exports last month fell 1.4 percent year-on-year, a reversal of the previous month’s 2.1 percent growth, the Taiwan Association of Machinery Industry (台灣機械公會) said in a report yesterday.

Machinery exports totaled US$2.45 billion last month, compared with US$2.49 billion a year earlier, data compiled by the association showed.

On a monthly basis, machinery exports increased 2.6 percent from US$2.39 billion, the data showed.

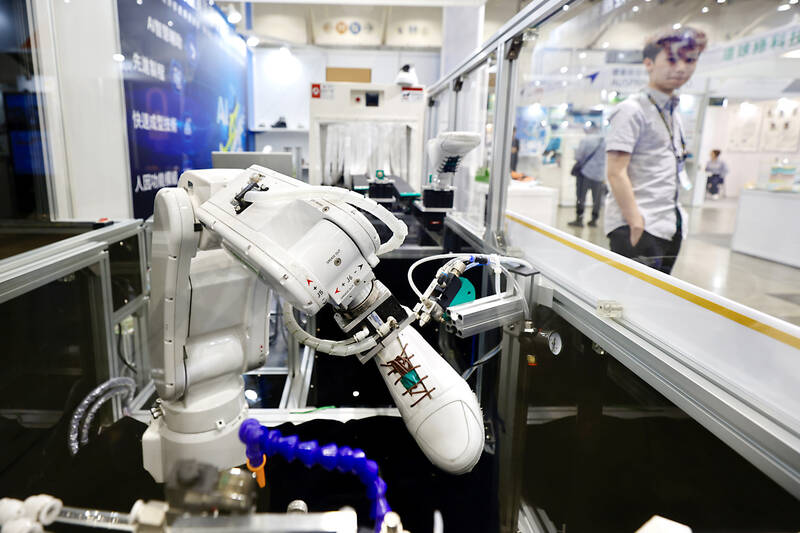

Photo: Ritchie B. Tongo, EPA-EFE

In the first 11 months of this year, machinery exports totaled US$26.66 billion, down 0.6 percent from US$26.86 billion in the same period last year, the association said.

Local machinery makers would see a gradual recovery in orders with room for improvement in the US market in particular, it said.

The association based its optimism on the latest export order statistics unveiled by the Ministry of Economic Affairs on Nov. 20, which showed that orders for machinery products and mechanical equipment had risen annually for four consecutive months through October.

However, as US president-elect Donald Trump has proposed tariff policies that he said would help shift manufacturing to the US, Taiwanese exporters must make early preparations to mitigate risk, even though the scope of the tariff impact needs to be monitored closely, it said.

Moreover, the unfavorable foreign exchange rates, such as the recent plunges in the yen and won, would weigh on local manufacturers in receiving orders, it added.

The US and China remained the two largest buyers of Taiwanese machinery goods during the 11-month period, at US$6.58 billion and US$6.21 billion respectively, followed by Japan, with purchases totaling US$1.96 billion, the data showed.

Purchases from the US, China and Japan accounted for 24.7 percent, 23.3 percent and 7.4 percent respectively of Taiwan’s machinery exports in the first 11 months, the data showed.

By product, inspection and testing equipment, electronic equipment and machine tools were the local industry’s top three machinery products from January to last month.

The report showed that overseas shipments of electronic equipment increased 3.4 percent year-on-year to US$4.54 billion and those of inspection and testing equipment rose 4 percent to US$4.34 billion, while outbound shipments of machine tools fell 16.2 percent to US$2 billion during the first 11 months.

Machine tool manufacturers are expected to regain momentum next year, as the segment has always been slower than other segments in the machinery industry in terms of business recovery, the association said, adding that it is also because the US market is expected to gradually heat up under Trump’s trade and industry policies.

The association said it maintains a cautiously optimistic view of this segment, as Taiwan’s machine tool exports to the US had shown positive growth for two consecutive months through last month.

Taiwan Semiconductor Manufacturing Co (TSMC, 台積電) would not produce its most advanced technologies in the US next year, Minister of Economic Affairs J.W. Kuo (郭智輝) said yesterday. Kuo made the comment during an appearance at the legislature, hours after the chipmaker announced that it would invest an additional US$100 billion to expand its manufacturing operations in the US. Asked by Taiwan People’s Party Legislator-at-large Chang Chi-kai (張啟楷) if TSMC would allow its most advanced technologies, the yet-to-be-released 2-nanometer and 1.6-nanometer processes, to go to the US in the near term, Kuo denied it. TSMC recently opened its first US factory, which produces 4-nanometer

PROTECTION: The investigation, which takes aim at exporters such as Canada, Germany and Brazil, came days after Trump unveiled tariff hikes on steel and aluminum products US President Donald Trump on Saturday ordered a probe into potential tariffs on lumber imports — a move threatening to stoke trade tensions — while also pushing for a domestic supply boost. Trump signed an executive order instructing US Secretary of Commerce Howard Lutnick to begin an investigation “to determine the effects on the national security of imports of timber, lumber and their derivative products.” The study might result in new tariffs being imposed, which would pile on top of existing levies. The investigation takes aim at exporters like Canada, Germany and Brazil, with White House officials earlier accusing these economies of

GREAT SUCCESS: Republican Senator Todd Young expressed surprise at Trump’s comments and said he expects the administration to keep the program running US lawmakers who helped secure billions of dollars in subsidies for domestic semiconductor manufacturing rejected US President Donald Trump’s call to revoke the 2022 CHIPS and Science Act, signaling that any repeal effort in the US Congress would fall short. US Senate Minority Leader Chuck Schumer, who negotiated the law, on Wednesday said that Trump’s demand would fail, while a top Republican proponent, US Senator Todd Young, expressed surprise at the president’s comments and said he expects the administration to keep the program running. The CHIPS Act is “essential for America leading the world in tech, leading the world in AI [artificial

REACTIONS: While most analysts were positive about TSMC’s investment, one said the US expansion could disrupt the company’s supply-demand balance Taiwan Semiconductor Manufacturing Co’s (TSMC, 台積電) new US$100 billion investment in the US would exert a positive effect on the chipmaker’s revenue in the medium term on the back of booming artificial intelligence (AI) chip demand from US chip designers, an International Data Corp (IDC) analyst said yesterday. “This is good for TSMC in terms of business expansion, as its major clients for advanced chips are US chip designers,” IDC senior semiconductor research manager Galen Zeng (曾冠瑋) said by telephone yesterday. “Besides, those US companies all consider supply chain resilience a business imperative,” Zeng said. That meant local supply would