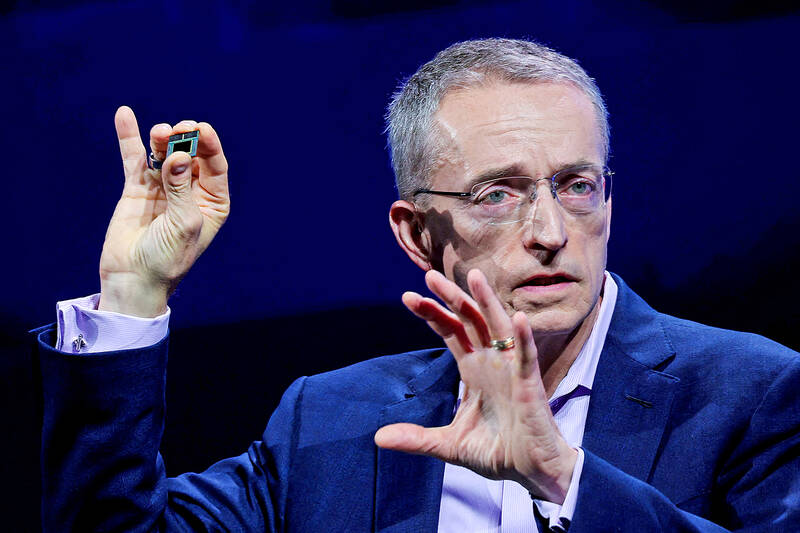

Intel Corp chief executive officer Pat Gelsinger has retired from the company and stepped down from its board of directors just as the company is in the middle of trying to execute a turnaround plan.

Intel chief financial officer David Zinsner and Intel Products CEO Michelle Johnston Holthaus are serving as interim co-CEOs while the board searches for Gelsinger’s replacement, the company said in a statement.

Frank Yeary, independent chair of the board of Intel, is to serve as interim executive chair, the company said.

Photo: Ann Wang, Reuters

Gelsinger’s departure is hitting at a tumultuous time for the US chipmaker. Once the industry leader in computer processors, the company is now working to preserve cash to fund a turnaround plan — one Gelsinger called the “most audacious rebuilding plan” in corporate history.

The company has fallen out of investor favor amid a shift in the semiconductor industry toward artificial intelligence (AI) hardware. Companies are spending on computers built around accelerator chips for AI, an area where Intel’s offerings have barely made a dent.

“While we have made significant progress in regaining manufacturing competitiveness and building the capabilities to be a world-class foundry, we know that we have much more work to do at the company and are committed to restoring investor confidence,” Yeary said in a news release. “As a board, we know first and foremost that we must put our product group at the center of all we do. Our customers demand this from us, and we will deliver for them.”

Shares of the chipmaker jumped more than 4 percent in premarket trading, but ended the day down 0.5 percent. They have lost more than half of their value this year.

Gelsinger started at Intel in 1979 and was its first chief technology officer. He returned to the company as chief executive in 2021 to spearhead a transformation of the chipmaker, which was once at the helm of the US semiconductor industry, but ceded its manufacturing lead to players like Taiwan Semiconductor Manufacturing Co (台積電).

Gelsinger said his exit was “bittersweet as this company has been my life for the bulk of my working career,” he said in a statement. “I can look back with pride at all that we have accomplished together. It has been a challenging year for all of us as we have made tough but necessary decisions to position Intel for the current market dynamics.”

Gelsinger's departure comes as Intel’s financial woes have been piling up. The company posted a US$16.6 billion loss and halted its dividend in the most recent quarter. He announced plans in August to slash 15 percent of Intel's huge workforce — or about 15,000 jobs — as part of cost-cutting efforts to save US$10 billion next year.

Nvidia Corp’s ascendance, meanwhile, was cemented earlier this month when it replaced Intel on the Dow Jones Industrial Average.

Additional reporting by Reuters and AP

To many, Tatu City on the outskirts of Nairobi looks like a success. The first city entirely built by a private company to be operational in east Africa, with about 25,000 people living and working there, it accounts for about two-thirds of all foreign investment in Kenya. Its low-tax status has attracted more than 100 businesses including Heineken, coffee brand Dormans, and the biggest call-center and cold-chain transport firms in the region. However, to some local politicians, Tatu City has looked more like a target for extortion. A parade of governors have demanded land worth millions of dollars in exchange

Hong Kong authorities ramped up sales of the local dollar as the greenback’s slide threatened the foreign-exchange peg. The Hong Kong Monetary Authority (HKMA) sold a record HK$60.5 billion (US$7.8 billion) of the city’s currency, according to an alert sent on its Bloomberg page yesterday in Asia, after it tested the upper end of its trading band. That added to the HK$56.1 billion of sales versus the greenback since Friday. The rapid intervention signals efforts from the city’s authorities to limit the local currency’s moves within its HK$7.75 to HK$7.85 per US dollar trading band. Heavy sales of the local dollar by

Taiwan Semiconductor Manufacturing Co’s (TSMC, 台積電) revenue jumped 48 percent last month, underscoring how electronics firms scrambled to acquire essential components before global tariffs took effect. The main chipmaker for Apple Inc and Nvidia Corp reported monthly sales of NT$349.6 billion (US$11.6 billion). That compares with the average analysts’ estimate for a 38 percent rise in second-quarter revenue. US President Donald Trump’s trade war is prompting economists to retool GDP forecasts worldwide, casting doubt over the outlook for everything from iPhone demand to computing and datacenter construction. However, TSMC — a barometer for global tech spending given its central role in the

An Indonesian animated movie is smashing regional box office records and could be set for wider success as it prepares to open beyond the Southeast Asian archipelago’s silver screens. Jumbo — a film based on the adventures of main character, Don, a large orphaned Indonesian boy facing bullying at school — last month became the highest-grossing Southeast Asian animated film, raking in more than US$8 million. Released at the end of March to coincide with the Eid holidays after the Islamic fasting month of Ramadan, the movie has hit 8 million ticket sales, the third-highest in Indonesian cinema history, Film