Super Micro Computer Inc on Tuesday gave a sales forecast that fell short of analysts’ estimates while saying it couldn’t predict when it would file official financial statements for its previous fiscal year. The company’s shares dropped about 20 percent in premarket trading yesterday.

The embattled server maker missed an August deadline to file its annual financial report and last week its auditor, Ernst & Young LLP, resigned, citing concerns about the company’s governance and transparency.

An investigation of the accounting issues by a special board committee found “no evidence of fraud or misconduct on the part of management or the board of directors,” Super Micro said on Tuesday in a statement.

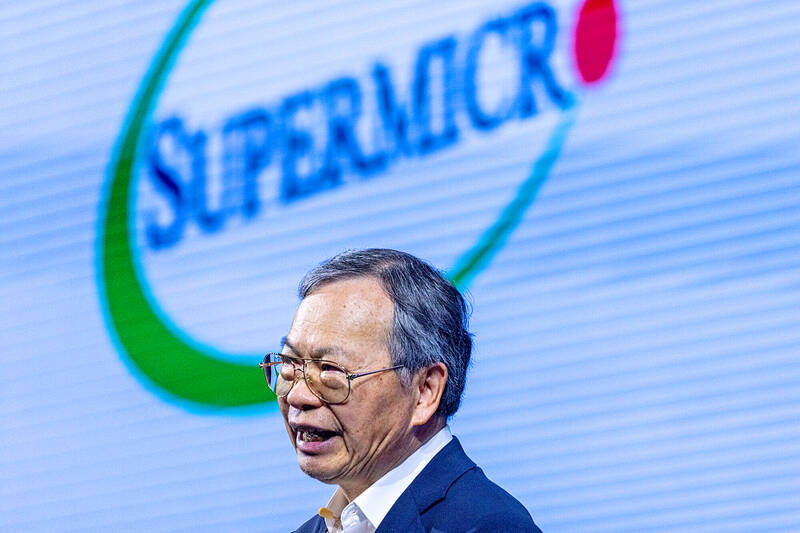

Photo: Annabelle Chih, Bloomberg

Revenue will be US$5.5 billion to US$6.1 billion in the quarter ending in December, the company said. Analysts, on average, projected sales of US$6.79 billion, according to data compiled by Bloomberg. Profit, excluding some items, is expected to be US$0.56 to US$0.65 per share, compared with US$0.80 anticipated by analysts.

Sales were hurt in the fiscal first quarter by the availability of semiconductors, Super Micro chief executive officer Charles Liang (梁見後) said. When asked on a conference call whether the company’s accounting issues had affected its relationship with Nvidia Corp, which is the top producer of powerful processors for artificial intelligence (AI), executives said the chipmaker hasn’t made any changes to Super Micro’s supply allocations.

“At this moment — according to our relationship, according to our communication — things are very positive,” Liang said of the relationship with Nvidia.

Super Micro has had a tumultuous year. Shares were rising at the start of this year, with Wall Street enthusiastic about AI-fueled demand for the company’s high-powered machines, and the company winning inclusion in the S&P 500.

But scrutiny intensified after a former employee alleged earlier this year in federal court that Super Micro had sought to overstate its revenue. Short seller Hindenburg Research referenced those claims in a research report, alleging “glaring accounting red flags, evidence of undisclosed related party transactions, sanctions and export control failures, and customer issues.”

Recently, the failure to file its 10-K financial disclosure and the departure of E&Y has put the San Jose, California-based company at a risk of being delisted by Nasdaq Inc and booted from the index. The shares have slipped 44 percent since the auditor’s resignation last week and are down more than 75 percent from a March peak. The shares fell to a low of US$22.52 after closing at US$27.70 in New York on Tuesday.

Super Micro said it “continues to work diligently” on the financial filing delays and continues to stand by previously issued disclosures, but can’t predict when the delayed form will be filed. The board’s special committee said it would recommend improvements to internal governance or controls in addition to “other work that is ongoing.”

Nasdaq rules give the company until mid-November to submit a plan to restore it to compliance. If Super Micro’s plan is approved, the company could get extra time to file its disclosures — pushing the deadline to February next year. “The company intends to take all necessary steps to achieve compliance with the Nasdaq continued listing requirements as soon as possible,” Super Micro said.

For the quarter that ended in September, Super Micro said preliminary results show sales of US$5.9 billion to US$6 billion. Analysts, on average, estimated US$6.47 billion. Profit, excluding some items, was about US$0.76 per share, the company said. Wall Street expected US$0.74. The results could change upon review by a new accounting firm, Super Micro chief financial officer David E. Weigand said on the conference call.

At the start of the call, executives said they wouldn’t answer questions about E&Y’s departure or the financial filing delays. That didn’t stop multiple analysts from trying.

“We’re diligently looking to replace the auditor as quickly as possible,” Weigand said when asked whether the company was comfortable with its ability to meet the deadline. “We will be filing a plan with Nasdaq regarding an extension.”

When an apartment comes up for rent in Germany’s big cities, hundreds of prospective tenants often queue down the street to view it, but the acute shortage of affordable housing is getting scant attention ahead of today’s snap general election. “Housing is one of the main problems for people, but nobody talks about it, nobody takes it seriously,” said Andreas Ibel, president of Build Europe, an association representing housing developers. Migration and the sluggish economy top the list of voters’ concerns, but analysts say housing policy fails to break through as returns on investment take time to register, making the

‘SILVER LINING’: Although the news caused TSMC to fall on the local market, an analyst said that as tariffs are not set to go into effect until April, there is still time for negotiations US President Donald Trump on Tuesday said that he would likely impose tariffs on semiconductor, automobile and pharmaceutical imports of about 25 percent, with an announcement coming as soon as April 2 in a move that would represent a dramatic widening of the US leader’s trade war. “I probably will tell you that on April 2, but it’ll be in the neighborhood of 25 percent,” Trump told reporters at his Mar-a-Lago club when asked about his plan for auto tariffs. Asked about similar levies on pharmaceutical drugs and semiconductors, the president said that “it’ll be 25 percent and higher, and it’ll

NOT TO WORRY: Some people are concerned funds might continue moving out of the country, but the central bank said financial account outflows are not unusual in Taiwan Taiwan’s outbound investments hit a new high last year due to investments made by contract chipmaker Taiwan Semiconductor Manufacturing Co (TSMC, 台積電) and other major manufacturers to boost global expansion, the central bank said on Thursday. The net increase in outbound investments last year reached a record US$21.05 billion, while the net increase in outbound investments by Taiwanese residents reached a record US$31.98 billion, central bank data showed. Chen Fei-wen (陳斐紋), deputy director of the central bank’s Department of Economic Research, said the increase was largely due to TSMC’s efforts to expand production in the US and Japan. Investments by Vanguard International

WARNING SHOT: The US president has threatened to impose 25 percent tariffs on all imported vehicles, and similar or higher duties on pharmaceuticals and semiconductors US President Donald Trump on Wednesday suggested that a trade deal with China was “possible” — a key target in the US leader’s tariffs policy. The US in 2020 had already agreed to “a great trade deal with China” and a new deal was “possible,” Trump said. Trump said he expected Chinese President Xi Jinping (習近平) to visit the US, without giving a timeline for his trip. Trump also said that he was talking to China about TikTok, as the US seeks to broker a sale of the popular app owned by Chinese firm ByteDance Ltd (字節跳動). Trump last week said that he had