A group of experts on Sunday called on Taiwan to strive to maintain its world-leading position in the semiconductor industry, with a US-China chip dispute expected to continue regardless of who becomes the next US president.

Tamkang University Graduate Institute of International Affairs and Strategic Studies director Li Da-jung (李大中) said at a Taipei seminar on global semiconductor security that the relationship between the two superpowers would remain confrontational.

There appears to be “no turning back” in US-China relations, as US presidential candidates US Vice President Kamala Harris and former US president Donald Trump are both expected to continue Washington’s hawkish stance against Beijing, including by continuing restrictions on China’s access to semiconductor technology, Li said.

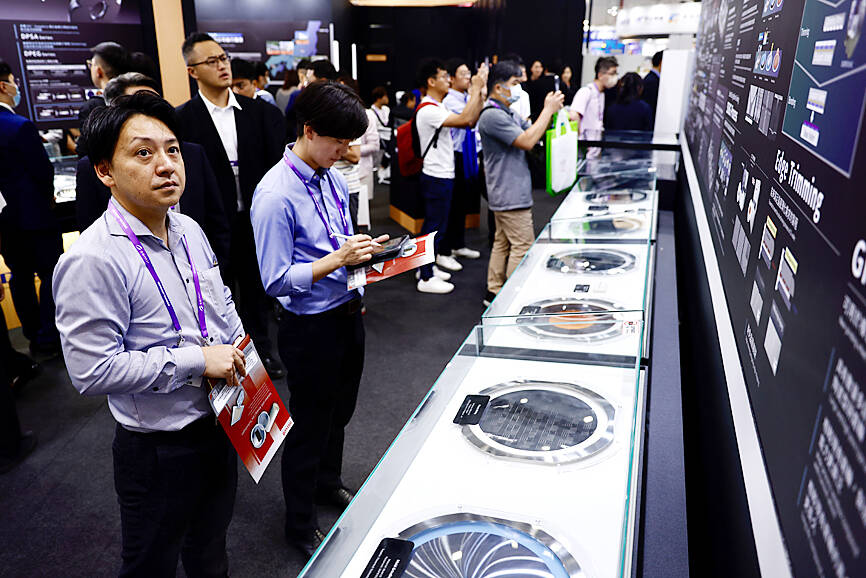

Photo: Ritchie B. Tongo, EPA-EFE

Speaking during the same event, Tamkang University Graduate Institute of International Affairs and Strategic Studies assistant professor Lin Ying-yu (林穎佑) said that despite the increasing state support China’s semiconductor industry has received in the past few years, it would still be a long time before it caught up with the US in terms of advanced chip development.

Whether China could continue its efforts in developing advanced semiconductors remained uncertain, because Beijing could soon withdraw the sector’s subsidy, he said, without elaborating.

“That could mean more opportunities for Taiwanese semiconductor businesses,” Lin said.

James Yang (楊健盟) — founder of Hsinchu City-based Microip Inc (擷發科技), which provides IC design services and chip performance analysis — said at the seminar that Taiwan’s semiconductor ecosystem has developed over the past 40 years and would be difficult to replace any time soon.

Taiwan’s advantage lies not just in a few companies, but in the entire industry cluster in Hsinchu Science Park (新竹科學園區), along with the supporting talent ecosystem drawn from nearby National Tsing Hua University, National Yang Ming Chiao Tung University and the Industrial Technology Research Institute, he said.

Taiwan needs to maintain the competitiveness of its semiconductor industry amid the ongoing US-China chip dispute and other geopolitical realities, he said.

As countries compete to build their own semiconductor industries, Taiwan’s public and private sectors need to work to maintain the nation’s edge, particularly in retaining talent, he added.

TECH CLUSTER: The US company’s new office is in the Shalun Smart Green Energy Science City, a new AI industry base and cybersecurity hub in southern Taiwan US chip designer Advanced Micro Devices Inc (AMD) yesterday launched an office in Tainan’s Gueiren District (歸仁), marking a significant milestone in the development of southern Taiwan’s artificial intelligence (AI) industry, the Tainan City Government said in a statement. AMD Taiwan general manager Vincent Chern (陳民皓) presided over the opening ceremony for the company’s new office at the Shalun Smart Green Energy Science City (沙崙智慧綠能科學城), a new AI industry base and cybersecurity hub in southern Taiwan. Facilities in the new office include an information processing center, and a research and development (R&D) center, the Tainan Economic Development Bureau said. The Ministry

ADVERSARIES: The new list includes 11 entities in China and one in Taiwan, which is a local branch of Chinese cloud computing firm Inspur Group The US added dozens of entities to a trade blacklist on Tuesday, the US Department of Commerce said, in part to disrupt Beijing’s artificial intelligence (AI) and advanced computing capabilities. The action affects 80 entities from countries including China, the United Arab Emirates and Iran, with the commerce department citing their “activities contrary to US national security and foreign policy.” Those added to the “entity list” are restricted from obtaining US items and technologies without government authorization. “We will not allow adversaries to exploit American technology to bolster their own militaries and threaten American lives,” US Secretary of Commerce Howard Lutnick said. The entities

Minister of Finance Chuang Tsui-yun (莊翠雲) yesterday told lawmakers that she “would not speculate,” but a “response plan” has been prepared in case Taiwan is targeted by US President Donald Trump’s reciprocal tariffs, which are to be announced on Wednesday next week. The Trump administration, including US Secretary of the Treasury Scott Bessent, has said that much of the proposed reciprocal tariffs would focus on the 15 countries that have the highest trade surpluses with the US. Bessent has referred to those countries as the “dirty 15,” but has not named them. Last year, Taiwan’s US$73.9 billion trade surplus with the US

The Taipei International Cycle Show (Taipei Cycle) yesterday opened at the Taipei Nangang Exhibition Center, with the event’s organizer expecting a steady recovery in the industry this year following a tough last year. This year, 980 companies from 35 countries are participating in the annual bicycle trade show, showcasing technological breakthroughs and market development trends of the bicycle industry at 3,600 booths, the Taiwan External Trade Development Council (TAITRA, 外貿協會) said in a statement. Under the theme “Ride the Revolution,” the exhibition has attracted more than 3,500 international buyers from 80 countries to preregister for the four-day event, which is expected to