Smartphone chip designer Media-Tek Inc (聯發科) yesterday said that it would perform better than the seasonal pattern with revenue forecast to grow 2 percent quarterly, thanks to robust demand for its new flagship smartphone chip that enables PC-like artificial intelligence (AI) features on phones.

The strong demand for the new Dimensity 9400 chip this year prompted MediaTek to raise its flagship smartphone chip revenue growth to 70 percent year-on-year, up from of an earlier estimate of 50 percent growth.

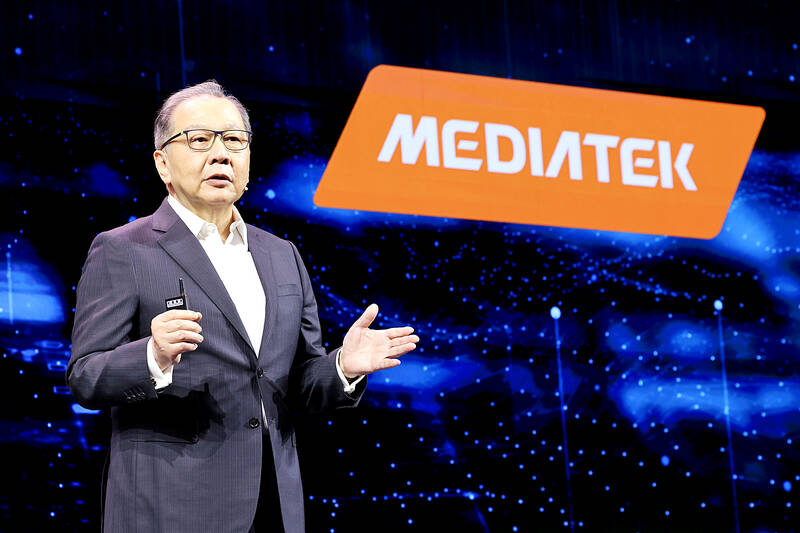

“For the fourth quarter, the strong ramp of Dimensity 9400 is expected to offset the lower seasonal demand for the mainstream and entry segments. Therefore, we expect mobile phone [platform] revenue to grow sequentially,” MediaTek vice chairman and chief executive officer Rick Tsai (蔡力行) told an online investors’ conference.

Photo: Ritchie B. Tongo, EPA-EFE

Dimensity 9400 has been better received by customers, compared with its predecessor, Dimensity 9300, in the initial adoption stage, Tsai said.

Market Share

China’s first-tier brands such as Vivo (維沃), Oppo (歐珀) and Redmi (紅米) have used the flagship chip from MediaTek in their phones, he said.

The new chip would help MediaTek elevate its market share in China to about 30 percent of premium smartphones this year, Tsai said.

With the new economic stimulus packages, MediaTek is “more comfortable with China’s economy now and going forward,” Tsai said.

“There was more uncertainty a year ago,” he added.

Tsai declined to comment if the new chip would help MediaTek reach non-Chinese brands like Samsung Electronics Co and Alphabet Inc’s Google.

Samsung adopted MediaTek’s chips in its tablets last quarter, Tsai said.

The company expects this quarter’s revenue to reach NT$126.5 billion to NT$134.5 billion (US$3.95 billion to US$4.3 billion), he said.

It posted NT$131.81 billion of revenue last quarter.

This year, revenue would expand 20 percent to 21 percent, or NT$519 billion to NT$526 billion, year-on-year surpassing the company’s mid-teens percentage growth target, MediaTek said.

Smartphone chips are the biggest revenue contributor to the company and accounted for 54 percent of its revenue last quarter.

Gross Margin

It would achieve its gross margin target range of 46 percent to 48 percent this year, the company said.

Gross margin is expected to fall this quarter to 46.6 percent to 48.5 percent, it said.

MediaTek reported a gross margin of 48.8 percent last quarter, beating its expectation of 48.5 percent.

Net profit last quarter surged 37.8 percent year-on-year to NT$25.59 billion, marking the third-highest level in all third quarters. That represented a sequential decline of 1.4 percent from NT$25.96 billion.

Earnings per share rose to NT$15.94 last quarter from NT$11.64 a year earlier, but they declined from NT$16.19 a quarter earlier.

When an apartment comes up for rent in Germany’s big cities, hundreds of prospective tenants often queue down the street to view it, but the acute shortage of affordable housing is getting scant attention ahead of today’s snap general election. “Housing is one of the main problems for people, but nobody talks about it, nobody takes it seriously,” said Andreas Ibel, president of Build Europe, an association representing housing developers. Migration and the sluggish economy top the list of voters’ concerns, but analysts say housing policy fails to break through as returns on investment take time to register, making the

‘SILVER LINING’: Although the news caused TSMC to fall on the local market, an analyst said that as tariffs are not set to go into effect until April, there is still time for negotiations US President Donald Trump on Tuesday said that he would likely impose tariffs on semiconductor, automobile and pharmaceutical imports of about 25 percent, with an announcement coming as soon as April 2 in a move that would represent a dramatic widening of the US leader’s trade war. “I probably will tell you that on April 2, but it’ll be in the neighborhood of 25 percent,” Trump told reporters at his Mar-a-Lago club when asked about his plan for auto tariffs. Asked about similar levies on pharmaceutical drugs and semiconductors, the president said that “it’ll be 25 percent and higher, and it’ll

CHIP BOOM: Revenue for the semiconductor industry is set to reach US$1 trillion by 2032, opening up opportunities for the chip pacakging and testing company, it said ASE Technology Holding Co (日月光投控), the world’s largest provider of outsourced semiconductor assembly and test (OSAT) services, yesterday launched a new advanced manufacturing facility in Penang, Malaysia, aiming to meet growing demand for emerging technologies such as generative artificial intelligence (AI) applications. The US$300 million facility is a critical step in expanding ASE’s global footprint, offering an alternative for customers from the US, Europe, Japan, South Korea and China to assemble and test chips outside of Taiwan amid efforts to diversify supply chains. The plant, the company’s fifth in Malaysia, is part of a strategic expansion plan that would more than triple

Taiwanese artificial intelligence (AI) server makers are expected to make major investments in Texas in May after US President Donald Trump’s first 100 days in office and amid his rising tariff threats, Taiwan Electrical and Electronic Manufacturers’ Association (TEEMA, 台灣電子電機公會) chairman Richard Lee (李詩欽) said yesterday. The association led a delegation of seven AI server manufacturers to Washington, as well as the US states of California, Texas and New Mexico, to discuss land and tax issues, as Taiwanese firms speed up their production plans in the US with many of them seeing Texas as their top option for investment, Lee said. The