Profits at China’s industrial firms last month declined at a faster pace than a month earlier, as deflationary pressures sap the strength of corporate finances.

Last month’s industrial profits at large Chinese companies fell 27.1 percent from a year earlier, after a 17.8 percent plunge in August, the National Bureau of Statistics said in a statement yesterday. Profits decreased 3.5 percent in the first nine months from the same period last year.

The data was “affected by factors such as high base in the same period last year” the bureau said in a statement.

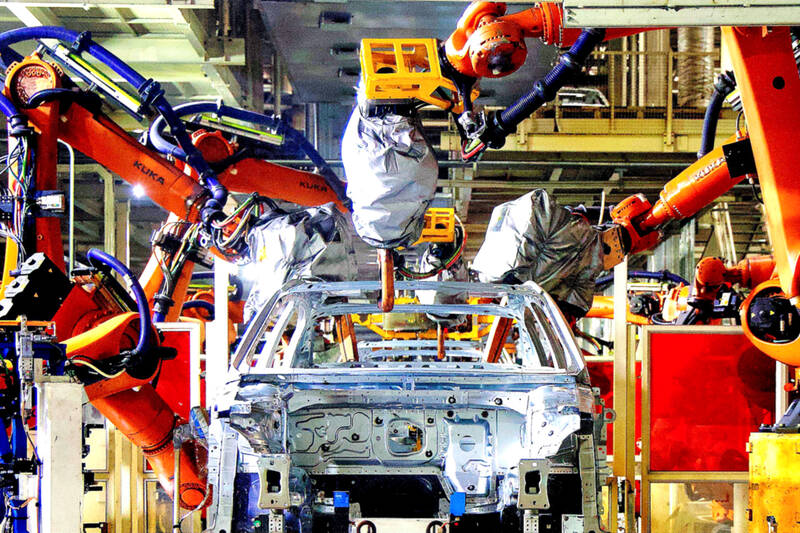

Photo: AFP

Industrial profits provide a key measure of the financial health of factories, mines and utilities that can affect their investment decisions in the months to come.

Weaker profits became emblematic of the challenges facing China’s US$18 trillion economy, prompting measures such as interest rate cuts since late last month.

The country’s top legislative body is to hold a highly anticipated session in Beijing on Nov. 4 to 8, as investors watch for any approval of further fiscal stimulus to revive growth.

Economists expect the meeting to confirm a plan to refinance local governments’ debt and issuance of sovereign bonds to inject capital into banks.

Investors have been on the lookout for fresh stimulus in the form of greater public borrowing and spending, but opinions differ over whether it would materialize this year.

Deepening deflation in producer prices was likely a drag on company earnings despite faster growth in industrial output, Bloomberg Economics said before the release. Factory-gate prices extended declines for a 24th straight month last month, with the recent drop accelerating, reflecting weak domestic demand.

The economy expanded 4.6 percent in the July-to-September period from a year earlier, the slowest pace since March last year.

The growth of the high-technology sector has offered signs of hope for the economy, with profit for the industry’s manufacturers climbing 6.3 percent in the first nine months, according to the statistics bureau.

Nvidia Corp’s demand for advanced packaging from Taiwan Semiconductor Manufacturing Co (TSMC, 台積電) remains strong though the kind of technology it needs is changing, Nvidia CEO Jensen Huang (黃仁勳) said yesterday, after he was asked whether the company was cutting orders. Nvidia’s most advanced artificial intelligence (AI) chip, Blackwell, consists of multiple chips glued together using a complex chip-on-wafer-on-substrate (CoWoS) advanced packaging technology offered by TSMC, Nvidia’s main contract chipmaker. “As we move into Blackwell, we will use largely CoWoS-L. Of course, we’re still manufacturing Hopper, and Hopper will use CowoS-S. We will also transition the CoWoS-S capacity to CoWos-L,” Huang said

Nvidia Corp CEO Jensen Huang (黃仁勳) is expected to miss the inauguration of US president-elect Donald Trump on Monday, bucking a trend among high-profile US technology leaders. Huang is visiting East Asia this week, as he typically does around the time of the Lunar New Year, a person familiar with the situation said. He has never previously attended a US presidential inauguration, said the person, who asked not to be identified, because the plans have not been announced. That makes Nvidia an exception among the most valuable technology companies, most of which are sending cofounders or CEOs to the event. That includes

TARIFF TRADE-OFF: Machinery exports to China dropped after Beijing ended its tariff reductions in June, while potential new tariffs fueled ‘front-loaded’ orders to the US The nation’s machinery exports to the US amounted to US$7.19 billion last year, surpassing the US$6.86 billion to China to become the largest export destination for the local machinery industry, the Taiwan Association of Machinery Industry (TAMI, 台灣機械公會) said in a report on Jan. 10. It came as some manufacturers brought forward or “front-loaded” US-bound shipments as required by customers ahead of potential tariffs imposed by the new US administration, the association said. During his campaign, US president-elect Donald Trump threatened tariffs of as high as 60 percent on Chinese goods and 10 percent to 20 percent on imports from other countries.

INDUSTRY LEADER: TSMC aims to continue outperforming the industry’s growth and makes 2025 another strong growth year, chairman and CEO C.C. Wei says Taiwan Semiconductor Manufacturing Co (TSMC, 台積電), a major chip supplier to Nvidia Corp and Apple Inc, yesterday said it aims to grow revenue by about 25 percent this year, driven by robust demand for artificial intelligence (AI) chips. That means TSMC would continue to outpace the foundry industry’s 10 percent annual growth this year based on the chipmaker’s estimate. The chipmaker expects revenue from AI-related chips to double this year, extending a three-fold increase last year. The growth would quicken over the next five years at a compound annual growth rate of 45 percent, fueled by strong demand for the high-performance computing