Powerchip Semiconductor Manufacturing Corp (力積電) yesterday said it had terminated a deal with SBI Holdings Inc to help build a chip manufacturing plant in Japan, as Powerchip found it unpractical to take the full responsibility of operating a plant it does not own for more than 10 years.

Powerchip, Taiwan’s third-largest contract chipmaker, inked a non-binding memorandum of understanding (MOU) with SBI in July last year to explore the possibility of building a 12-inch chip fab in Japan.

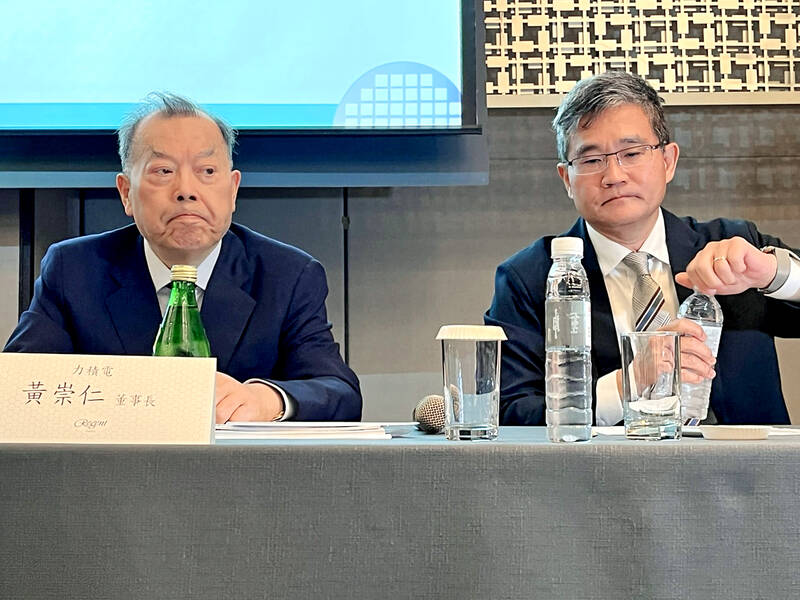

According to the MOU, Powerchip’s role was that of a technology provider, as the company hopes to generate a new revenue stream, chairman Frank Huang (黃崇仁) said.

Photo: Grace Hung, Taipei Times

The fab would belong to JSMC Holdings Inc, which is owned by SBI, and Powerchip would have no stake in it, Huang said.

His company was requested to apply for Japanese government subsidies of about ¥140 billion (US$929.1 million) to fund the construction, as SBI, a financial service provider, was not eligible to apply for such subsidies.

Nonetheless, “Powerchip has to withdraw from the project, because it cannot promise that it would take the responsibility of running the fab for 10 years, which is requested by the Japanese government,” Huang said.

Huang denied SBI Holdings chairman Yoshitaka Kitao’s accusation that Powerchip was dishonest and did not commit to creating a semiconductor venture in Japan.

There are also fears the fab would lack competitiveness, given its expensive manufacturing costs and relatively small scale in capacity, he said.

The company would focus on India instead, where it has agreed to provide its technologies to Indian partner Tata Electronics Pvt Ltd to help the company build an advanced chip fab, Huang said.

Tata Electronics would apply for Indian government subsidies, he said.

Powerchip expects to gain NT$20 billion (US$623.9 million) from the partnership with Tata Electronics over four years, he said.

Powerchip last quarter reported its fifth unprofitable quarter in a row, with losses ballooning to NT2.28 billion, following losses of NT$1.96 billion in the second quarter.

The company said the losses stemmed from heavy depreciation caused by a new factory in Miaoli County’s Tongluo Science Park (銅鑼科學園區) as well as growing competition from Chinese competitors.

Powerchip said it expects sluggish demand for display driver ICs and mounting price pressure this quarter.

Demand for power management chips also looks flat this quarter compared with last quarter, it said.

DRAM chip prices are expected to go down amid a global supply glut, it said.

Meanwhile, the company plans to invest NT$2 billion initially on 3D artificial intelligence chips and expects to ramp up production by the end of next year, it said.

TAKING STOCK: A Taiwanese cookware firm in Vietnam urged customers to assess inventory or place orders early so shipments can reach the US while tariffs are paused Taiwanese businesses in Vietnam are exploring alternatives after the White House imposed a 46 percent import duty on Vietnamese goods, following US President Donald Trump’s announcement of “reciprocal” tariffs on the US’ trading partners. Lo Shih-liang (羅世良), chairman of Brico Industry Co (裕茂工業), a Taiwanese company that manufactures cast iron cookware and stove components in Vietnam, said that more than 40 percent of his business was tied to the US market, describing the constant US policy shifts as an emotional roller coaster. “I work during the day and stay up all night watching the news. I’ve been following US news until 3am

Six years ago, LVMH’s billionaire CEO Bernard Arnault and US President Donald Trump cut the blue ribbon on a factory in rural Texas that would make designer handbags for Louis Vuitton, one of the world’s best-known luxury brands. However, since the high-profile opening, the factory has faced a host of problems limiting production, 11 former Louis Vuitton employees said. The site has consistently ranked among the worst-performing for Louis Vuitton globally, “significantly” underperforming other facilities, said three former Louis Vuitton workers and a senior industry source, who cited internal rankings shared with staff. The plant’s problems — which have not

UNCERTAINTY: Innolux activated a stringent supply chain management mechanism, as it did during the COVID-19 pandemic, to ensure optimal inventory levels for customers Flat-panel display makers AUO Corp (友達) and Innolux Corp (群創) yesterday said that about 12 to 20 percent of their display business is at risk of potential US tariffs and that they would relocate production or shipment destinations to mitigate the levies’ effects. US tariffs would have a direct impact of US$200 million on AUO’s revenue, company chairman Paul Peng (彭雙浪) told reporters on the sidelines of the Touch Taiwan trade show in Taipei yesterday. That would make up about 12 percent of the company’s overall revenue. To cope with the tariff uncertainty, AUO plans to allocate its production to manufacturing facilities in

TARIFF CONCERNS: The chipmaker cited global uncertainty from US tariffs and a weakening economic outlook, but said its Singapore expansion remains on track Vanguard International Semiconductor Corp (世界先進), a foundry service provider specializing in producing power management and display driver chips, yesterday withdrew its full-year revenue projection of moderate growth for this year, as escalating US tariff tensions raised uncertainty and concern about a potential economic recession. The Hsinchu-based chipmaker in February said revenues this year would grow mildly from last year based on improving supply chain inventory levels and market demand. At the time, it also anticipated gradual quarter revenue growth. However, the US’ sweeping tariff policy has upended the industry’s supply chains and weakened economic prospects for the world economy, it said. “Now