US officials have discussed capping sales of advanced artificial intelligence (AI) chips from Nvidia Corp and other American companies on a country-specific basis, people familiar with the matter said, a move that would limit some nations’ AI capabilities.

The new approach would set a ceiling on export licenses for some countries in the interest of national security, according to the people, who described the private discussions on condition of anonymity.

Officials in the administration of US President Joe Biden focused on Persian Gulf countries that have a growing appetite for AI data centers and the deep pockets to fund them, the people said, adding that deliberations are in early stages and remain fluid.

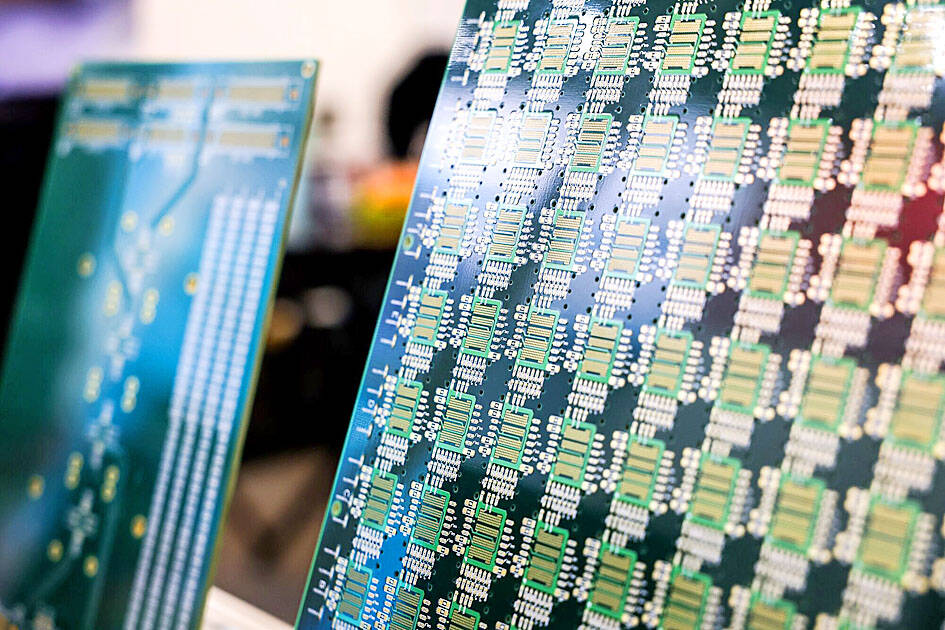

Photo: Cheng I-hwa, Bloomberg

The policy would build on a new framework to ease the licensing process for AI chip shipments to data centers in places such as the United Arab Emirates (UAE) and Saudi Arabia.

US Department of Commerce officials unveiled those regulations last month and said there are more rules coming.

The agency’s Bureau of Industry and Security, which oversees export controls, declined to comment.

Nvidia, the market leader for AI chips, also declined to comment, as did Advanced Micro Devices Inc (AMD).

A representative for Intel Corp, which also makes such processors, did not respond to a request for comment.

A spokesperson for the White House National Security Council declined to comment on the talks, but pointed to a recent joint statement by the US and the UAE on AI.

In it, the two countries acknowledged the “tremendous potential of AI for good,” as well as the “challenges and risks of this emerging technology and the vital importance of safeguards.”

Setting country-based caps would tighten restrictions that originally targeted China’s ambitions in AI, as Washington considers the security risks of AI development around the world.

Already, the Biden administration has restricted AI chip shipments by companies like Nvidia and AMD to more than 40 countries across the Middle East, Africa and Asia over fears their products could be diverted to China.

At the same time, some US officials have come to view semiconductor export licenses, particularly for Nvidia chips, as a point of leverage to achieve broader diplomatic goals. That could include asking key companies to reduce ties with China to gain access to US technology — but the concerns extend beyond Beijing.

It is unclear how leading AI chipmakers would react to additional US restrictions. When the Biden administration first issued sweeping chip regulations for China, Nvidia redesigned its AI offerings to ensure it can keep selling into that market.

If the administration moves forward with country-based caps, it might prove difficult to deliver a comprehensive new policy in the final months of Biden’s term. Such rules could be challenging to enforce and would be a major test of US diplomatic relationships.

Governments around the world are in a quest for so-called sovereign AI — the ability to build and run their own AI systems — and that pursuit has become a key driver of demand for advanced processors, Nvidia chief executive officer Jensen Huang (黃仁勳) has said.

Meanwhile, China is working to develop its own advanced semiconductors, although they still trail the best chips made in the US.

Still, there is concern among US officials that if Huawei Technologies Co (華為) or another foreign maker one day offers a viable alternative to Nvidia chips — presumably with fewer strings attached — that could weaken the US’ ability to shape the global AI landscape.

Some US officials argue that is only a distant possibility and that Washington should adopt a more restrictive approach to global AI chip exports given its current negotiating position. Others warn against making it too difficult for other countries to buy American technology, in the event that China gains ground and captures those customers.

While officials have debated the best approach, they have slowed high-volume AI chip license approvals to the Middle East and elsewhere.

However, there are signs things could get moving soon: Under the new rules for shipments to data centers, US officials would vet and preapprove specific customers based on security commitments from the companies and their national governments, paving the way for easier licensing down the road.

Semiconductor business between Taiwan and the US is a “win-win” model for both sides given the high level of complementarity, the government said yesterday responding to tariff threats from US President Donald Trump. Home to the world’s largest contract chipmaker, Taiwan Semiconductor Manufacturing Co (TSMC, 台積電), Taiwan is a key link in the global technology supply chain for companies such as Apple Inc and Nvidia Corp. Trump said on Monday he plans to impose tariffs on imported chips, pharmaceuticals and steel in an effort to get the producers to make them in the US. “Taiwan and the US semiconductor and other technology industries

SMALL AND EFFICIENT: The Chinese AI app’s initial success has spurred worries in the US that its tech giants’ massive AI spending needs re-evaluation, a market strategist said Chinese artificial intelligence (AI) start-up DeepSeek’s (深度求索) eponymous AI assistant rocketed to the top of Apple Inc’s iPhone download charts, stirring doubts in Silicon Valley about the strength of the US’ technological dominance. The app’s underlying AI model is widely seen as competitive with OpenAI and Meta Platforms Inc’s latest. Its claim that it cost much less to train and develop triggered share moves across Asia’s supply chain. Chinese tech firms linked to DeepSeek, such as Iflytek Co (科大訊飛), surged yesterday, while chipmaking tool makers like Advantest Corp slumped on the potential threat to demand for Nvidia Corp’s AI accelerators. US stock

The US Federal Reserve is expected to announce a pause in rate cuts on Wednesday, as policymakers look to continue tackling inflation under close and vocal scrutiny from US President Donald Trump. The Fed cut its key lending rate by a full percentage point in the final four months of last year and indicated it would move more cautiously going forward amid an uptick in inflation away from its long-term target of 2 percent. “I think they will do nothing, and I think they should do nothing,” Federal Reserve Bank of St Louis former president Jim Bullard said. “I think the

SUBSIDIES: The nominee for commerce secretary indicated the Trump administration wants to put its stamp on the plan, but not unravel it entirely US President Donald Trump’s pick to lead the agency in charge of a US$52 billion semiconductor subsidy program declined to give it unqualified support, raising questions about the disbursement of funds to companies like Intel Corp and Taiwan Semiconductor Manufacturing Co (台積電). “I can’t say that I can honor something I haven’t read,” Howard Lutnick, Trump’s nominee for commerce secretary, said of the binding CHIPS and Science Act awards in a confirmation hearing on Wednesday. “To the extent monies have been disbursed, I would commit to rigorously enforcing documents that have been signed by those companies to make sure we get