Advanced Micro Devices Inc (AMD) suffered its biggest stock decline in more than a month after the company unveiled new artificial intelligence (AI) chips, but did not provide hoped-for information on customers or financial performance.

The stock slid 4 percent to US$164.18 on Thursday, the biggest single-day drop since Sept. 3. Shares of the company remain up 11 percent this year.

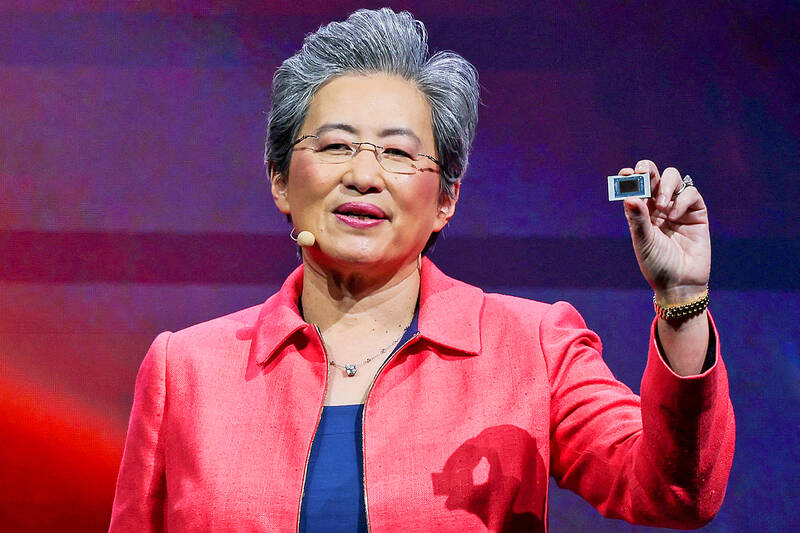

AMD has emerged as the biggest contender to Nvidia Corp in the lucrative market of AI processors. The company’s latest chips would exceed some capabilities of its rival, AMD chief executive officer Lisa Su (蘇姿丰) said at an event hosted by the company in San Francisco on Thursday,

Photo: Ann Wang, Reuters

Computer systems based on AMD’s MI325X processors would be available soon and have an edge over machines running Nvidia’s H100, she said, adding that the MI325X’s use of a new type of memory chip would give it better performance at running AI software — a process known as inference.

“This is an incredibly fast-growing market,” Su said during an interview with Bloomberg Television’s Ed Ludlow.

“We view this as a multiyear opportunity,” she added.

The Santa Clara, California-based company is trying to crack Nvidia’s dominance in so-called AI accelerators — chips that have become essential to the development of AI systems. Like Nvidia, AMD has committed to releasing new accelerators every year, stepping up its pace of innovation.

Under Su, the company has eclipsed its longtime rival Intel Corp in market valuation. However, both companies were caught off guard by how ferociously the industry embraced AI accelerators.

Of the two, AMD has responded far more quickly and established itself as the closest rival to Nvidia. AMD has set a target of US$4.5 billion of revenue from the new type of chips for this year, a rapid increase.

Su has said the overall market for such chips would hit US$400 billion in 2027. On Thursday, she said that the company expects that number to reach US$500 billion in 2028.

At the event, Su also said the company is releasing a new line of server processors based on its “Turin” technology, making a fresh push into a market once dominated by Intel.

Computers are going on sale with AMD’s fifth-generation EPYC central processing units, she said, adding that the chips have as many as 192 processor cores and can outperform the latest Intel products.

The company said that it now has 34 percent of the market for this category of chips when measured by revenue. Although Intel still dominates the segment, it once had a 99 percent share.

Su said that she expects continued growth in demand for AI and that the industry is still “just getting started” in its use of the new technology.

Separately, Su said AMD has no current plans to change the suppliers it uses for cutting-edge manufacturing. However, the company wants more geographical diversity in terms of its production, and is looking to work with Taiwan Semiconductor Manufacturing Co’s (台積電) new Arizona facility. Su refused to rule out using either Samsung Electronics Co or Intel in the future. She said AMD is keeping an open mind.

“We’re always looking at the manufacturing landscape and will always think about how we can have the most resilient supply chain,” she said.

TAKING STOCK: A Taiwanese cookware firm in Vietnam urged customers to assess inventory or place orders early so shipments can reach the US while tariffs are paused Taiwanese businesses in Vietnam are exploring alternatives after the White House imposed a 46 percent import duty on Vietnamese goods, following US President Donald Trump’s announcement of “reciprocal” tariffs on the US’ trading partners. Lo Shih-liang (羅世良), chairman of Brico Industry Co (裕茂工業), a Taiwanese company that manufactures cast iron cookware and stove components in Vietnam, said that more than 40 percent of his business was tied to the US market, describing the constant US policy shifts as an emotional roller coaster. “I work during the day and stay up all night watching the news. I’ve been following US news until 3am

UNCERTAINTY: Innolux activated a stringent supply chain management mechanism, as it did during the COVID-19 pandemic, to ensure optimal inventory levels for customers Flat-panel display makers AUO Corp (友達) and Innolux Corp (群創) yesterday said that about 12 to 20 percent of their display business is at risk of potential US tariffs and that they would relocate production or shipment destinations to mitigate the levies’ effects. US tariffs would have a direct impact of US$200 million on AUO’s revenue, company chairman Paul Peng (彭雙浪) told reporters on the sidelines of the Touch Taiwan trade show in Taipei yesterday. That would make up about 12 percent of the company’s overall revenue. To cope with the tariff uncertainty, AUO plans to allocate its production to manufacturing facilities in

Six years ago, LVMH’s billionaire CEO Bernard Arnault and US President Donald Trump cut the blue ribbon on a factory in rural Texas that would make designer handbags for Louis Vuitton, one of the world’s best-known luxury brands. However, since the high-profile opening, the factory has faced a host of problems limiting production, 11 former Louis Vuitton employees said. The site has consistently ranked among the worst-performing for Louis Vuitton globally, “significantly” underperforming other facilities, said three former Louis Vuitton workers and a senior industry source, who cited internal rankings shared with staff. The plant’s problems — which have not

COLLABORATION: Given Taiwan’s key position in global supply chains, the US firm is discussing strategies with local partners and clients to deal with global uncertainties Advanced Micro Devices Inc (AMD) yesterday said it is meeting with local ecosystem partners, including Taiwan Semiconductor Manufacturing Co (TSMC, 台積電), to discuss strategies, including long-term manufacturing, to navigate uncertainties such as US tariffs, as Taiwan occupies an important position in global supply chains. AMD chief executive officer Lisa Su (蘇姿丰) told reporters that Taiwan is an important part of the chip designer’s ecosystem and she is discussing with partners and customers in Taiwan to forge strong collaborations on different areas during this critical period. AMD has just become the first artificial-intelligence (AI) server chip customer of TSMC to utilize its advanced