Taiwan’s tech and non-tech sectors have mixed reactions to the basic carbon fee recommended by a government review committee, with major electronics companies saying they are ready while petrochemical, steel and cement suppliers urged caution.

The committee on Monday recommended a basic fee of NT$300 per tonne of carbon emissions (tCO2), as well as preferential rates of NT$50/tCO2 and NT$100/tCO2 for companies that meet defined emissions reduction targets.

Carbon fees would not be collected until 2026, while next year would be used as a dry run in which large emitters would only have to report emissions amounts for this year, but would not have to pay carbon fees, the committee said.

Photo: CNA

The recommended fees still have to be approved by the Ministry of the Environment.

In response to the recommendations, the Taiwan Electrical and Electronic Manufacturers’ Association (電電公會) said it has arranged courses for its members every month to help them improve their operations and ease the impact of the new costs.

Many tech heavyweights in Taiwan have prepared themselves for the new rules, but smaller tech firms would need help from the government to mitigate the impact of the additional costs, it said.

Taiwan Semiconductor Manufacturing Co (台積電) said it is determined to abide by the new carbon fee levies and has faith that the new costs would not affect its operations financially, while United Microelectronics Corp (UMC, 聯電) said it would continue its efforts to cut carbon emissions by participating in the government’s schemes to reduce emissions voluntarily and push emission reduction plans.

UMC added that it would apply for carbon offset projects and buy carbon credits on carbon exchanges, while introducing negative emissions technologies and seeking cheaper renewable energy.

However, the Petrochemical Industry Association of Taiwan (石化公會) said the petrochemical industry has been struggling in the regional markets amid overproduction by China and the removal of preferential tariffs on exports to China.

It urged the government to pay close attention to the added financial burden of the new fees, but added that its members would comply with the new carbon fee rules.

China Steel Corp (中鋼) said the carbon fees would no doubt create more challenges, and estimated that it would have to pay NT$200 million to NT$400 million a year under the new system.

TCC Group Holdings Co (台泥企業團) chairman Nelson Chang (張安平) said the best-ever price for cement produced in the country was NT$3,000 per tonne, but if suppliers have to pay NT$3,000 in carbon fees per tonne by 2030, few companies would want to produce cement in Taiwan.

If Taiwan has to completely depend on imported cement, it would deal a hard blow to the nation’s heavy industries, Chang said.

Hon Hai Precision Industry Co (鴻海精密) yesterday said that its research institute has launched its first advanced artificial intelligence (AI) large language model (LLM) using traditional Chinese, with technology assistance from Nvidia Corp. Hon Hai, also known as Foxconn Technology Group (富士康科技集團), said the LLM, FoxBrain, is expected to improve its data analysis capabilities for smart manufacturing, and electric vehicle and smart city development. An LLM is a type of AI trained on vast amounts of text data and uses deep learning techniques, particularly neural networks, to process and generate language. They are essential for building and improving AI-powered servers. Nvidia provided assistance

DOMESTIC SUPPLY: The probe comes as Donald Trump has called for the repeal of the US$52.7 billion CHIPS and Science Act, which the US Congress passed in 2022 The Office of the US Trade Representative is to hold a hearing tomorrow into older Chinese-made “legacy” semiconductors that could heap more US tariffs on chips from China that power everyday goods from cars to washing machines to telecoms equipment. The probe, which began during former US president Joe Biden’s tenure in December last year, aims to protect US and other semiconductor producers from China’s massive state-driven buildup of domestic chip supply. A 50 percent US tariff on Chinese semiconductors began on Jan. 1. Legacy chips use older manufacturing processes introduced more than a decade ago and are often far simpler than

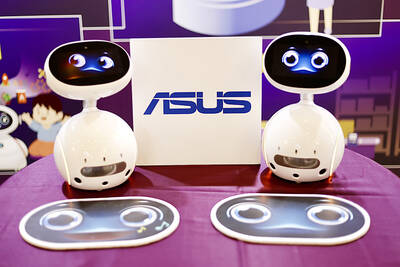

STILL HOPEFUL: Delayed payment of NT$5.35 billion from an Indian server client sent its earnings plunging last year, but the firm expects a gradual pickup ahead Asustek Computer Inc (華碩), the world’s No. 5 PC vendor, yesterday reported an 87 percent slump in net profit for last year, dragged by a massive overdue payment from an Indian cloud service provider. The Indian customer has delayed payment totaling NT$5.35 billion (US$162.7 million), Asustek chief financial officer Nick Wu (吳長榮) told an online earnings conference. Asustek shipped servers to India between April and June last year. The customer told Asustek that it is launching multiple fundraising projects and expected to repay the debt in the short term, Wu said. The Indian customer accounted for less than 10 percent to Asustek’s

Gasoline and diesel prices this week are to decrease NT$0.5 and NT$1 per liter respectively as international crude prices continued to fall last week, CPC Corp, Taiwan (CPC, 台灣中油) and Formosa Petrochemical Corp (台塑石化) said yesterday. Effective today, gasoline prices at CPC and Formosa stations are to decrease to NT$29.2, NT$30.7 and NT$32.7 per liter for 92, 95 and 98-octane unleaded gasoline respectively, while premium diesel is to cost NT$27.9 per liter at CPC stations and NT$27.7 at Formosa pumps, the companies said in separate statements. Global crude oil prices dropped last week after the eight OPEC+ members said they would