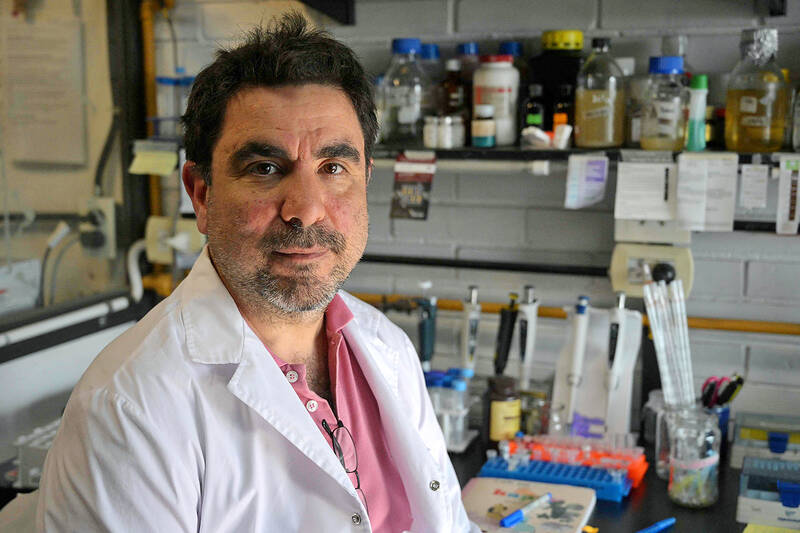

Argentine biochemist Alejandro Nadra worries that Argentine President Javier Milei’s budget cuts would undo his scientific quest to unravel the cause of genetic diseases that disable and kill millions.

Since taking office in December last year, budget-slashing Milei has frozen public university and research budgets even as annual inflation stands at 236 percent.

This meant real spending on science and technology fell 33 percent year-on-year in August, the CIICTI research center said.

Photo: AFP

Nadra said he has already had to stop some of his experiments with the proteins responsible for gene mutations that cause diseases.

“We are on the verge of collapse,” Nadra said from his laboratory at the University of Buenos Aires, home to three Nobel Prize laureates in science.

Along with artists, teachers, pilots, social workers and countless other professionals affected by Milei’s drive to curb flyaway inflation and public debt, scientists fear for their future in Argentina.

“People are leaving, and they aren’t applying for scholarships or teaching positions anymore, because they can’t make a living,” Nadra said.

Those who do often end up working in labs without the necessary equipment or supplies.

“If things don’t change, the time is near when everything disintegrates,” said Nadra.

Nadra said he has not been able to buy anything he needs for his research since November last year.

“So, if I run out of supplies, I either borrow from someone who still has some, or I stop doing those experiments,” Nadra said.

The gross monthly salary of a research assistant today at the Argentine National Council for Scientific and Technical Research of Argentina (CONICET) is about 30 percent less, about US$1,180, than a year ago, the RAICYT network of science institutes said.

Official figures released last week showed that 52.9 percent of people live in poverty in Milei’s Argentina.

Biologist Edith Kordon works at the Institute for Physiology, Molecular Biology and Neurosciences, where she investigates breast cancer.

“This is the first time this has happened to me. I mean, it has always been very hard to get funding, it has always been very hard to get scholarships, but now there is this practical certainty that we have nothing... I’ve never had so little money to do anything,” she said.

Former Argentine minister of science, technology and innovation Lino Baranao recently highlighted that even before Milei’s cuts, Argentina spent about 0.31 percent of GDP on science compared with 1.21 percent in Brazil, 3.45 percent in the US and 4.9 percent in South Korea.

Today, it is even less, at about 0.2 percent.

“Never in the recent history of Argentina has there been such a drastic reduction in the [scientific] budget,” Baranao told La Nacion newspaper.

In a more prosperous past, state funding of research had made possible the development of a transgenic wheat strain resistant to drought by a CONICET research team, among other life-changing breakthroughs.

Last week, Milei’s government adjusted CONICET’s working budget upward to just more than US$100,000 for this year, a figure which physicist Jorge Aliaga considers “irrelevant” in its inadequacy.

“It doesn’t change anything,” Aliaga said.

The US dollar was trading at NT$29.7 at 10am today on the Taipei Foreign Exchange, as the New Taiwan dollar gained NT$1.364 from the previous close last week. The NT dollar continued to rise today, after surging 3.07 percent on Friday. After opening at NT$30.91, the NT dollar gained more than NT$1 in just 15 minutes, briefly passing the NT$30 mark. Before the US Department of the Treasury's semi-annual currency report came out, expectations that the NT dollar would keep rising were already building. The NT dollar on Friday closed at NT$31.064, up by NT$0.953 — a 3.07 percent single-day gain. Today,

‘SHORT TERM’: The local currency would likely remain strong in the near term, driven by anticipated US trade pressure, capital inflows and expectations of a US Fed rate cut The US dollar is expected to fall below NT$30 in the near term, as traders anticipate increased pressure from Washington for Taiwan to allow the New Taiwan dollar to appreciate, Cathay United Bank (國泰世華銀行) chief economist Lin Chi-chao (林啟超) said. Following a sharp drop in the greenback against the NT dollar on Friday, Lin told the Central News Agency that the local currency is likely to remain strong in the short term, driven in part by market psychology surrounding anticipated US policy pressure. On Friday, the US dollar fell NT$0.953, or 3.07 percent, closing at NT$31.064 — its lowest level since Jan.

The New Taiwan dollar and Taiwanese stocks surged on signs that trade tensions between the world’s top two economies might start easing and as US tech earnings boosted the outlook of the nation’s semiconductor exports. The NT dollar strengthened as much as 3.8 percent versus the US dollar to 30.815, the biggest intraday gain since January 2011, closing at NT$31.064. The benchmark TAIEX jumped 2.73 percent to outperform the region’s equity gauges. Outlook for global trade improved after China said it is assessing possible trade talks with the US, providing a boost for the nation’s currency and shares. As the NT dollar

The Financial Supervisory Commission (FSC) yesterday met with some of the nation’s largest insurance companies as a skyrocketing New Taiwan dollar piles pressure on their hundreds of billions of dollars in US bond investments. The commission has asked some life insurance firms, among the biggest Asian holders of US debt, to discuss how the rapidly strengthening NT dollar has impacted their operations, people familiar with the matter said. The meeting took place as the NT dollar jumped as much as 5 percent yesterday, its biggest intraday gain in more than three decades. The local currency surged as exporters rushed to