Taiwan Semiconductor Manufacturing Co (TSMC, 台積電) is collaborating with Amkor Technology Inc to provide local advanced packaging and test capacities in Arizona to address customer requirements for geographical flexibility in chip manufacturing.

As part of the agreement, TSMC, the world’s biggest contract chipmaker, would contract turnkey advanced packaging and test services from Amkor at their planned facility in Peoria, Arizona, a joint statement released yesterday said.

TSMC would leverage these services to support its customers, particularly those using TSMC’s advanced wafer fabrication facilities in Phoenix, Arizona, it said.

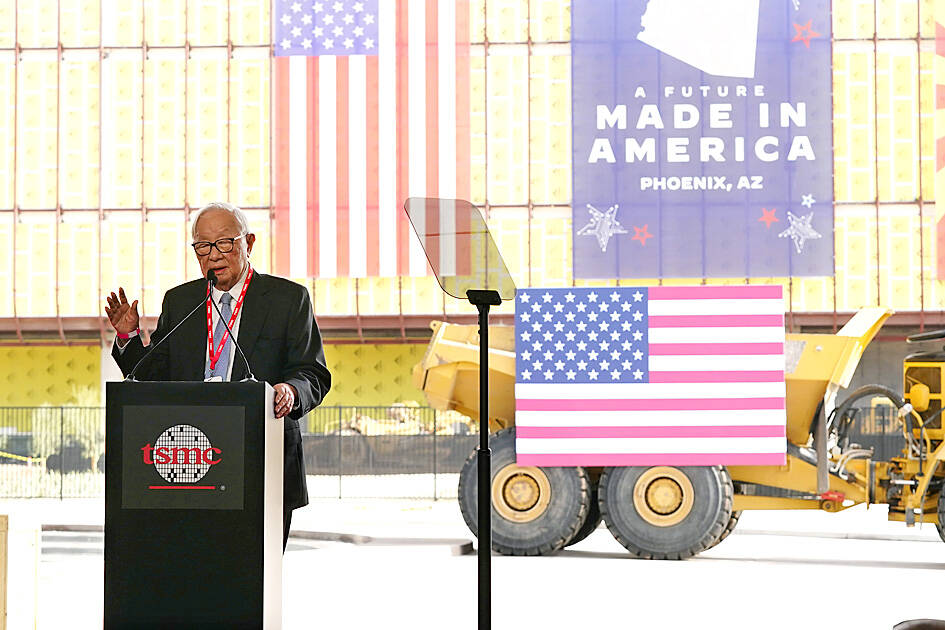

Photo: AP

The companies would jointly define the specific packaging technologies, such as TSMC’s Integrated Fan-Out (InFO) and Chip on Wafer on Substrate (CoWoS) that would be employed to address common customers’ needs, the statement said.

The agreement underscores a shared commitment to supporting customer requirements for geographic flexibility in front-end and back-end manufacturing, as well as fostering the development of a vibrant and comprehensive semiconductor manufacturing ecosystem in the US, the statement said.

“Our customers are increasingly depending on advanced packaging technologies for their breakthroughs in advanced mobile applications, artificial intelligence [AI] and high-performance computing, and TSMC is pleased to work side by side with a trusted long-time strategic partner in Amkor to support them with a more diverse manufacturing footprint,” TSMC senior vice president Kevin Zhang (張曉強) said in the statement.

Amkor, based in Tempe, Arizona, in November last year announced plans to build its first domestic outsourced semiconductor assembly and test in Peoria, Arizona for US$2 billion.

Upon completion, it would be the largest outsourced advanced packaging and test (OSAT) facility in the US.

The advanced packaging and production outsourcing agreement came as TSMC’s first Arizona fab is to begin high-volume production of 4-nanometer chips in the first half of next year, mostly for its US customers, including Apple Inc, Nvidia Corp and Advanced Micro Devices Inc.

In Arizona, TSMC plans to build three fabs to produce advanced chips, such as 3-nanometer and 2-nanometer chips, with a total investment of US$65 billion.

Amkor is already on TSMC’s CoWoS capacity supplier list along with Taiwan’s Siliconware Precision Industries Co (SPIL, 矽品) and Advanced Semiconductor Engineering Inc (ASE, 日月光半導體) to help resolve prolonged capacity scarcity amid surging AI chip demand, TrendForce Technology Corp (集邦科技) analyst Joanne Chiao (喬安) said.

“Due to geopolitical factors, some of TSMC’s US-based customers are seeking localized production,” Chiao said.

As TSMC’s Arizona plant is only designed for front-end chip manufacturing and no back-end packaging capacity was planned, it requires a US-based OSAT partner to supply CoWoS capacity, Chiao said.

Amkor has apparently emerged as a suitable choice, she added.

ASE and SPIL did not build large-scale packaging and testing capacity in the US.

ASE in July unveiled a second testing fab in San Jose, operated by its US subsidiary, to cope with rising demand for AI and high-performance-computing applications.

TARIFFS: The global ‘panic atmosphere remains strong,’ and foreign investors have continued to sell their holdings since the start of the year, the Ministry of Finance said The government yesterday authorized the activation of its NT$500 billion (US$15.15 billion) National Stabilization Fund (NSF) to prop up the local stock market after two days of sharp falls in reaction to US President Donald Trump’s new import tariffs. The Ministry of Finance said in a statement after the market close that the steering committee of the fund had been given the go-ahead to intervene in the market to bolster Taiwanese shares in a time of crisis. The fund has been authorized to use its assets “to carry out market stabilization tasks as appropriate to maintain the stability of Taiwan’s

STEEP DECLINE: Yesterday’s drop was the third-steepest in its history, the steepest being Monday’s drop in the wake of the tariff announcement on Wednesday last week Taiwanese stocks continued their heavy sell-off yesterday, as concerns over US tariffs and unwinding of leveraged bets weighed on the market. The benchmark TAIEX plunged 1,068.19 points, or 5.79 percent, to 17,391.76, notching the biggest drop among Asian peers as it hit a 15-month low. The decline came even after the government on late Tuesday authorized the NT$500 billion (US$15.2 billion) National Stabilization Fund (國安基金) to step in to buoy the market amid investors’ worries over tariffs imposed by US President Donald Trump. Yesterday’s decline was the third-steepest in its history, trailing only the declines of 2,065.87 points on Monday and

TAKING STOCK: A Taiwanese cookware firm in Vietnam urged customers to assess inventory or place orders early so shipments can reach the US while tariffs are paused Taiwanese businesses in Vietnam are exploring alternatives after the White House imposed a 46 percent import duty on Vietnamese goods, following US President Donald Trump’s announcement of “reciprocal” tariffs on the US’ trading partners. Lo Shih-liang (羅世良), chairman of Brico Industry Co (裕茂工業), a Taiwanese company that manufactures cast iron cookware and stove components in Vietnam, said that more than 40 percent of his business was tied to the US market, describing the constant US policy shifts as an emotional roller coaster. “I work during the day and stay up all night watching the news. I’ve been following US news until 3am

TARIFF CONCERNS: The chipmaker cited global uncertainty from US tariffs and a weakening economic outlook, but said its Singapore expansion remains on track Vanguard International Semiconductor Corp (世界先進), a foundry service provider specializing in producing power management and display driver chips, yesterday withdrew its full-year revenue projection of moderate growth for this year, as escalating US tariff tensions raised uncertainty and concern about a potential economic recession. The Hsinchu-based chipmaker in February said revenues this year would grow mildly from last year based on improving supply chain inventory levels and market demand. At the time, it also anticipated gradual quarter revenue growth. However, the US’ sweeping tariff policy has upended the industry’s supply chains and weakened economic prospects for the world economy, it said. “Now