Beijing is stepping up pressure on Chinese companies to buy locally produced artificial intelligence (AI) chips instead of Nvidia Corp products, part of the nation’s effort to expand its semiconductor industry and counter US sanctions.

Chinese regulators have been discouraging companies from purchasing Nvidia’s H20 chips, which are used to develop and run AI models, sources familiar with the matter said.

The policy has taken the form of guidance rather than an outright ban, as Beijing wants to avoid handicapping its own AI start-ups and escalating tensions with the US, said the sources, who asked not to be identified because the matter is private.

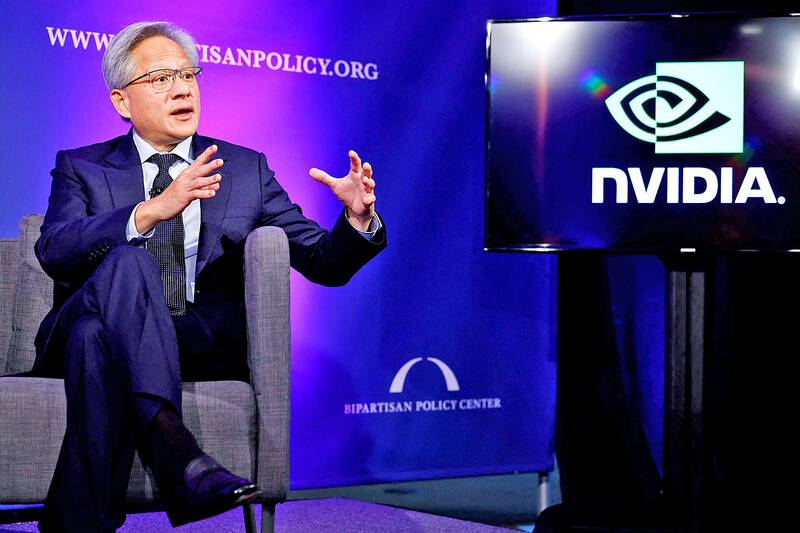

Photo: AFP

The move is designed to help domestic Chinese AI chipmakers gain more market share while preparing local tech companies for any potential additional US restrictions, the sources said.

The country’s leading makers of AI processors include Cambricon Technologies Corp (寒武紀) and Huawei Technologies Co (華為).

The US government banned Nvidia from selling its most advanced AI processors to Chinese customers in 2022, part of an attempt to limit Beijing’s technological advances. Nvidia, based in Santa Clara, California, modified subsequent versions of the chips so they could be sold under US Department of Commerce regulations. The H20 line fits that criteria.

In recent months, several Chinese regulators, including the powerful Ministry of Industry and Information Technology, issued so-called window guidance — instructions without the force of law — to reduce the use of Nvidia, the sources said.

The notice was aimed at encouraging companies to rely on domestic vendors like Huawei and Cambricon, they added.

Beijing also amplified the message via a local trade group, according to another.

At the same time, Chinese officials want local companies to build the best AI systems possible. If that means they need to buy some foreign semiconductors over domestic alternatives, Beijing would still tolerate that, sources familiar with China’s AI policy said.

Nvidia declined to comment. China’s Ministry of Commerce, Ministry of Information and Technology, and Cyberspace Administration did not respond to faxed requests for comment.

Separately, Nvidia chief executive officer Jensen Huang (黃仁勳) on Friday said that he is doing his best to serve customers in China and stay within the requirements of US government restrictions.

“The first thing we have to do is comply with whatever policies and regulations that are being imposed,” he said. “And, meanwhile, do the best we can to compete in the markets that we serve. We have a lot of customers there that depend on us, and we’ll do our best to support them.”

Nvidia, the world’s most valuable chipmaker, has seen sales soar as data center operators across the globe scramble to buy more of its processors. China continues to be part of that growth, although trade restrictions have taken a toll. In the July quarter, the firm got 12 percent of its revenue, or about US$3.7 billion, from the country, including Hong Kong. That was up more than 30 percent from a year earlier.

“Our data center revenue in China grew sequentially in Q2 and is a significant contributor to our data center revenue,” Nvidia chief financial officer Colette Kress said during an earnings call last month.

“As a percentage of total data center revenue, it remains below levels seen prior to the imposition of export controls. We continue to expect the China market to be very competitive going forward,” she said.

Meanwhile, Chinese chip designers and manufacturers are working to introduce alternatives to Nvidia. Beijing has offered billions in subsidies to the semiconductor sector, but local AI chips remain well behind Nvidia’s fare.

China does have a burgeoning AI sector, despite the US restrictions. ByteDance Ltd (字節跳動) and Alibaba Group Holding Ltd (阿里巴巴) have been investing aggressively, while a flock of start-ups are vying for leadership. There are six so-called tigers in developing large language models, the key technology behind generative AI: 01.AI (零一萬物), Baichuan (百川智能), Moonshot (月之暗面), MiniMax (稀宇科技), Stepfun (階躍星辰) and Zhipu (智譜).

Some of the companies are turning a blind eye to the Chinese decree to avoid H20 chips and rushing to buy more before an anticipated sanction from the US by the end of this year, while also buying homemade Huawei chips to please Beijing, one of the sources said.

TAKING STOCK: A Taiwanese cookware firm in Vietnam urged customers to assess inventory or place orders early so shipments can reach the US while tariffs are paused Taiwanese businesses in Vietnam are exploring alternatives after the White House imposed a 46 percent import duty on Vietnamese goods, following US President Donald Trump’s announcement of “reciprocal” tariffs on the US’ trading partners. Lo Shih-liang (羅世良), chairman of Brico Industry Co (裕茂工業), a Taiwanese company that manufactures cast iron cookware and stove components in Vietnam, said that more than 40 percent of his business was tied to the US market, describing the constant US policy shifts as an emotional roller coaster. “I work during the day and stay up all night watching the news. I’ve been following US news until 3am

UNCERTAINTY: Innolux activated a stringent supply chain management mechanism, as it did during the COVID-19 pandemic, to ensure optimal inventory levels for customers Flat-panel display makers AUO Corp (友達) and Innolux Corp (群創) yesterday said that about 12 to 20 percent of their display business is at risk of potential US tariffs and that they would relocate production or shipment destinations to mitigate the levies’ effects. US tariffs would have a direct impact of US$200 million on AUO’s revenue, company chairman Paul Peng (彭雙浪) told reporters on the sidelines of the Touch Taiwan trade show in Taipei yesterday. That would make up about 12 percent of the company’s overall revenue. To cope with the tariff uncertainty, AUO plans to allocate its production to manufacturing facilities in

COLLABORATION: Given Taiwan’s key position in global supply chains, the US firm is discussing strategies with local partners and clients to deal with global uncertainties Advanced Micro Devices Inc (AMD) yesterday said it is meeting with local ecosystem partners, including Taiwan Semiconductor Manufacturing Co (TSMC, 台積電), to discuss strategies, including long-term manufacturing, to navigate uncertainties such as US tariffs, as Taiwan occupies an important position in global supply chains. AMD chief executive officer Lisa Su (蘇姿丰) told reporters that Taiwan is an important part of the chip designer’s ecosystem and she is discussing with partners and customers in Taiwan to forge strong collaborations on different areas during this critical period. AMD has just become the first artificial-intelligence (AI) server chip customer of TSMC to utilize its advanced

Six years ago, LVMH’s billionaire CEO Bernard Arnault and US President Donald Trump cut the blue ribbon on a factory in rural Texas that would make designer handbags for Louis Vuitton, one of the world’s best-known luxury brands. However, since the high-profile opening, the factory has faced a host of problems limiting production, 11 former Louis Vuitton employees said. The site has consistently ranked among the worst-performing for Louis Vuitton globally, “significantly” underperforming other facilities, said three former Louis Vuitton workers and a senior industry source, who cited internal rankings shared with staff. The plant’s problems — which have not