The US Department of Commerce yesterday said that it had finalized a US$123 million grant for Polar Semiconductor LLC to expand its plant in Minnesota, which would allow the company to nearly double its US production capacity of power and sensor chips.

The award, part of a US$52.7 billion semiconductor manufacturing and research subsidy program, is the first in the program to be finalized by the Commerce Department.

The department would distribute funds based on Polar’s completion of project milestones.

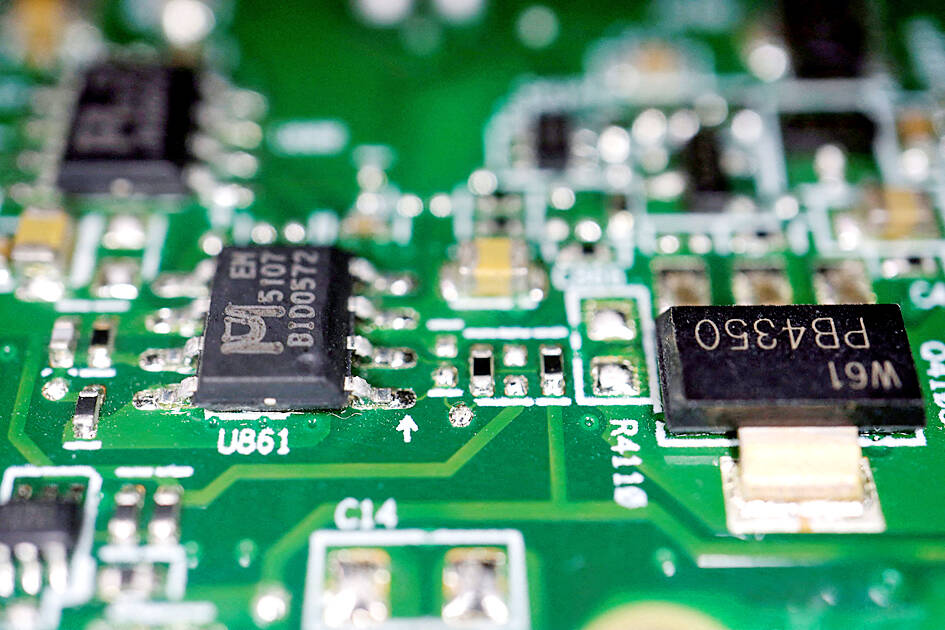

Photo: Reuters

US Secretary of Commerce Gina Raimondo said that the award would help “create a new US-owned foundry for sensor and power semiconductors” and boost Polar production from roughly 20,000 wafers per month to 40,000 serving aerospace, automotive and defense needs.

The state of Minnesota is contributing US$75 million to the US$525 million expansion at Polar, which is 70 percent owned by Sanken Electric Co and 30 percent held by Allegro MicroSystems Inc.

The department has allocated more than US$35 billion for 26 projects, including US$6.4 billion in grants to Samsung Electric Co to expand chip production in Texas, US$8.5 billion for Intel Corp, US$6.6 billion for Taiwan Semiconductor Manufacturing Co (台積電) to build out its US production and US$6.1 billion for Micron Technology Inc to fund US factories.

The department must complete due diligence before it can finalize awards.

“You’re going to start to see more awards like this, dollars to companies in the coming weeks and months,” Raimondo said.

The 2022 CHIPS and Science Act championed by the administration of US President Joe Biden aims to boost efforts to make the US more competitive with China and dramatically expand US chips production. The law also includes a 25 percent investment tax credit for building chip plants, estimated to be worth US$24 billion.

Separately, the US Congress on Monday gave final approval to legislation that would streamline federal permitting processes for semiconductor manufacturing projects.

TAKING STOCK: A Taiwanese cookware firm in Vietnam urged customers to assess inventory or place orders early so shipments can reach the US while tariffs are paused Taiwanese businesses in Vietnam are exploring alternatives after the White House imposed a 46 percent import duty on Vietnamese goods, following US President Donald Trump’s announcement of “reciprocal” tariffs on the US’ trading partners. Lo Shih-liang (羅世良), chairman of Brico Industry Co (裕茂工業), a Taiwanese company that manufactures cast iron cookware and stove components in Vietnam, said that more than 40 percent of his business was tied to the US market, describing the constant US policy shifts as an emotional roller coaster. “I work during the day and stay up all night watching the news. I’ve been following US news until 3am

Six years ago, LVMH’s billionaire CEO Bernard Arnault and US President Donald Trump cut the blue ribbon on a factory in rural Texas that would make designer handbags for Louis Vuitton, one of the world’s best-known luxury brands. However, since the high-profile opening, the factory has faced a host of problems limiting production, 11 former Louis Vuitton employees said. The site has consistently ranked among the worst-performing for Louis Vuitton globally, “significantly” underperforming other facilities, said three former Louis Vuitton workers and a senior industry source, who cited internal rankings shared with staff. The plant’s problems — which have not

TARIFF CONCERNS: The chipmaker cited global uncertainty from US tariffs and a weakening economic outlook, but said its Singapore expansion remains on track Vanguard International Semiconductor Corp (世界先進), a foundry service provider specializing in producing power management and display driver chips, yesterday withdrew its full-year revenue projection of moderate growth for this year, as escalating US tariff tensions raised uncertainty and concern about a potential economic recession. The Hsinchu-based chipmaker in February said revenues this year would grow mildly from last year based on improving supply chain inventory levels and market demand. At the time, it also anticipated gradual quarter revenue growth. However, the US’ sweeping tariff policy has upended the industry’s supply chains and weakened economic prospects for the world economy, it said. “Now

COLLABORATION: Given Taiwan’s key position in global supply chains, the US firm is discussing strategies with local partners and clients to deal with global uncertainties Advanced Micro Devices Inc (AMD) yesterday said it is meeting with local ecosystem partners, including Taiwan Semiconductor Manufacturing Co (TSMC, 台積電), to discuss strategies, including long-term manufacturing, to navigate uncertainties such as US tariffs, as Taiwan occupies an important position in global supply chains. AMD chief executive officer Lisa Su (蘇姿丰) told reporters that Taiwan is an important part of the chip designer’s ecosystem and she is discussing with partners and customers in Taiwan to forge strong collaborations on different areas during this critical period. AMD has just become the first artificial-intelligence (AI) server chip customer of TSMC to utilize its advanced