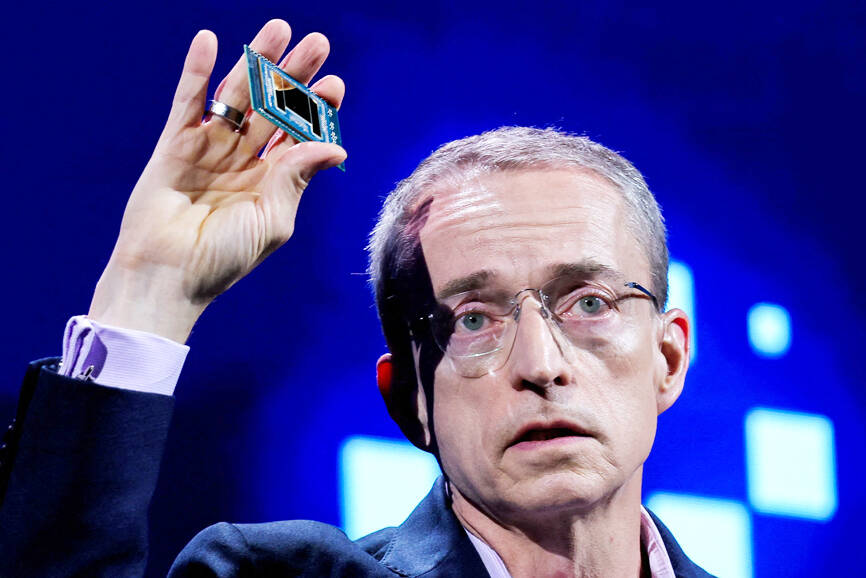

Intel Corp chief executive officer Pat Gelsinger has landed Amazon.com Inc’s Amazon Web Services (AWS) as a customer for the company’s manufacturing business, potentially bringing work to new plants under construction in the US and boosting his efforts to turn around the embattled chipmaker.

Intel and AWS are to coinvest in a custom semiconductor for artificial intelligence computing — what is known as a fabric chip — in a “multiyear, multibillion-dollar framework,” Intel said in a statement on Monday.

The work would rely on Intel’s 18A process, an advanced chipmaking technology.

Photo: Ann Wang, Reuters

Intel shares rose more than 8 percent in late trading after the announcement. They had been down 58 percent this year, closing at US$20.91 on Monday.

“Today’s announcement is big,” Gelsinger said in an interview. “This is a very discerning customer who has very sophisticated design capabilities.”

The news was part of a flurry of announcements that followed a pivotal board meeting last week. Intel also is postponing new factories in Germany and Poland, but remains committed to its US expansion in Arizona, New Mexico, Oregon and Ohio.

The Poland and Germany construction projects would be paused for about two years depending on market demand.

Another one in Malaysia would be completed, but only put into operation when conditions support it, Intel said.

At last week’s three-day board meeting, executives presented options on how to conserve cash, while keeping Gelsinger’s turnaround plan on track. The CEO’s effort hinges on transforming Intel into a so-called foundry, a chipmaker that manufactures products for outside customers.

The Santa Clara, California-based company has been slow to line up customers for the project — and a high-profile customer such as Amazon represents a notable win.

AWS is the largest provider of cloud computing, and it could help build confidence that Intel can compete with the likes of foundry leader Taiwan Semiconductor Manufacturing Co (台積電). AWS has used Intel processors over the years, but has been shifting more toward in-house designs — the products that Intel might now help manufacture.

Microsoft Corp, another major cloud-computing provider, in February announced plans to use Intel for some of its in-house chips as well.

Another change: Intel’s foundry operations would be further separated from the rest of the company and become a wholly owned subsidiary. That move is aimed in part at convincing prospective customers — some of whom compete with Intel — that they are dealing with an independent supplier.

Bloomberg reported earlier on a potential foundry separation.

“We still have things to learn about becoming a foundry,” Gelsinger said in the interview. “I need lots of customers.”

In another win, Intel earlier on Monday said that it is eligible to receive as much as US$3 billion in US government funding to manufacture chips for the military. The effort, called the Secure Enclave, aims to establish a steady supply of cutting-edge chips for defense and intelligence purposes.

That news helped send the shares up 6.4 percent in regular trading on Monday.

The Secure Enclave award is separate from a possible US$8.5 billion CHIPS and Science Act grant that Intel is set to receive to support factories in four US states. The projects include a facility in New Albany, Ohio, that Intel has said could become the world’s largest chipmaking operation.

Intel still has a long way to go to win back Wall Street’s full confidence. After years of losing ground to rivals and seeing its technological edge slip, the Silicon Valley pioneer is valued at less than US$90 billion. It no longer ranks as one of the top 10 chip companies on that basis.

Meanwhile, Nvidia Corp has a market capitalization of about US$2.9 trillion.

Gelsinger, in a letter to employees, acknowledged that the chipmaker’s performance has drawn negative scrutiny — and spurred speculation over what might happen to the company.

The only way to “quiet our critics” would be to deliver results and execute better, he said.

Monday’s announcements are a step toward that, he added.

“Is it good enough? No. Is it substantial? Yes,” he said in the interview. “I’ve re-upped my commitment. We’re going to finish a seminal assignment.”

The US dollar was trading at NT$29.7 at 10am today on the Taipei Foreign Exchange, as the New Taiwan dollar gained NT$1.364 from the previous close last week. The NT dollar continued to rise today, after surging 3.07 percent on Friday. After opening at NT$30.91, the NT dollar gained more than NT$1 in just 15 minutes, briefly passing the NT$30 mark. Before the US Department of the Treasury's semi-annual currency report came out, expectations that the NT dollar would keep rising were already building. The NT dollar on Friday closed at NT$31.064, up by NT$0.953 — a 3.07 percent single-day gain. Today,

‘SHORT TERM’: The local currency would likely remain strong in the near term, driven by anticipated US trade pressure, capital inflows and expectations of a US Fed rate cut The US dollar is expected to fall below NT$30 in the near term, as traders anticipate increased pressure from Washington for Taiwan to allow the New Taiwan dollar to appreciate, Cathay United Bank (國泰世華銀行) chief economist Lin Chi-chao (林啟超) said. Following a sharp drop in the greenback against the NT dollar on Friday, Lin told the Central News Agency that the local currency is likely to remain strong in the short term, driven in part by market psychology surrounding anticipated US policy pressure. On Friday, the US dollar fell NT$0.953, or 3.07 percent, closing at NT$31.064 — its lowest level since Jan.

The New Taiwan dollar and Taiwanese stocks surged on signs that trade tensions between the world’s top two economies might start easing and as US tech earnings boosted the outlook of the nation’s semiconductor exports. The NT dollar strengthened as much as 3.8 percent versus the US dollar to 30.815, the biggest intraday gain since January 2011, closing at NT$31.064. The benchmark TAIEX jumped 2.73 percent to outperform the region’s equity gauges. Outlook for global trade improved after China said it is assessing possible trade talks with the US, providing a boost for the nation’s currency and shares. As the NT dollar

The Financial Supervisory Commission (FSC) yesterday met with some of the nation’s largest insurance companies as a skyrocketing New Taiwan dollar piles pressure on their hundreds of billions of dollars in US bond investments. The commission has asked some life insurance firms, among the biggest Asian holders of US debt, to discuss how the rapidly strengthening NT dollar has impacted their operations, people familiar with the matter said. The meeting took place as the NT dollar jumped as much as 5 percent yesterday, its biggest intraday gain in more than three decades. The local currency surged as exporters rushed to