The Dutch government on Tuesday said that ASML Holding NV needs a license to provide spare parts and software updates for computer chipmaking equipment it previously sold to Chinese customers that now fall under export restrictions.

That includes the two additional tools that the Dutch government added to its national control list on Friday last week in a move to coordinate policy with the US, the Dutch Ministry of Foreign Affairs said in a statement.

The clarification follows confusion over whether the Dutch government is planning additional servicing restrictions on ASML, Europe’s largest technology firm, which the ministry indicated is not the case.

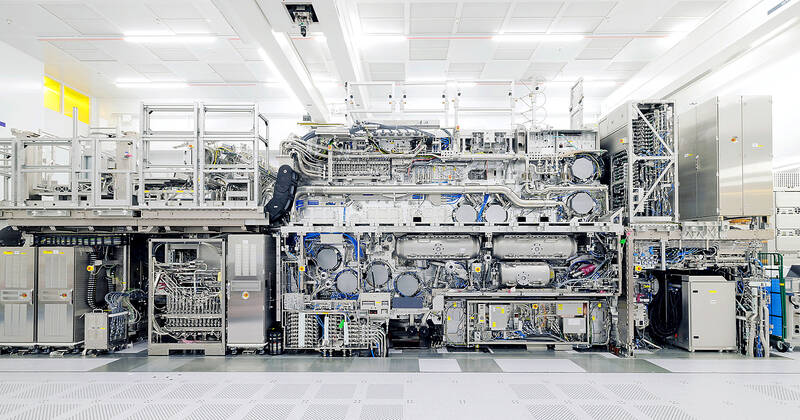

Photo: Reuters

“Servicing ... is vetted under the licensing requirement (and includes) ... parts, software and technology developed specially for this equipment,” the ministry said.

“As of Sept. 6, 2024 this licensing obligation is expanded” to include ASML’s 1980di and 1970di machines, it added.

ASML, which on Friday said it did not expect the change to impact on its earnings, declined to comment.

The company dominates the market for deep ultraviolet (DUV) and extreme ultraviolet (EUV) lithography tools, essential to chipmakers for creating the circuitry of chips.

After an initial round of Dutch restrictions last year, the company instructed its customers in China — its third-largest market after Taiwan and South Korea — not to expect licenses to import its most advanced DUV tools after Jan. 1.

ASML has never been able to sell its EUV machines to China amid pressure from the US government.

ASML CEO Christophe Fouquet at an event in New York on Wednesday last week said that he expects the US government to continue pushing for additional restrictions on the company’s exports to China.

“That is a bipartisan issue, so I think whatever happens in November this will stay,” he said, referring to the US presidential election.

He added that he expects pushback from the Dutch government against additional US restrictions, which he said are increasingly motivated by economic rather than security considerations.

SELL-OFF: Investors expect tariff-driven volatility as the local boarse reopens today, while analysts say government support and solid fundamentals would steady sentiment Local investors are bracing for a sharp market downturn today as the nation’s financial markets resume trading following a two-day closure for national holidays before the weekend, with sentiment rattled by US President Donald Trump’s sweeping tariff announcement. Trump’s unveiling of new “reciprocal tariffs” on Wednesday triggered a sell-off in global markets, with the FTSE Taiwan Index Futures — a benchmark for Taiwanese equities traded in Singapore — tumbling 9.2 percent over the past two sessions. Meanwhile, the American depositary receipts (ADRs) of Taiwan Semiconductor Manufacturing Co (TSMC, 台積電), the most heavily weighted stock on the TAIEX, plunged 13.8 percent in

A wave of stop-loss selling and panic selling hit Taiwan's stock market at its opening today, with the weighted index plunging 2,086 points — a drop of more than 9.7 percent — marking the largest intraday point and percentage loss on record. The index bottomed out at 19,212.02, while futures were locked limit-down, with more than 1,000 stocks hitting their daily drop limit. Three heavyweight stocks — Taiwan Semiconductor Manufacturing Co (TSMC, 台積電), Hon Hai Precision Industry Co (Foxconn, 鴻海精密) and MediaTek (聯發科) — hit their limit-down prices as soon as the market opened, falling to NT$848 (US$25.54), NT$138.5 and NT$1,295 respectively. TSMC's

ASML Holding NV, the sole producer of the most advanced machines used in semiconductor manufacturing, said geopolitical tensions are harming innovation a day after US President Donald Trump levied massive tariffs that promise to disrupt trade flows across the entire world. “Our industry has been built basically on the ability of people to work together, to innovate together,” ASML chief executive officer Christophe Fouquet said in a recorded message at a Thursday industry event in the Netherlands. Export controls and increasing geopolitical tensions challenge that collaboration, he said, without specifically addressing the new US tariffs. Tech executives in the EU, which is

In a small town in Paraguay, a showdown is brewing between traditional producers of yerba mate, a bitter herbal tea popular across South America, and miners of a shinier treasure: gold. A rush for the precious metal is pitting mate growers and indigenous groups against the expanding operations of small-scale miners who, until recently, were their neighbors, not nemeses. “They [the miners] have destroyed everything... The canals, springs, swamps,” said Vidal Britez, president of the Yerba Mate Producers’ Association of the town of Paso Yobai, about 210km east of capital Asuncion. “You can see the pollution from the dead fish.