European firms in China doubt the Chinese government has a credible plan to boost demand in the ailing economy or would carry out long-promised reforms, diminishing their appetite to invest in the country, a European business lobby group said on Wednesday.

The EU Chamber of Commerce in China said in the latest edition of its Position Paper that many of its more than 1,700 member companies are now reconciling themselves to the fact that the problems they face might have become permanent features rather than “growing pains” of an emerging market.

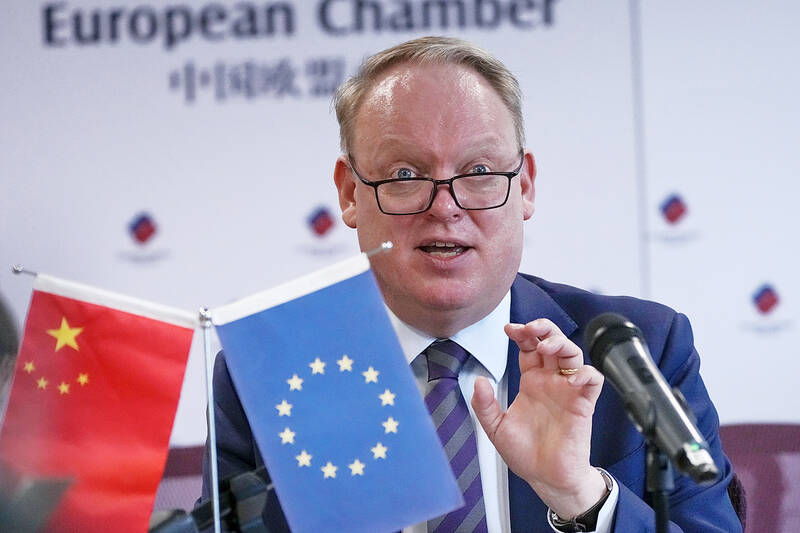

“A tipping point has been reached, with investors now scrutinizing their China operations more closely as the challenges of doing business are beginning to outweigh the returns,” chamber president Jens Eskelund said at an event where the paper was released.

Photo: AP

“It has become so much harder to make money in the Chinese market,” he added.

Last year, EU foreign direct investment (FDI) flows to China dropped by 29 percent from the previous year to 6.4 billion euros (US$7.07 billion), European Commission data showed.

Meanwhile, profit margins in China have sunk for about two-thirds of its members to equal to or below the global average, the chamber said.

“With many other markets offering greater predictability and legal certainty along with the same return on investment, continuing to invest at previous levels in the China market is simply becoming harder to justify,” the chamber’s report read.

European firms must wrestle with Chinese competitors receiving unfair subsidies, a highly politicized business environment, Chinese President Xi Jinping’s (習近平) heightened focus on national security, and perennial market access and regulatory barriers, the chamber said.

However, the “central concern” was China’s economic slowdown.

After a dismal second quarter, Chinese policymakers signaled they were ready to deviate from their playbook of pouring funds into infrastructure, instead targeting fresh stimulus at households.

However, promise fatigue has become prevalent among European firms, and doubts over China’s commitment to reform are increasing, the chamber said.

Economists are still waiting for specific plans to reinvigorate the 1.4 billion-strong consumer market. The top decisionmaking body of the ruling Chinese Communist Party in July pledged that it would announce such plans and it recently rolled-out subsidized trade-in scheme for consumer goods.

The chamber said the trade-in program is unlikely to significantly increase domestic consumption as the amount budgeted for it works out to just about 210 yuan (US$29.53) per capita.

“The government needs to look at what can be done for China to regain its position as a top location for European FDI,” Eskelund said.

Intel Corp chief executive officer Lip-Bu Tan (陳立武) is expected to meet with Taiwanese suppliers next month in conjunction with the opening of the Computex Taipei trade show, supply chain sources said on Monday. The visit, the first for Tan to Taiwan since assuming his new post last month, would be aimed at enhancing Intel’s ties with suppliers in Taiwan as he attempts to help turn around the struggling US chipmaker, the sources said. Tan is to hold a banquet to celebrate Intel’s 40-year presence in Taiwan before Computex opens on May 20 and invite dozens of Taiwanese suppliers to exchange views

Application-specific integrated circuit designer Faraday Technology Corp (智原) yesterday said that although revenue this quarter would decline 30 percent from last quarter, it retained its full-year forecast of revenue growth of 100 percent. The company attributed the quarterly drop to a slowdown in customers’ production of chips using Faraday’s advanced packaging technology. The company is still confident about its revenue growth this year, given its strong “design-win” — or the projects it won to help customers design their chips, Faraday president Steve Wang (王國雍) told an online earnings conference. “The design-win this year is better than we expected. We believe we will win

Chizuko Kimura has become the first female sushi chef in the world to win a Michelin star, fulfilling a promise she made to her dying husband to continue his legacy. The 54-year-old Japanese chef regained the Michelin star her late husband, Shunei Kimura, won three years ago for their Sushi Shunei restaurant in Paris. For Shunei Kimura, the star was a dream come true. However, the joy was short-lived. He died from cancer just three months later in June 2022. He was 65. The following year, the restaurant in the heart of Montmartre lost its star rating. Chizuko Kimura insisted that the new star is still down

While China’s leaders use their economic and political might to fight US President Donald Trump’s trade war “to the end,” its army of social media soldiers are embarking on a more humorous campaign online. Trump’s tariff blitz has seen Washington and Beijing impose eye-watering duties on imports from the other, fanning a standoff between the economic superpowers that has sparked global recession fears and sent markets into a tailspin. Trump says his policy is a response to years of being “ripped off” by other countries and aims to bring manufacturing to the US, forcing companies to employ US workers. However, China’s online warriors