Taiwan Semiconductor Manufacturing Co (TSMC, 台積電) and other related companies would add ¥11.2 trillion (US$78.31 billion) to Japan’s chipmaking hot spot Kumamoto Prefecture over the next decade, a local bank’s analysis said.

Kyushu Financial Group, a lender based in Kumamoto’s capital, almost doubled its projection for the economic impact that the chip sector would bring to the region compared to its estimate a year earlier, a presentation on Thursday said.

The bank said that 171 firms had made new investments since November 2021, up from 90 in an earlier analysis.

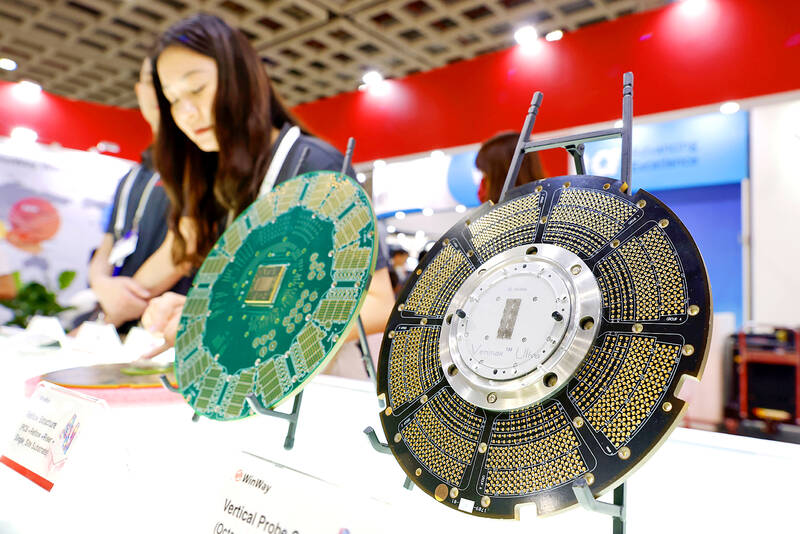

Photo: EPA-EFE

TSMC’s Kumamoto location was once a sleepy farming area, but has undergone rapid growth as part of Japan’s chipmaking ambitions. TSMC, which opened its first plant there in February, is to start building a second by the end of the year and has shown intentions to construct a third.

The local economy is racing to keep up, with skyrocketing land prices and new infrastructure planned to deal with congestion from an influx of industry personnel. Kumamoto’s growth spurt has been supported by generous government subsidies, including grants totaling about ¥1.1 trillion for TSMC’s two plants to date.

Cooperation between Taiwan and Japan is increasingly crucial as supply chains become shorter and more regionally focused, a compound semiconductor company chairman said yesterday at a Taiwan-Japan exchange forum.

The global division of labor has been disrupted by the US-China trade and technology war, WIN Semiconductors Corp (穩懋) chairman Dennis Chen (陳進財) said.

“We have come to a point where there is no turning back, no matter who wins the presidency [in the next US presidential election],” he said during Semicon Taiwan.

However, localizing semiconductor manufacturing — widely regarded as a strategic resource — is easier said than done, as “every country has its specialty following 40 years of [globalized] supply chain development,” Chen said.

Taiwan and Japan are highly complementary in terms of their supply chain division of labor, he said.

“Taiwan is top in foundry and advanced packaging, and Japan leads in materials and equipment,” Chen said, citing Japan’s official numbers showing that it has 48 percent of the semiconductor material global market share and 31 percent of the equipment market share.

The two countries are also geographically and culturally close to each other, especially in terms of attitude toward work, he added.

On top of complementary dominant supply chain positions, Taiwan and Japan are on the side of democracy as “geopolitical changes have divided the world into two camps.”

In this democracy camp, more cooperation with the US, Europe, South Korea and Southeast Asia in forming a new supply chain is expected, he added.

Chen also said that customers in the US have urged his company to implement the “Taiwan plus one” strategy — manufacturing bases outside Taiwan.

In response, Chen said: “I believe Taiwan and Japan can take our cooperation to another level as we are natural partners in the industry.”

Taiwan Semiconductor Manufacturing Co (TSMC, 台積電) last week recorded an increase in the number of shareholders to the highest in almost eight months, despite its share price falling 3.38 percent from the previous week, Taiwan Stock Exchange data released on Saturday showed. As of Friday, TSMC had 1.88 million shareholders, the most since the week of April 25 and an increase of 31,870 from the previous week, the data showed. The number of shareholders jumped despite a drop of NT$50 (US$1.59), or 3.38 percent, in TSMC’s share price from a week earlier to NT$1,430, as investors took profits from their earlier gains

In a high-security Shenzhen laboratory, Chinese scientists have built what Washington has spent years trying to prevent: a prototype of a machine capable of producing the cutting-edge semiconductor chips that power artificial intelligence (AI), smartphones and weapons central to Western military dominance, Reuters has learned. Completed early this year and undergoing testing, the prototype fills nearly an entire factory floor. It was built by a team of former engineers from Dutch semiconductor giant ASML who reverse-engineered the company’s extreme ultraviolet lithography (EUV) machines, according to two people with knowledge of the project. EUV machines sit at the heart of a technological Cold

Taiwan’s long-term economic competitiveness will hinge not only on national champions like Taiwan Semiconductor Manufacturing Co. (TSMC, 台積電) but also on the widespread adoption of artificial intelligence (AI) and other emerging technologies, a US-based scholar has said. At a lecture in Taipei on Tuesday, Jeffrey Ding, assistant professor of political science at the George Washington University and author of "Technology and the Rise of Great Powers," argued that historical experience shows that general-purpose technologies (GPTs) — such as electricity, computers and now AI — shape long-term economic advantages through their diffusion across the broader economy. "What really matters is not who pioneers

TAIWAN VALUE CHAIN: Foxtron is to fully own Luxgen following the transaction and it plans to launch a new electric model, the Foxtron Bria, in Taiwan next year Yulon Motor Co (裕隆汽車) yesterday said that its board of directors approved the disposal of its electric vehicle (EV) unit, Luxgen Motor Co (納智捷汽車), to Foxtron Vehicle Technologies Co (鴻華先進) for NT$787.6 million (US$24.98 million). Foxtron, a half-half joint venture between Yulon affiliate Hua-Chuang Automobile Information Technical Center Co (華創車電) and Hon Hai Precision Industry Co (鴻海精密), expects to wrap up the deal in the first quarter of next year. Foxtron would fully own Luxgen following the transaction, including five car distributing companies, outlets and all employees. The deal is subject to the approval of the Fair Trade Commission, Foxtron said. “Foxtron will be