Chunghwa Precision Test Technology Co (CHPT, 中華精測), a chip testing and wafer probing services provider, yesterday said it expects improvements in revenue and gross margin in the second half of this year and next year, thanks to strong testing demand for artificial intelligence (AI) and high-performance computing (HPC) chips.

In addition, the company has the competitive edge in providing advanced testing services for AI graphics processing units (GPUs) and HPC chips, CHPT president Scott Huang (黃水可) said at the Semicon Taiwan trade show at the Taipei Nangang Exhibition Center.

“Artificial intelligence has created good business opportunities for us,” Huang said.

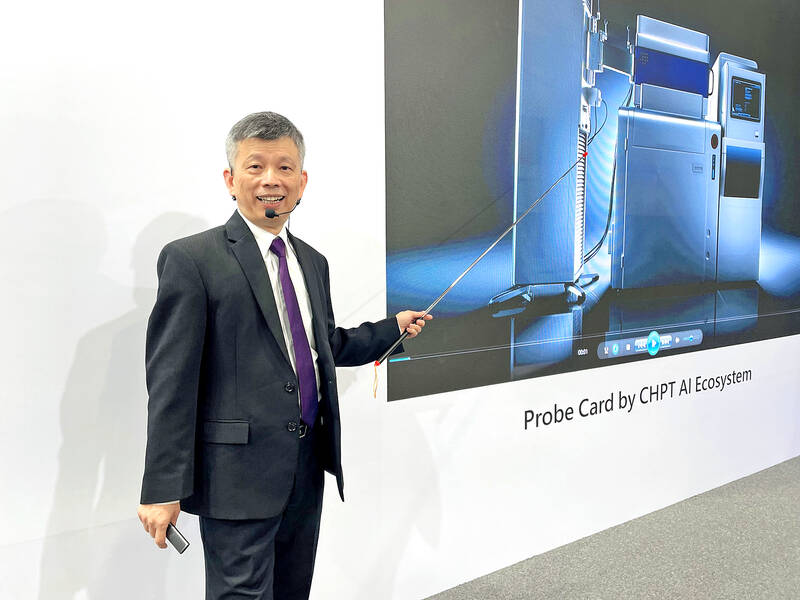

Photo: CNA

“The second half will be better than the first half and we anticipate a better year next year compared with this year,” he said.

The company in July said that its new probe card solutions, used in AI GPU testing, were under customers’ verification. It had started small volume shipments by testing high-bandwidth-memory chips and expected revenue contribution to emerge next year, the company said at the time.

Thanks to HPC and AI-related business, the company’s revenue last month surged 45.35 percent year-on-year to NT$302 million (US$9.38 million), the highest level in 20 months.

During the first eight months, revenue climbed 5.41 percent to NT$2 billion from a year earlier.

Gross margin last quarter rose to 52.4 percent as faster design flows and operational efficiency on the back of integrating AI technology in the company’s operations led to a reduction in costs, Huang said.

Gross margin is expected to rise to between 50 percent and 55 percent on average this year, a pickup from 48.26 percent last year, and the company’s goal is to keep its gross margin stable at 50 percent in the long term, he said.

CHPT recently received orders from a US customer, which was impressed by the Taoyuan-based company’s 3D imaging technology, Huang said.

The company uses the technology in the drilling process to improve precision, drilling depth and residual copper rate, achieving a 100 percent yield in back drilling, he said, adding that the company is a pioneer among the world’s wafer testing companies in adopting the technology.

ADVANCED: Previously, Taiwanese chip companies were restricted from building overseas fabs with technology less than two generations behind domestic factories Taiwan Semiconductor Manufacturing Co (TSMC, 台積電), a major chip supplier to Nvidia Corp, would no longer be restricted from investing in next-generation 2-nanometer chip production in the US, the Ministry of Economic Affairs said yesterday. However, the ministry added that the world’s biggest contract chipmaker would not be making any reckless decisions, given the weight of its up to US$30 billion investment. To safeguard Taiwan’s chip technology advantages, the government has barred local chipmakers from making chips using more advanced technologies at their overseas factories, in China particularly. Chipmakers were previously only allowed to produce chips using less advanced technologies, specifically

BRAVE NEW WORLD: Nvidia believes that AI would fuel a new industrial revolution and would ‘do whatever we can’ to guide US AI policy, CEO Jensen Huang said Nvidia Corp cofounder and chief executive officer Jensen Huang (黃仁勳) on Tuesday said he is ready to meet US president-elect Donald Trump and offer his help to the incoming administration. “I’d be delighted to go see him and congratulate him, and do whatever we can to make this administration succeed,” Huang said in an interview with Bloomberg Television, adding that he has not been invited to visit Trump’s home base at Mar-a-Lago in Florida yet. As head of the world’s most valuable chipmaker, Huang has an opportunity to help steer the administration’s artificial intelligence (AI) policy at a moment of rapid change.

TARIFF SURGE: The strong performance could be attributed to the growing artificial intelligence device market and mass orders ahead of potential US tariffs, analysts said The combined revenue of companies listed on the Taiwan Stock Exchange and the Taipei Exchange for the whole of last year totaled NT$44.66 trillion (US$1.35 trillion), up 12.8 percent year-on-year and hit a record high, data compiled by investment consulting firm CMoney showed on Saturday. The result came after listed firms reported a 23.92 percent annual increase in combined revenue for last month at NT$4.1 trillion, the second-highest for the month of December on record, and posted a 15.63 percent rise in combined revenue for the December quarter at NT$12.25 billion, the highest quarterly figure ever, the data showed. Analysts attributed the

Taiwan Semiconductor Manufacturing Co’s (TSMC, 台積電) quarterly sales topped estimates, reinforcing investor hopes that the torrid pace of artificial intelligence (AI) hardware spending would extend into this year. The go-to chipmaker for Nvidia Corp and Apple Inc reported a 39 percent rise in December-quarter revenue to NT$868.5 billion (US$26.35 billion), based on calculations from monthly disclosures. That compared with an average estimate of NT$854.7 billion. The strong showing from Taiwan’s largest company bolsters expectations that big tech companies from Alphabet Inc to Microsoft Corp would continue to build and upgrade datacenters at a rapid clip to propel AI development. Growth accelerated for