Domestic gasoline and diesel prices are to increase NT$0.2 and NT$0.1 per liter respectively this week, after international crude oil prices rose last week as the geopolitical situation in the Middle East remained unstable, CPC Corp, Taiwan (CPC, 台灣中油) and Formosa Petrochemical Corp (台塑石化) said in separate statements yesterday.

In addition, news that oilfields in eastern Libya would be closed and exports halted due to domestic political tension and reports that Iraq plans to reduce its oil production this month as part of a deal with OPEC also helped boost crude oil prices last week, the companies said.

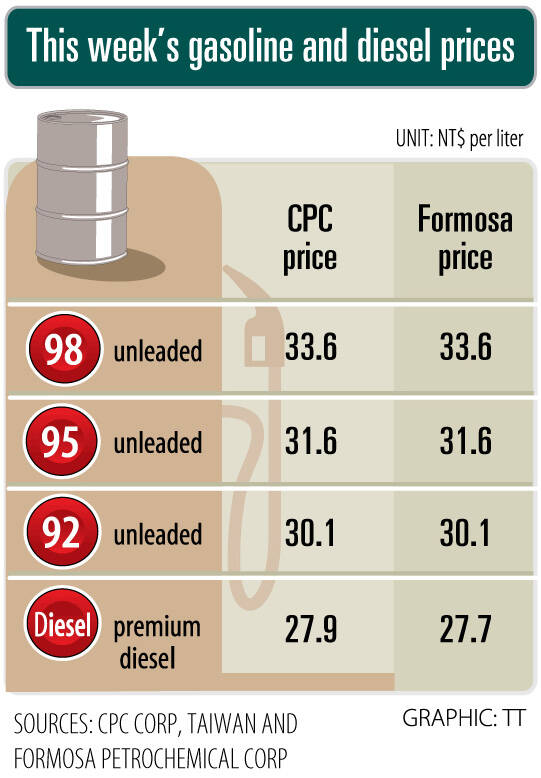

Effective today, gasoline prices at CPC and Formosa stations are to increase to NT$30.1, NT$31.6 and NT$33.6 per liter for 92, 95 and 98-octane unleaded gasoline respectively, the companies said.

Premium diesel would cost NT$27.9 per liter at CPC stations and NT$27.7 at Formosa pumps, they said.

Separately, prices of liquefied petroleum gas (LPG) products, including household and automotive LPG, propane and butane, as well as propane and butane mixes, would remain unchanged this month, CPC said.

Liquefied natural gas prices for retail and industrial users would also stay the same this month, although prices for power generation users such as Taiwan Power Co (台電) would rise 2 percent and those for industrial users like Taiwan Cogeneration Corp (台灣汽電共生) would increase 10 percent from last month, it added.

TECH BOOST: New TSMC wafer fabs in Arizona are to dramatically improve US advanced chip production, a report by market research firm TrendForce said With Taiwan Semiconductor Manufacturing Co (TSMC, 台積電) pouring large funds into Arizona, the US is expected to see an improvement in its status to become the second-largest maker of advanced semiconductors in 2027, Taipei-based market researcher TrendForce Corp (集邦科技) said in a report last week. TrendForce estimates the US would account for a 21 percent share in the global advanced integrated circuit (IC) production market by 2027, sharply up from the current 9 percent, as TSMC is investing US$65 billion to build three wafer fabs in Arizona, the report said. TrendForce defined the advanced chipmaking processes as the 7-nanometer process or more

China’s Huawei Technologies Co (華為) plans to start mass-producing its most advanced artificial intelligence (AI) chip in the first quarter of next year, even as it struggles to make enough chips due to US restrictions, two people familiar with the matter said. The telecoms conglomerate has sent samples of the Ascend 910C — its newest chip, meant to rival those made by US chipmaker Nvidia Corp — to some technology firms and started taking orders, the sources told Reuters. The 910C is being made by top Chinese contract chipmaker Semiconductor Manufacturing International Corp (SMIC, 中芯) on its N+2 process, but a lack

Who would not want a social media audience that grows without new content? During the three years she paused production of her short do-it-yourself (DIY) farmer’s lifestyle videos, Chinese vlogger Li Ziqi (李子柒), 34, has seen her YouTube subscribers increase to 20.2 million from about 14 million. While YouTube is banned in China, her fan base there — although not the size of YouTube’s MrBeast, who has 330 million subscribers — is close to 100 million across the country’s social media platforms Douyin (抖音), Sina Weibo (新浪微博) and Xiaohongshu (小紅書). When Li finally released new videos last week — ending what has

OPEN SCIENCE: International collaboration on math and science will persevere even if the incoming Trump administration imposes strict controls, Nvidia’s CEO said Nvidia Corp CEO Jensen Huang (黃仁勳) said on Saturday that global cooperation in technology would continue even if the incoming US administration imposes stricter export controls on advanced computing products. US president-elect Donald Trump, in his first term in office, imposed restrictions on the sale of US technology to China citing national security — a policy continued under US President Joe Biden. The curbs forced Nvidia, the world’s leading maker of chips used for artificial intelligence (AI) applications, to change its product lineup in China. The US chipmaking giant last week reported record-high quarterly revenue on the back of strong AI chip