Fans are not the only ones eagerly awaiting next year’s Oasis reunion tour: British hoteliers and pub owners are looking forward to a boom in business, with hopes of a Taylor Swift-style economy boost.

The price of hotel rooms shot up in host cities including Oasis’ hometown Manchester, England, as soon as the tour dates were announced.

“It’s clear the pull of live music is as strong as ever. Hotels will get booked up quickly as fans secure tickets, and pubs, bars and restaurants will all be packed next summer with concert-going fans,” said Kate Nicholls, chief executive of UKHospitality, which represents the industry. “We expect to see huge demand from fans, both from the UK and from abroad, and that will no doubt deliver a multimillion-pound boost to the hospitality sector next year.”

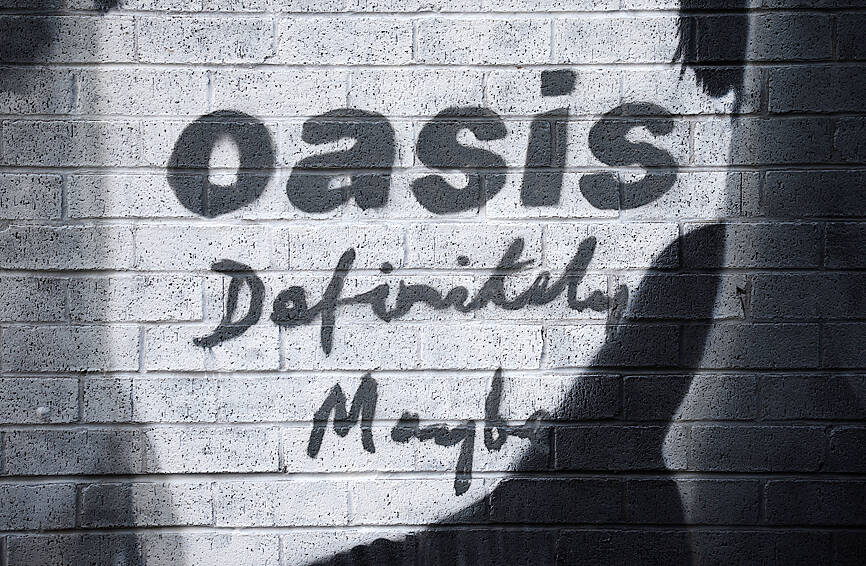

Photo: EPA-EFE

Warring brothers Liam and Noel Gallagher have put their 15-year feud behind them to reunite for the tour.

The Britpop duo behind hit songs including Wonderwall and Champagne Supernova on Tuesday announced they would play an initial 14 gigs next year in Cardiff, Manchester, London, Edinburgh and Dublin, starting in July next year.

Furious fans accused one hotel in Manchester of canceling their reservations for the dates to relist the rooms for three times the price.

The hotel blamed a “technical error,” but consumer body Which? said it was concerned about such practices and called on customers to be vigilant.

“Some accommodation providers will charge whatever they can get away with when a major event comes to town,” said Lisa Webb, a consumer law expert at Which?, adding that some hotels had made “eye-watering price” rises ahead of the tour.

One fan in Manchester living near the city’s Heaton Park venue offered an innovative solution in a viral post on X.

She offered concert-goers a free camping spot in her garden in exchange for a ticket.

The tour looks set to “join the likes of Taylor Swift, Harry Styles and Beyonce in delivering record-setting shows,” Nicholls added.

The economic impact of the European leg of Swift’s “Eras Tour” — which ended last week in London — went far beyond ticket sales.

British bank Barclays PLC estimated in a study in May that Swift’s tour would inject almost £1 billion (US$1.31 billion) into the UK economy, with fans splurging on tickets, travel, accommodation and eating and drinking out.

Several economists also said that the tour and related activities could have marginally boosted inflation.

Tuesday’s tour announcement delighted fans who had despaired of ever seeing the Gallagher brothers perform together again.

As expected, sky-high demand led to a further three dates being announced on Thursday.

The three extra concerts take the total announced so far for the UK and Ireland to 17.

More on “continents outside of Europe later next year,” are also expected, a statement on Oasis’s Web site said.

Ticket prices were also unveiled on Thursday with seated tickets priced at about £75 and standing tickets at about £150.

Ticket sales, merchandise and possible licensing for a film alone could generate a £400 million profit, said Matt Grimes, a music industry researcher at Birmingham City University.

After accounting for expenses and paying their teams, the Gallagher brothers could come away with £50 million each, he said.

They would not be the only ones to profit.

“When a band like Oasis comes to your city to play, you’ve got people coming along. So hotels make money, public transport companies make money, food outlets make money, licensed pubs make money,” he said.

UK tickets were go on sale yesterday at 9am.

“They will be gone before midday,” Grimes said. “This is probably going to be perhaps a once in a lifetime event, so people will find the money to buy the tickets.”

When an apartment comes up for rent in Germany’s big cities, hundreds of prospective tenants often queue down the street to view it, but the acute shortage of affordable housing is getting scant attention ahead of today’s snap general election. “Housing is one of the main problems for people, but nobody talks about it, nobody takes it seriously,” said Andreas Ibel, president of Build Europe, an association representing housing developers. Migration and the sluggish economy top the list of voters’ concerns, but analysts say housing policy fails to break through as returns on investment take time to register, making the

NOT TO WORRY: Some people are concerned funds might continue moving out of the country, but the central bank said financial account outflows are not unusual in Taiwan Taiwan’s outbound investments hit a new high last year due to investments made by contract chipmaker Taiwan Semiconductor Manufacturing Co (TSMC, 台積電) and other major manufacturers to boost global expansion, the central bank said on Thursday. The net increase in outbound investments last year reached a record US$21.05 billion, while the net increase in outbound investments by Taiwanese residents reached a record US$31.98 billion, central bank data showed. Chen Fei-wen (陳斐紋), deputy director of the central bank’s Department of Economic Research, said the increase was largely due to TSMC’s efforts to expand production in the US and Japan. Investments by Vanguard International

WARNING SHOT: The US president has threatened to impose 25 percent tariffs on all imported vehicles, and similar or higher duties on pharmaceuticals and semiconductors US President Donald Trump on Wednesday suggested that a trade deal with China was “possible” — a key target in the US leader’s tariffs policy. The US in 2020 had already agreed to “a great trade deal with China” and a new deal was “possible,” Trump said. Trump said he expected Chinese President Xi Jinping (習近平) to visit the US, without giving a timeline for his trip. Trump also said that he was talking to China about TikTok, as the US seeks to broker a sale of the popular app owned by Chinese firm ByteDance Ltd (字節跳動). Trump last week said that he had

STRUGGLING TO SURVIVE: The group is proposing a consortium of investors, with Tesla as the largest backer, and possibly a minority investment by Hon Hai Precision Nissan Motor Co shares jumped after the Financial Times reported that a high-level Japanese group has drawn up plans to seek investment from Elon Musk’s Tesla Inc to aid the struggling automaker. The group believes the electric vehicle (EV) maker is interested in acquiring Nissan’s plants in the US, the newspaper reported, citing people it did not identify. The proposal envisions a consortium of investors, with Tesla as the largest backer, but also includes the possibility of a minority investment by Hon Hai Precision Industry Co (鴻海精密) to prevent a full takeover by the Apple supplier, the report said. The group is