PDD Holdings Inc’s (拼多多) shares fell the most on record after Temu’s owner warned that revenue growth would inevitably dwindle, highlighting the challenges of sustaining its pace of expansion against aggressive rivals like ByteDance Ltd (字節跳動).

Cofounder Chen Lei (陳磊) repeatedly stressed that PDD’s current trajectory was not sustainable, at a time competitors such as ByteDance’s TikTok and Alibaba Group Holding Ltd (阿里巴巴) are vying for budget-conscious shoppers.

PDD’s American depositary receipts on Monday tumbled 29 percent in New York, the stock’s worst loss since its initial public offering in 2018 and wiping out US$55 billion of market value.

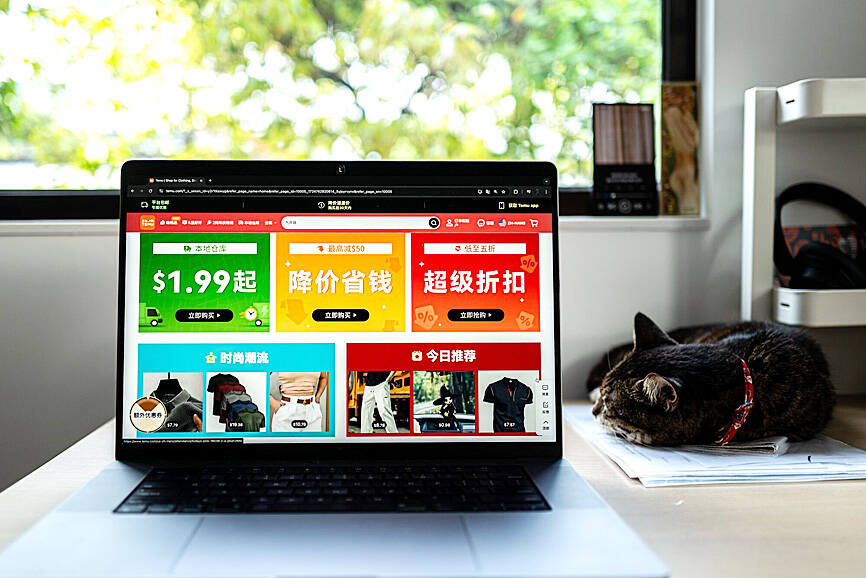

Photo: Bloomberg

PDD has spent big on e-commerce business Temu to drive its global presence and escape an ailing Chinese economy.

However, executives have kept a lid on the overseas unit’s performance as competition turns cutthroat.

On Monday, Chen said PDD needed to invest more in supporting merchants — at a time rivals are trying to woo them away.

“Competition is here to stay and is expected to intensify in our industry,” Chen told analysts during a post-results briefing. “High revenue growth is not sustainable, and a downward trend in profitability is inevitable.”

The Chinese e-commerce platform, which became a market darling with low-priced goods that helped propel sales and profits during China’s economic downturn, reported revenue of 97.1 billion yuan (US$13.6 billion) for the April-to-June quarter, missing the average estimate of 100 billion yuan.

Its net income was 32 billion yuan, compared with a projected 27.5 billion yuan.

“Going forward, PDD will face fierce competition in China, with merchants going through a hard time,” said Wang Xiaoyan (王曉燕), a Shanghai-based analyst with 86Research.

“PDD will likely invest more in China, and that means we’ll see downside for the group in the Chinese market,” Wang said.

The company’s disappointing results were the latest in a series of red flags about the Chinese economy. This week, popular restaurant chain Din Tai Fung (鼎泰豐) said it was shutting 14 outlets in northern China. Last month, Starbucks Corp disclosed a 14 percent plunge in Chinese revenue in the June quarter.

“The big issue is weakness in China consumer,” Robeco Hong Kong Ltd’s head of Asia Pacific equities Joshua Crabb said. “The read-across for competition and a weak consumer will be negative for sure.”

Consumption, a main driver of the economy, weakened this year after a rebound in post-COVID-19 reopening spending last year. Against the backdrop of widespread job and salary cuts, as well as plunging property prices, Chinese consumers have become more cautious with their spending, leading to intense price wars in sectors such as cars.

Retail sales expanded just a little more than 3 percent in the first seven months of this year, far worse than the 8 percent-plus growth recorded in pre-pandemic times.

Residents’ confidence in future income plunged to the worst level since the end of 2022, a central bank survey conducted in the second quarter showed.

TARIFFS: The global ‘panic atmosphere remains strong,’ and foreign investors have continued to sell their holdings since the start of the year, the Ministry of Finance said The government yesterday authorized the activation of its NT$500 billion (US$15.15 billion) National Stabilization Fund (NSF) to prop up the local stock market after two days of sharp falls in reaction to US President Donald Trump’s new import tariffs. The Ministry of Finance said in a statement after the market close that the steering committee of the fund had been given the go-ahead to intervene in the market to bolster Taiwanese shares in a time of crisis. The fund has been authorized to use its assets “to carry out market stabilization tasks as appropriate to maintain the stability of Taiwan’s

STEEP DECLINE: Yesterday’s drop was the third-steepest in its history, the steepest being Monday’s drop in the wake of the tariff announcement on Wednesday last week Taiwanese stocks continued their heavy sell-off yesterday, as concerns over US tariffs and unwinding of leveraged bets weighed on the market. The benchmark TAIEX plunged 1,068.19 points, or 5.79 percent, to 17,391.76, notching the biggest drop among Asian peers as it hit a 15-month low. The decline came even after the government on late Tuesday authorized the NT$500 billion (US$15.2 billion) National Stabilization Fund (國安基金) to step in to buoy the market amid investors’ worries over tariffs imposed by US President Donald Trump. Yesterday’s decline was the third-steepest in its history, trailing only the declines of 2,065.87 points on Monday and

TARIFF CONCERNS: The chipmaker cited global uncertainty from US tariffs and a weakening economic outlook, but said its Singapore expansion remains on track Vanguard International Semiconductor Corp (世界先進), a foundry service provider specializing in producing power management and display driver chips, yesterday withdrew its full-year revenue projection of moderate growth for this year, as escalating US tariff tensions raised uncertainty and concern about a potential economic recession. The Hsinchu-based chipmaker in February said revenues this year would grow mildly from last year based on improving supply chain inventory levels and market demand. At the time, it also anticipated gradual quarter revenue growth. However, the US’ sweeping tariff policy has upended the industry’s supply chains and weakened economic prospects for the world economy, it said. “Now

Six years ago, LVMH’s billionaire CEO Bernard Arnault and US President Donald Trump cut the blue ribbon on a factory in rural Texas that would make designer handbags for Louis Vuitton, one of the world’s best-known luxury brands. However, since the high-profile opening, the factory has faced a host of problems limiting production, 11 former Louis Vuitton employees said. The site has consistently ranked among the worst-performing for Louis Vuitton globally, “significantly” underperforming other facilities, said three former Louis Vuitton workers and a senior industry source, who cited internal rankings shared with staff. The plant’s problems — which have not