Chinese technology giants including Huawei Technologies Co (華為) and Baidu Inc (百度) as well as start-ups are stockpiling high bandwidth memory (HBM) semiconductors from Samsung Electronics Co in anticipation of US curbs on exports of the chips to China, three sources said.

The companies have ramped up their buying of the artificial intelligence (AI) capable semiconductors since early this year, helping China account for about 30 percent of Samsung’s HBM chip revenue in the first half of this year, one of the sources said.

US authorities are planning to unveil an export-control package this month that would impose new restrictions on shipments for China’s semiconductor industry, reports from last week said, citing sources.

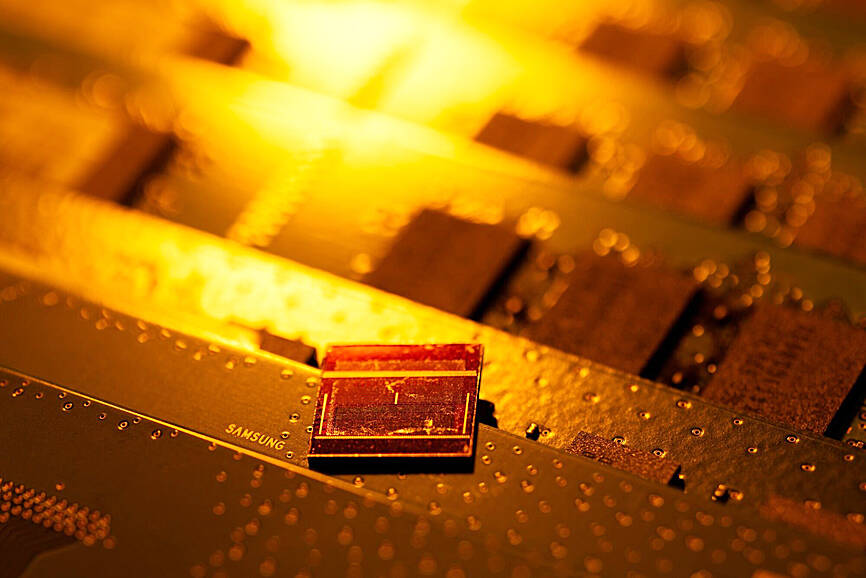

Photo: Bloomberg

Those sources also said the package is expected to lay out parameters for restricting HBM chip access.

HBM chips are crucial components in developing advanced processors such as Nvidia Corp’s graphics processing units that can be used for generative AI work.

There are only three major chipmakers producing HBM chips — SK Hynix Inc and Samsung from South Korea, and US-based Micron Technology Inc.

Chinese chip demand has been largely focused on the HBM2E model, which is two generations behind the most advanced version HBM3E, the sources said.

The global AI boom has led to a tightness in supply of the advanced model.

“Given that its domestic technology development is not yet fully mature, China’s demand for Samsung’s HBM has become exceptionally high, as other manufacturers’ capacities are already fully booked by American AI companies,” White Oak Capital Partners Pte Ltd investment director Nori Chiou said in Singapore.

Although it is hard to estimate the volume or value of the stockpiled HBM chips in China, businesses ranging from satellite manufacturers to tech firms such as Tencent Holdings Ltd (騰訊) have been buying them, the sources said.

One of the sources said that chip designing start-up Beijing Haawking Technology Co (北京中科昊芯) recently ordered HBM chips from Samsung.

Meanwhile, Huawei has been using Samsung HBM2E semiconductors to make its advanced Ascend AI chip, one of the sources said.

Chinese firms have made some headway in producing HBM, with Huawei and memory chipmaker Changxin Xinqiao Memory Technologies Inc (長鑫存儲) focusing on developing HBM2 chips, which are three generations behind the HBM3E model, earlier reports said.

Those efforts could be affected by the new US rule.

Restrictions on HBM sales to China could have a bigger effect on Samsung than its key rivals, which rely less on the Chinese market, said the sources who were briefed on the sales.

Micron has refrained from selling its HBM products to China since last year, while SK Hynix, whose major HBM customers include Nvidia, focuses more on advanced HBM chip production, they said.

Nvidia Corp CEO Jensen Huang (黃仁勳) is expected to miss the inauguration of US president-elect Donald Trump on Monday, bucking a trend among high-profile US technology leaders. Huang is visiting East Asia this week, as he typically does around the time of the Lunar New Year, a person familiar with the situation said. He has never previously attended a US presidential inauguration, said the person, who asked not to be identified, because the plans have not been announced. That makes Nvidia an exception among the most valuable technology companies, most of which are sending cofounders or CEOs to the event. That includes

TARIFF TRADE-OFF: Machinery exports to China dropped after Beijing ended its tariff reductions in June, while potential new tariffs fueled ‘front-loaded’ orders to the US The nation’s machinery exports to the US amounted to US$7.19 billion last year, surpassing the US$6.86 billion to China to become the largest export destination for the local machinery industry, the Taiwan Association of Machinery Industry (TAMI, 台灣機械公會) said in a report on Jan. 10. It came as some manufacturers brought forward or “front-loaded” US-bound shipments as required by customers ahead of potential tariffs imposed by the new US administration, the association said. During his campaign, US president-elect Donald Trump threatened tariffs of as high as 60 percent on Chinese goods and 10 percent to 20 percent on imports from other countries.

Taiwanese manufacturers have a chance to play a key role in the humanoid robot supply chain, Tongtai Machine and Tool Co (東台精機) chairman Yen Jui-hsiung (嚴瑞雄) said yesterday. That is because Taiwanese companies are capable of making key parts needed for humanoid robots to move, such as harmonic drives and planetary gearboxes, Yen said. This ability to produce these key elements could help Taiwanese manufacturers “become part of the US supply chain,” he added. Yen made the remarks a day after Nvidia Corp cofounder and chief executive officer Jensen Huang (黃仁勳) said his company and Taiwan Semiconductor Manufacturing Co (TSMC, 台積電) are jointly

MARKET SHIFTS: Exports to the US soared more than 120 percent to almost one quarter, while ASEAN has steadily increased to 18.5 percent on rising tech sales The proportion of Taiwan’s exports directed to China, including Hong Kong, declined by more than 12 percentage points last year compared with its peak in 2020, the Ministry of Finance said on Thursday last week. The decrease reflects the ongoing restructuring of global supply chains, driven by escalating trade tensions between Beijing and Washington. Data compiled by the ministry showed China and Hong Kong accounted for 31.7 percent of Taiwan’s total outbound sales last year, a drop of 12.2 percentage points from a high of 43.9 percent in 2020. In addition to increasing trade conflicts between China and the US, the ministry said