The US is considering unilateral restrictions on China’s access to artificial intelligence (AI) memory chips and equipment capable of making those semiconductors as soon as next month, a move that would further escalate the tech rivalry between the world’s biggest economies.

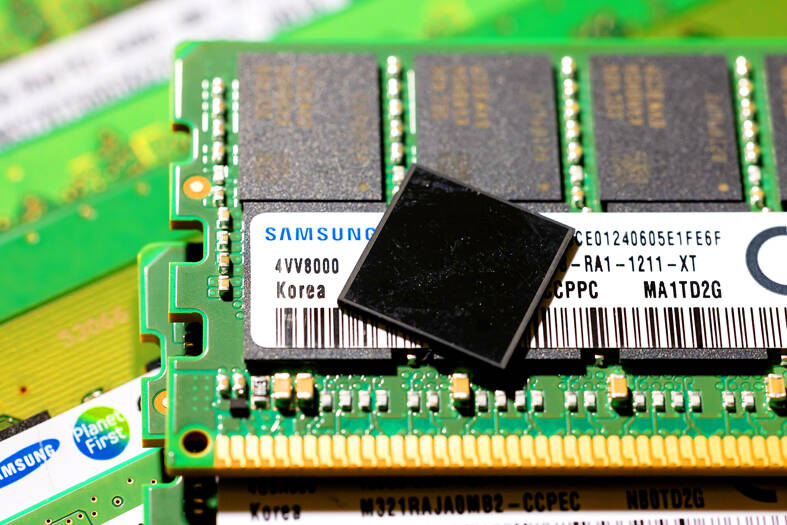

The measure is designed to keep Micron Technology Inc and South Korea’s leading memorychip makers SK Hynix Inc and Samsung Electronics Co from supplying Chinese firms with so-called high-bandwidth memory (HBM) chips, people familiar with the matter said. The three firms dominate the global HBM market.

US President Joe Biden’s administration is working on several restrictions aimed at keeping vital technology out of the hands of Chinese manufacturers, including limits on sales of chipmaking equipment. This rule would deliver a new set of constraints against memory chips for AI, the latest arena of US-China competition.

Photo: Bloomberg

If enacted, the measure would capture HBM2 and more advanced chips including HBM3 and HBM3E, the most cutting-edge AI memory chips being produced right now, as well as the tools required to make them, the sources said.

HBM chips are required to run AI accelerators like those offered by Nvidia Corp and Advanced Micro Devices Inc.

Micron would largely be unaffected as the Boise, Idaho-based chipmaker has refrained from selling its HBM products to China after Beijing banned its memory chips from critical infrastructure last year, the people said.

It is unclear what authority the US would use to restrict the South Korean firms, the people said. One possibility is the Foreign Direct Product Rule, which lets Washington impose controls on foreign-made products that use even the tiniest amount of US technology. SK Hynix and Samsung rely on US chip design software and equipment from the likes of Cadence Design Systems Inc and Applied Materials Inc.

Micron, Samsung and SK Hynix representatives declined to comment.

The new restrictions are likely to be unveiled later this month as part of a broader package that also includes sanctions against more than 120 Chinese firms and fresh limits on various types of chip equipment, with carve-outs for key allies including Japan, the Netherlands and South Korea, the people said.

As part of its comprehensive HBM-related curbs in the same export control package, the US plans to lower the threshold for what qualifies as advanced DRAM. A single HBM chip contains several DRAM dies.

New restrictions on HBM equipment and DRAM aim to deter leading Chinese memorychip maker ChangXin Memory Technologies Inc (長鑫存儲) from advancing its technology, the sources said. ChangXin is now capable of making HBM2, which first became commercially available in 2016.

Biden administration officials also plan to create a list of the critical components that China needs to keep producing semiconductors. They are also eyeing what is called a zero de-minimis rule, an even tighter standard for Foreign Direct Product Rule under which any products containing US technology would be subject to potential restrictions. A large group of US allies would be exempted from that measure, including Japan and the Netherlands.

Intel Corp chief executive officer Lip-Bu Tan (陳立武) is expected to meet with Taiwanese suppliers next month in conjunction with the opening of the Computex Taipei trade show, supply chain sources said on Monday. The visit, the first for Tan to Taiwan since assuming his new post last month, would be aimed at enhancing Intel’s ties with suppliers in Taiwan as he attempts to help turn around the struggling US chipmaker, the sources said. Tan is to hold a banquet to celebrate Intel’s 40-year presence in Taiwan before Computex opens on May 20 and invite dozens of Taiwanese suppliers to exchange views

Application-specific integrated circuit designer Faraday Technology Corp (智原) yesterday said that although revenue this quarter would decline 30 percent from last quarter, it retained its full-year forecast of revenue growth of 100 percent. The company attributed the quarterly drop to a slowdown in customers’ production of chips using Faraday’s advanced packaging technology. The company is still confident about its revenue growth this year, given its strong “design-win” — or the projects it won to help customers design their chips, Faraday president Steve Wang (王國雍) told an online earnings conference. “The design-win this year is better than we expected. We believe we will win

Chizuko Kimura has become the first female sushi chef in the world to win a Michelin star, fulfilling a promise she made to her dying husband to continue his legacy. The 54-year-old Japanese chef regained the Michelin star her late husband, Shunei Kimura, won three years ago for their Sushi Shunei restaurant in Paris. For Shunei Kimura, the star was a dream come true. However, the joy was short-lived. He died from cancer just three months later in June 2022. He was 65. The following year, the restaurant in the heart of Montmartre lost its star rating. Chizuko Kimura insisted that the new star is still down

While China’s leaders use their economic and political might to fight US President Donald Trump’s trade war “to the end,” its army of social media soldiers are embarking on a more humorous campaign online. Trump’s tariff blitz has seen Washington and Beijing impose eye-watering duties on imports from the other, fanning a standoff between the economic superpowers that has sparked global recession fears and sent markets into a tailspin. Trump says his policy is a response to years of being “ripped off” by other countries and aims to bring manufacturing to the US, forcing companies to employ US workers. However, China’s online warriors