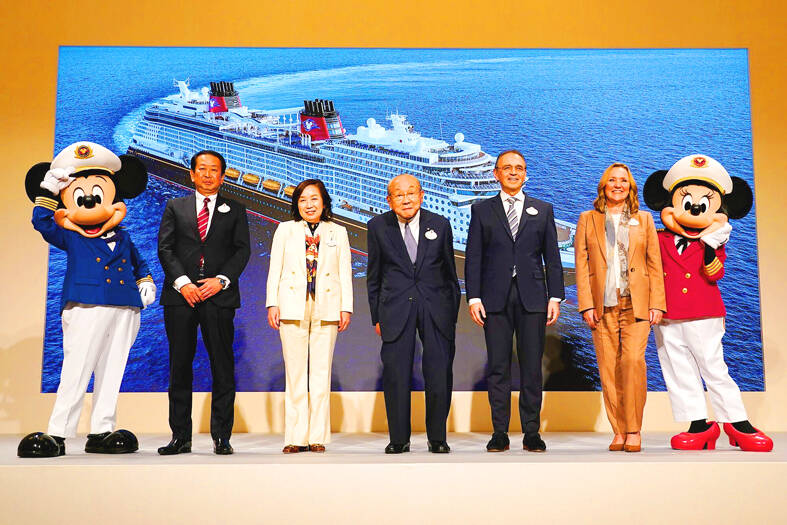

Walt Disney Co yesterday unveiled plans to launch a new cruise ship to set sail from Tokyo starting in fiscal 2028, adding a ninth vessel to the brand’s growing fleet.

The new ship, to be modeled after the Wish, which is the largest vessel in the group, is a partnership with Oriental Land Co (OLC), the operator of Tokyo Disneyland. It is part of a 10-year, US$60 billion expansion of Disney’s theme parks and cruise business.

Disney has five cruise ships in operation. In addition to the Tokyo-based vessel, it has plans for three others, including one that is to set sail from Singapore next year.

Photo: Toru Hanai

The new Tokyo-based ship, whose name was not revealed, would have a maximum capacity of 4,000 passengers and is expected to bring in about ¥100 billion (US$621.77 million) in annual sales within several years of launch, OLC said.

“To set sail from Japan will make Disney vacations at sea more accessible to Japanese guests, who we know are some of our biggest fans,” Disney Signature Experiences president Thomas Mazloum told reporters.

The cruise line expansion comes as the industry is enjoying a rebound from a global shutdown during the COVID-19 pandemic.

The Cruise Lines International Association expects the number of passengers to reach 34.7 million this year, up 17 percent from 2019.

Disney’s experiences business, which includes its domestic and international parks and cruise line, accounted for more than one-third of the company’s revenue in the March quarter and nearly 60 percent of its operating income.

The company’s stock tumbled in May after chief financial officer Hugh Johnston warned about a “global moderation” in travel in the fiscal third quarter and other impacts, including higher wages and pre-opening expenses related to two of the new cruise ships and the new vacation island, Lookout Cay.

The rising tide for Disney’s cruise lines could help offset any softness in the company’s domestic theme park business, UBS analyst John Hodulik said.

The company said its second-quarter booking occupancy is at 97 percent for all five ships.

The rapid expansion of Disney’s cruise capacity “helps derisk the medium-term outlook” for the parks business, Hodulik said.

Disney’s other recent investments include three new areas at the Tokyo DisneySea theme park, recreating the worlds of Frozen, Tangled and Peter Pan, the opening of a Frozen-themed land at Hong Kong Disneyland and a Zootopia experience in Shanghai.

The company at its D23 fan convention next month is expected to announce plans for new attractions at Disneyland in California and Walt Disney World in central Florida.

The US dollar was trading at NT$29.7 at 10am today on the Taipei Foreign Exchange, as the New Taiwan dollar gained NT$1.364 from the previous close last week. The NT dollar continued to rise today, after surging 3.07 percent on Friday. After opening at NT$30.91, the NT dollar gained more than NT$1 in just 15 minutes, briefly passing the NT$30 mark. Before the US Department of the Treasury's semi-annual currency report came out, expectations that the NT dollar would keep rising were already building. The NT dollar on Friday closed at NT$31.064, up by NT$0.953 — a 3.07 percent single-day gain. Today,

‘SHORT TERM’: The local currency would likely remain strong in the near term, driven by anticipated US trade pressure, capital inflows and expectations of a US Fed rate cut The US dollar is expected to fall below NT$30 in the near term, as traders anticipate increased pressure from Washington for Taiwan to allow the New Taiwan dollar to appreciate, Cathay United Bank (國泰世華銀行) chief economist Lin Chi-chao (林啟超) said. Following a sharp drop in the greenback against the NT dollar on Friday, Lin told the Central News Agency that the local currency is likely to remain strong in the short term, driven in part by market psychology surrounding anticipated US policy pressure. On Friday, the US dollar fell NT$0.953, or 3.07 percent, closing at NT$31.064 — its lowest level since Jan.

The New Taiwan dollar and Taiwanese stocks surged on signs that trade tensions between the world’s top two economies might start easing and as US tech earnings boosted the outlook of the nation’s semiconductor exports. The NT dollar strengthened as much as 3.8 percent versus the US dollar to 30.815, the biggest intraday gain since January 2011, closing at NT$31.064. The benchmark TAIEX jumped 2.73 percent to outperform the region’s equity gauges. Outlook for global trade improved after China said it is assessing possible trade talks with the US, providing a boost for the nation’s currency and shares. As the NT dollar

The Financial Supervisory Commission (FSC) yesterday met with some of the nation’s largest insurance companies as a skyrocketing New Taiwan dollar piles pressure on their hundreds of billions of dollars in US bond investments. The commission has asked some life insurance firms, among the biggest Asian holders of US debt, to discuss how the rapidly strengthening NT dollar has impacted their operations, people familiar with the matter said. The meeting took place as the NT dollar jumped as much as 5 percent yesterday, its biggest intraday gain in more than three decades. The local currency surged as exporters rushed to