Taiwan’s exports last month increased 23.5 percent from a year earlier to US$39.9 billion, the fastest in 28 months as most product categories posted gains, led by electronics used in artificial intelligence (AI) applications, the Ministry of Finance said yesterday.

The advance was much faster than a range of 7 to 10 percent the ministry predicted last month thanks to an AI boom and demand ahead of expected launches of next-generation smartphones, laptops and other tech gadgets, Department of Statistics Director-General Beatrice Tsai (蔡美娜) said.

“As the high season [for technology products] approaches, export volume this month would gain further traction at an annual rate of 3 to 6 percent, even as the low-base effect tapers,” Tsai told an online media briefing.

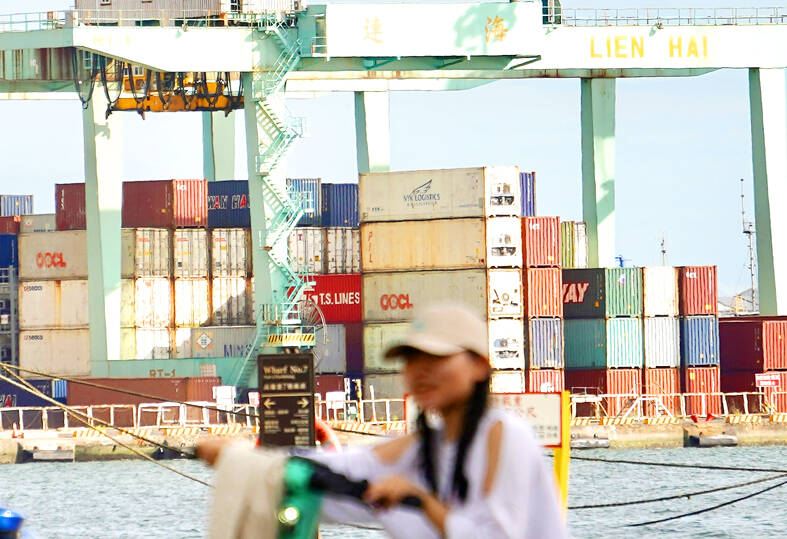

Photo: CNA

Shipments of information and communications technology products last month more than doubled to US$10.78 billion, while electronic components, mainly semiconductors, rose 7.3 percent to US$14.58 billion, she said, adding that the two product categories combined accounted for about 90 percent of overall exports.

Technology titans in the US have built up AI capacities, efforts that have made the US the second-largest destination for Taiwanese exports after China, she said.

Taiwan is home to major suppliers of AI chips, servers, and storage and memory devices.

AI servers reportedly cost 10 times more than traditional servers, Tsai said, adding that it is difficult to gauge their exact contributions.

That explained why local electronics suppliers Hon Hai Precision Industry Co (鴻海精密), Quanta Computer Inc (廣達電腦) and Wistron Corp (緯創) had strong sales last month and their share prices soared.

Exports to almost all trade partners trended upward, except Japan, which declined 2.3 percent, ministry data showed.

Meanwhile, shipments of non-technology products improved, with increases ranging from 2.5 percent for base metal products to 23.8 percent for mineral products, the ministry said.

Tsai attributed the improvement to rising international oil prices and the end of inventory adjustments.

Textile products have benefitted from the upcoming Paris Olympics, she added.

Imports grew 33.9 percent from a year earlier to US$35.22 billion, giving Taiwan a trade surplus of US$4.68 billion, a 22.2 percent retreat year-on-year, the ministry said.

Better sales and business visibility made local firms more willing to buy materials that would be used to manufacture products for export and capital equipment to expand capacity, Tsai said.

In the April-to-June period, exports advanced 9.9 percent to US$114.73 billion, missing a forecast in May by the Directorate-General of Budget, Accounting and Statistics by 4.6 percentage points, she said.

Imports grew 12.7 percent to US$97.55 billion, beating the projected 11.54 percent increase, she said.

The results indicate that the statistics agency might have been optimistic in its projections for exports and GDP growth this year, , the ministry said.

In the first half, exports rose 11.4 percent to US$225.03 billion, while imports picked up 7.8 percent to US$188.91 billion, it added.

The US dollar was trading at NT$29.7 at 10am today on the Taipei Foreign Exchange, as the New Taiwan dollar gained NT$1.364 from the previous close last week. The NT dollar continued to rise today, after surging 3.07 percent on Friday. After opening at NT$30.91, the NT dollar gained more than NT$1 in just 15 minutes, briefly passing the NT$30 mark. Before the US Department of the Treasury's semi-annual currency report came out, expectations that the NT dollar would keep rising were already building. The NT dollar on Friday closed at NT$31.064, up by NT$0.953 — a 3.07 percent single-day gain. Today,

‘SHORT TERM’: The local currency would likely remain strong in the near term, driven by anticipated US trade pressure, capital inflows and expectations of a US Fed rate cut The US dollar is expected to fall below NT$30 in the near term, as traders anticipate increased pressure from Washington for Taiwan to allow the New Taiwan dollar to appreciate, Cathay United Bank (國泰世華銀行) chief economist Lin Chi-chao (林啟超) said. Following a sharp drop in the greenback against the NT dollar on Friday, Lin told the Central News Agency that the local currency is likely to remain strong in the short term, driven in part by market psychology surrounding anticipated US policy pressure. On Friday, the US dollar fell NT$0.953, or 3.07 percent, closing at NT$31.064 — its lowest level since Jan.

The New Taiwan dollar and Taiwanese stocks surged on signs that trade tensions between the world’s top two economies might start easing and as US tech earnings boosted the outlook of the nation’s semiconductor exports. The NT dollar strengthened as much as 3.8 percent versus the US dollar to 30.815, the biggest intraday gain since January 2011, closing at NT$31.064. The benchmark TAIEX jumped 2.73 percent to outperform the region’s equity gauges. Outlook for global trade improved after China said it is assessing possible trade talks with the US, providing a boost for the nation’s currency and shares. As the NT dollar

The Financial Supervisory Commission (FSC) yesterday met with some of the nation’s largest insurance companies as a skyrocketing New Taiwan dollar piles pressure on their hundreds of billions of dollars in US bond investments. The commission has asked some life insurance firms, among the biggest Asian holders of US debt, to discuss how the rapidly strengthening NT dollar has impacted their operations, people familiar with the matter said. The meeting took place as the NT dollar jumped as much as 5 percent yesterday, its biggest intraday gain in more than three decades. The local currency surged as exporters rushed to