The entertainment giant Paramount Global will merge with Skydance Media LLC, closing out a decades long run by the Redstone family in Hollywood and injecting desperately needed cash into a legacy studio that has struggled to adapt to a shifting entertainment landscape.

It also signals rise of a new power player, David Ellison, the founder of Skydance and son of billionaire Larry Ellison, the founder of the software company Oracle Corp.

Shari Redstone’s National Amusements Inc has owned more than three-quarters of Paramount’s Class A voting shares through the estate of her late father, Sumner Redstone. She had battled to maintain control of the company that owns CBS, which is behind blockbuster films such as “Top Gun" and “The Godfather.”

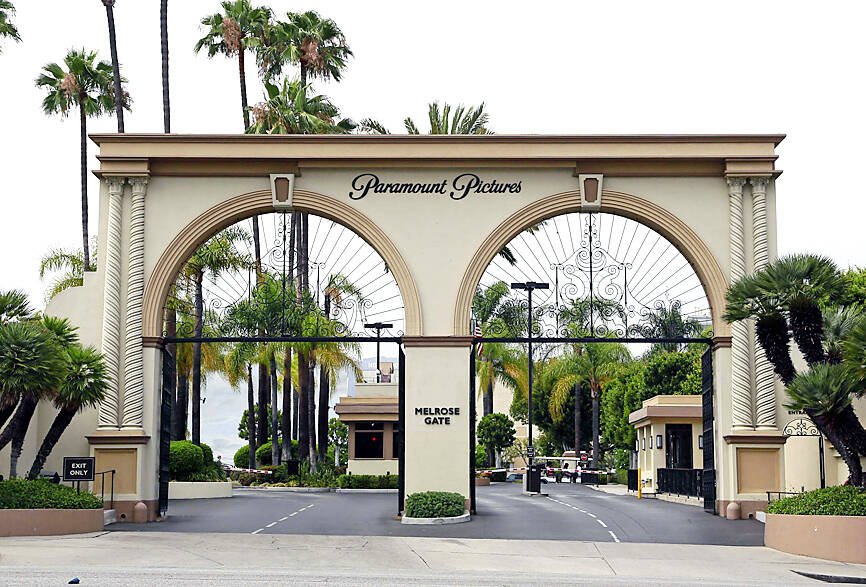

Photo: AP

Just weeks after turning down a similar agreement with Skydance, however, Redstone agreed to a deal on terms that had not changed much.

“Given the changes in the industry, we want to fortify Paramount for the future while ensuring that content remains king,” Paramount Global chair Shari Redstone said.

The new combined company is valued at around US$28 billion.

Skydance, based in Santa Monica, California, has helped produce some major Paramount hits in recent years, including Tom Cruise films like “Top Gun: Maverick” and installments of the “Mission Impossible” series.

Skydance was founded in 2010 by David Ellison and it quickly formed a production partnership with Paramount that same year. David Ellison, if the deal is approved by US regulators, will become chairman and chief executive officer of what’s being called New Paramount.

The on-again, off-again merger arrives at a tumultuous time for Paramount, which in an annual shareholder meeting in early last month laid out a restructuring plan that includes major cost cuts.

Leadership at Paramount has been volatile this year after its CEO Bob Bakish, following a number of disputes with Shari Redstone, was replaced with an “office of the C.E.O,” run by three executives. Four company directors were also replaced.

Paramount, however, has struggled to find its footing for years and its cable business has been hemorrhaging. To capture today’s growing streaming audience, the company launched Paramount+ back in 2021, but losses and debts have continued to grow.

Sumner Redstone used National Amusements, his family’s movie theater chain, to build a vast media empire that included CBS Corp and Viacom Inc, which have merged and separated a number of times over the years. Most recently, the companies re-joined forces in 2019, undoing the split consummated in 2006. The company, ViacomCBS, changed its name to Paramount Global in 2022.

Under Sumner Redstone’s leadership, Viacom became one of the nation’s media titans, home to pay TV channels MTV and Comedy Central and movie studio Paramount Pictures.

It is a company with a rich history, as well as a deep bank of media assets, and Skydance wasn’t the only one to gun for Paramount in recent months — Apollo Global Management Inc and Sony Pictures Entertainment Inc also made competing offers.

Late last year, Warner Bros Discovery Inc also made headlines for exploring a potential merger with Paramount. But by February, Warner had reportedly halted those talks.

‘SWASTICAR’: Tesla CEO Elon Musk’s close association with Donald Trump has prompted opponents to brand him a ‘Nazi’ and resulted in a dramatic drop in sales Demonstrators descended on Tesla Inc dealerships across the US, and in Europe and Canada on Saturday to protest company chief Elon Musk, who has amassed extraordinary power as a top adviser to US President Donald Trump. Waving signs with messages such as “Musk is stealing our money” and “Reclaim our country,” the protests largely took place peacefully following fiery episodes of vandalism on Tesla vehicles, dealerships and other facilities in recent weeks that US officials have denounced as terrorism. Hundreds rallied on Saturday outside the Tesla dealership in Manhattan. Some blasted Musk, the world’s richest man, while others demanded the shuttering of his

ADVERSARIES: The new list includes 11 entities in China and one in Taiwan, which is a local branch of Chinese cloud computing firm Inspur Group The US added dozens of entities to a trade blacklist on Tuesday, the US Department of Commerce said, in part to disrupt Beijing’s artificial intelligence (AI) and advanced computing capabilities. The action affects 80 entities from countries including China, the United Arab Emirates and Iran, with the commerce department citing their “activities contrary to US national security and foreign policy.” Those added to the “entity list” are restricted from obtaining US items and technologies without government authorization. “We will not allow adversaries to exploit American technology to bolster their own militaries and threaten American lives,” US Secretary of Commerce Howard Lutnick said. The entities

Minister of Finance Chuang Tsui-yun (莊翠雲) yesterday told lawmakers that she “would not speculate,” but a “response plan” has been prepared in case Taiwan is targeted by US President Donald Trump’s reciprocal tariffs, which are to be announced on Wednesday next week. The Trump administration, including US Secretary of the Treasury Scott Bessent, has said that much of the proposed reciprocal tariffs would focus on the 15 countries that have the highest trade surpluses with the US. Bessent has referred to those countries as the “dirty 15,” but has not named them. Last year, Taiwan’s US$73.9 billion trade surplus with the US

Prices of gasoline and diesel products at domestic gas stations are to fall NT$0.2 and NT$0.1 per liter respectively this week, even though international crude oil prices rose last week, CPC Corp, Taiwan (台灣中油) and Formosa Petrochemical Corp (台塑石化) said yesterday. International crude oil prices continued rising last week, as the US Energy Information Administration reported a larger-than-expected drop in US commercial crude oil inventories, CPC said in a statement. Based on the company’s floating oil price formula, the cost of crude oil rose 2.38 percent last week from a week earlier, it said. News that US President Donald Trump plans a “secondary