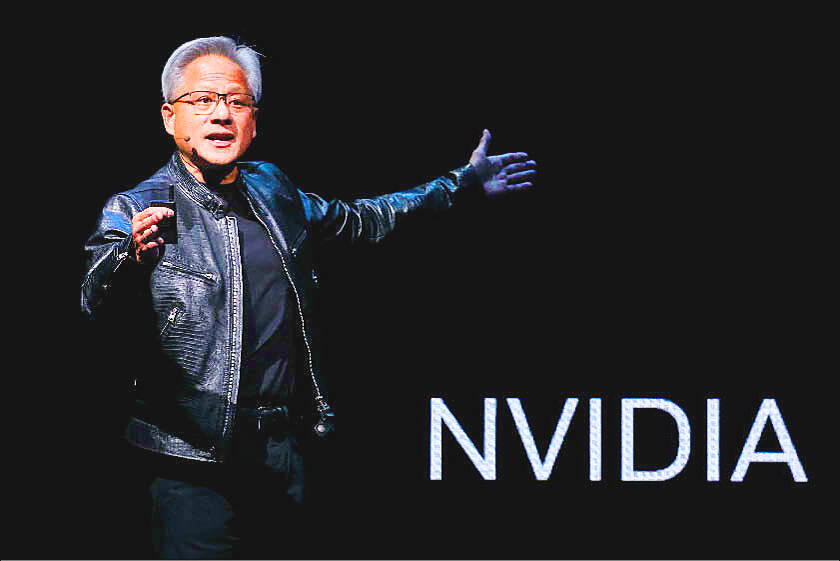

Nvidia Corp CEO Jensen Huang (黃仁勳) unloaded shares worth nearly US$169 million last month, the most he has netted in a single month, as insatiable demand for the chips used to power artificial intelligence (AI) drove the stock to fresh peaks.

The sale of 1.3 million shares, his first of the year, came during a month when Nvidia’s market value rose above US$3 trillion for the first time. That briefly made it the world’s most valuable company and pushed Huang, 61, into the rarefied group of ultra-rich with fortunes above US$100 billion.

The series of transactions were executed under a 10b5-1 trading plan adopted in March, the company’s regulatory filings showed.

Photo: Ann Wang, Reuters

Nvidia declined to comment.

Nvidia’s dominant share of the market for high-end accelerators has made it one of the biggest beneficiaries of the AI craze.

Due to the stock’s more than 150 percent gain since the start of the year, Huang’s net worth has more than doubled — rising by US$63.7 billion — in the past six months. The cofounder of the company is now ranked 13th on the Bloomberg Billionaires Index, with a US$107.7 billion fortune.

Huang is not the only insider selling. Nvidia executives and directors unloaded more than US$700 million of shares in the first half of this year, a dollar amount that dwarfs any other period in company history.

Huang has cashed out nearly US$1.1 billion in shares since the start of 2020, including last month’s sales.

Additional filings showed that Huang plans to continue selling in this month.

Semiconductor business between Taiwan and the US is a “win-win” model for both sides given the high level of complementarity, the government said yesterday responding to tariff threats from US President Donald Trump. Home to the world’s largest contract chipmaker, Taiwan Semiconductor Manufacturing Co (TSMC, 台積電), Taiwan is a key link in the global technology supply chain for companies such as Apple Inc and Nvidia Corp. Trump said on Monday he plans to impose tariffs on imported chips, pharmaceuticals and steel in an effort to get the producers to make them in the US. “Taiwan and the US semiconductor and other technology industries

A start-up in Mexico is trying to help get a handle on one coastal city’s plastic waste problem by converting it into gasoline, diesel and other fuels. With less than 10 percent of the world’s plastics being recycled, Petgas’ idea is that rather than letting discarded plastic become waste, it can become productive again as fuel. Petgas developed a machine in the port city of Boca del Rio that uses pyrolysis, a thermodynamic process that heats plastics in the absence of oxygen, breaking it down to produce gasoline, diesel, kerosene, paraffin and coke. Petgas chief technology officer Carlos Parraguirre Diaz said that in

SMALL AND EFFICIENT: The Chinese AI app’s initial success has spurred worries in the US that its tech giants’ massive AI spending needs re-evaluation, a market strategist said Chinese artificial intelligence (AI) start-up DeepSeek’s (深度求索) eponymous AI assistant rocketed to the top of Apple Inc’s iPhone download charts, stirring doubts in Silicon Valley about the strength of the US’ technological dominance. The app’s underlying AI model is widely seen as competitive with OpenAI and Meta Platforms Inc’s latest. Its claim that it cost much less to train and develop triggered share moves across Asia’s supply chain. Chinese tech firms linked to DeepSeek, such as Iflytek Co (科大訊飛), surged yesterday, while chipmaking tool makers like Advantest Corp slumped on the potential threat to demand for Nvidia Corp’s AI accelerators. US stock

SUBSIDIES: The nominee for commerce secretary indicated the Trump administration wants to put its stamp on the plan, but not unravel it entirely US President Donald Trump’s pick to lead the agency in charge of a US$52 billion semiconductor subsidy program declined to give it unqualified support, raising questions about the disbursement of funds to companies like Intel Corp and Taiwan Semiconductor Manufacturing Co (台積電). “I can’t say that I can honor something I haven’t read,” Howard Lutnick, Trump’s nominee for commerce secretary, said of the binding CHIPS and Science Act awards in a confirmation hearing on Wednesday. “To the extent monies have been disbursed, I would commit to rigorously enforcing documents that have been signed by those companies to make sure we get