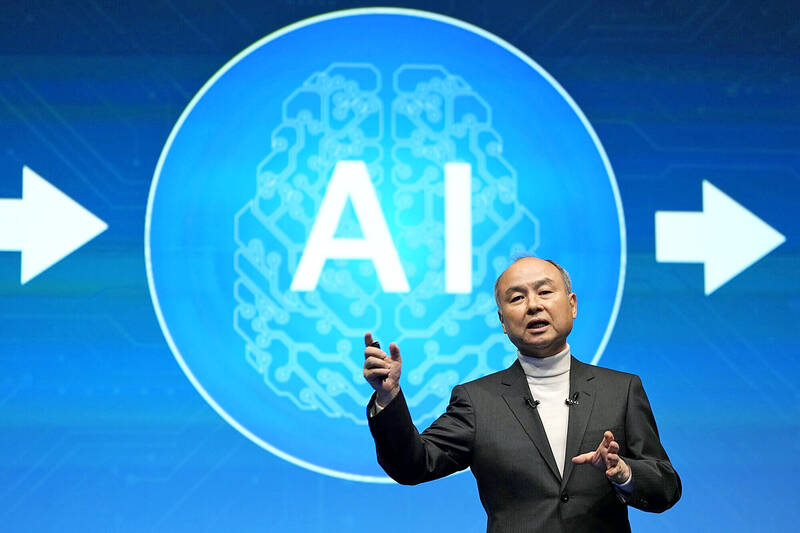

Softbank Group Corp’s stock rose 1.5 percent to a new lifetime high yesterday, a vote of confidence in chairman and chief executive officer Masayoshi Son’s ambitions to ramp up investments in artificial intelligence (AI) and semiconductors.

The Japanese tech investor is gaining investor attention as its telecom arm moves aggressively to invest in generative AI, tying up with Microsoft Corp and start-up Perplexity AI Inc and building data centers stocked with Nvidia Corp accelerators.

Softbank’s chip unit Arm Holdings PLC is also trying to position its architecture as a means to conserve energy in devices running AI.

Photo: Toru Hanai, Bloomberg

The rally is a vindication for Softbank founder Son, whose reputation has been tarnished by big start-up bets that cost the company billions of dollars in recent years. The company’s close ties with Nvidia and OpenAI have strengthened its position amid a global race to build AI-related infrastructure.

Shares of Softbank got a lift in part because the benchmark Nikkei 225’s recovery is expected to help the investment firm’s earnings, according to Tomoaki Kawasaki, a senior analyst at Iwaicosmo Securities Co. “It’s getting another boost as more investors see it as a semiconductor-related stock,” he said.

A darling of retail investors, Softbank shares remain volatile. During the dot-com boom and bust, the company lost 99 percent of its market capitalization, erasing US$70 billion of Son’s wealth.

The company regained ground through two decades of effort rolling out broadband networks in Japan, selling the country’s first Apple Inc iPhones and investments in some of the world’s biggest start-ups.

But its shares plunged again in 2021 in the wake of Beijing’s crackdown on tech firms and a flurry of missteps including investments in start-ups such as WeWork, Katerra Inc, OneWeb Ltd and Zume Pizza Inc.

The share rise has also lifted Son’s rhetoric, with the billionaire making more grandiose pronouncements about the future of AI. Recently, he told shareholders he was preparing to swing for the fences, in a move that will make his previous bets seem like “warmups.”

Nvidia Corp’s demand for advanced packaging from Taiwan Semiconductor Manufacturing Co (TSMC, 台積電) remains strong though the kind of technology it needs is changing, Nvidia CEO Jensen Huang (黃仁勳) said yesterday, after he was asked whether the company was cutting orders. Nvidia’s most advanced artificial intelligence (AI) chip, Blackwell, consists of multiple chips glued together using a complex chip-on-wafer-on-substrate (CoWoS) advanced packaging technology offered by TSMC, Nvidia’s main contract chipmaker. “As we move into Blackwell, we will use largely CoWoS-L. Of course, we’re still manufacturing Hopper, and Hopper will use CowoS-S. We will also transition the CoWoS-S capacity to CoWos-L,” Huang said

Nvidia Corp CEO Jensen Huang (黃仁勳) is expected to miss the inauguration of US president-elect Donald Trump on Monday, bucking a trend among high-profile US technology leaders. Huang is visiting East Asia this week, as he typically does around the time of the Lunar New Year, a person familiar with the situation said. He has never previously attended a US presidential inauguration, said the person, who asked not to be identified, because the plans have not been announced. That makes Nvidia an exception among the most valuable technology companies, most of which are sending cofounders or CEOs to the event. That includes

INDUSTRY LEADER: TSMC aims to continue outperforming the industry’s growth and makes 2025 another strong growth year, chairman and CEO C.C. Wei says Taiwan Semiconductor Manufacturing Co (TSMC, 台積電), a major chip supplier to Nvidia Corp and Apple Inc, yesterday said it aims to grow revenue by about 25 percent this year, driven by robust demand for artificial intelligence (AI) chips. That means TSMC would continue to outpace the foundry industry’s 10 percent annual growth this year based on the chipmaker’s estimate. The chipmaker expects revenue from AI-related chips to double this year, extending a three-fold increase last year. The growth would quicken over the next five years at a compound annual growth rate of 45 percent, fueled by strong demand for the high-performance computing

TARIFF TRADE-OFF: Machinery exports to China dropped after Beijing ended its tariff reductions in June, while potential new tariffs fueled ‘front-loaded’ orders to the US The nation’s machinery exports to the US amounted to US$7.19 billion last year, surpassing the US$6.86 billion to China to become the largest export destination for the local machinery industry, the Taiwan Association of Machinery Industry (TAMI, 台灣機械公會) said in a report on Jan. 10. It came as some manufacturers brought forward or “front-loaded” US-bound shipments as required by customers ahead of potential tariffs imposed by the new US administration, the association said. During his campaign, US president-elect Donald Trump threatened tariffs of as high as 60 percent on Chinese goods and 10 percent to 20 percent on imports from other countries.