Packed into a small room, a drone, bipedal robot, supermarket checkout and other devices showcase a vision of China’s software future — one where an operating system developed by national champion Huawei (華為) has replaced Windows and Android.

The collection is at the Harmony Ecosystem Innovation Center in the southern city of Shenzhen, a local government-owned entity that encourages authorities, companies and hardware makers to develop software using OpenHarmony (鴻蒙), an open-source version of the operating system Huawei launched five years ago after US sanctions cut off support for Google’s Android.

While Huawei’s recent strong-selling smartphone launches have been closely watched for signs of advances in China’s chip supply chain, the company has also quietly built up expertise in sectors crucial to Beijing’s vision of technology self-sufficiency, from operating systems to in-vehicle software.

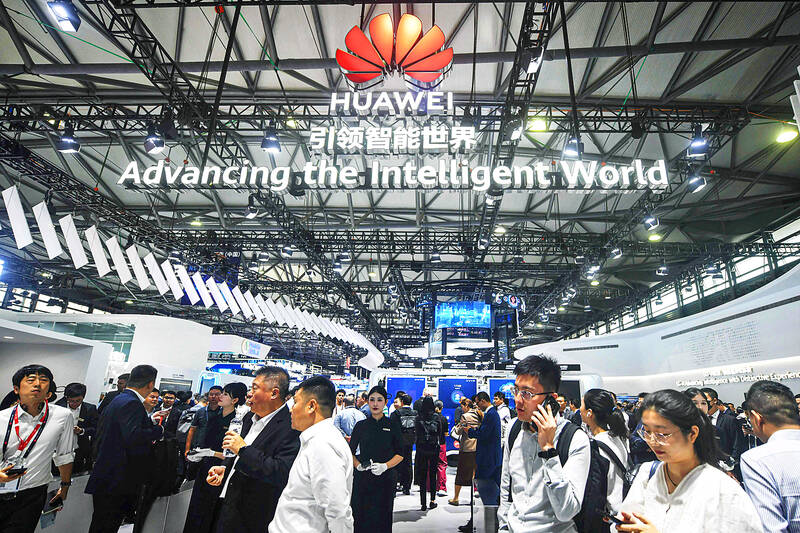

Photo: AFP

Chinese President Xi Jinping (習近平) last year told the Chinese Communist Party’s elite politburo that China must wage a difficult battle to localize operating systems and other technology “as soon as possible,” as the US cracks down on exports of advanced chips and other components.

OpenHarmony is being widely promoted within China as a “national operating system,” amid concerns that other major companies could be severed from the Microsoft Windows and Android products upon which many systems rely.

“This strategic move will likely erode the market share of Western operating systems like Android and Windows in China, as local products gain traction,” Jamestown Foundation associate fellow Sunny Cheung said.

In the first quarter of this year, Huawei’s HarmonyOS, the company’s in-house version of the operating system, surpassed Apple’s iOS to become the second best-selling mobile operating system in China behind Android, research firm Counterpoint said. It has not been launched on smartphones outside China.

Huawei no longer controls OpenHarmony, having gifted its source code to a nonprofit called the OpenAtom Foundation (開放原子開源基金會) in 2020 and 2021, an internal memo and other releases said.

The growth of HarmonyOS, expected to be rolled out in a PC version this year or next, would spur adoption of OpenHarmony, analysts said.

“Harmony has created a powerful foundational operating system for the future of China’s devices,” Huawei consumer business group chairman Richard Yu (余承東) said last week.

Huawei first unveiled Harmony in August 2019, three months after Washington placed it under trade restrictions over alleged security concerns. Huawei denies its equipment poses a risk.

Since then, China has stepped up its self-sufficiency efforts, cutting itself off from the main code sharing hub Github and championing a local version, Gitee.

China banned the use of Windows on government computers in 2014 and they now use mostly Linux-based operating systems.

Originally built on an open source Android system, this year Huawei launched its first “pure” version of HarmonyOS that no longer supports Android-based apps, in a move that further bifurcates China’s app ecosystem from the rest of the world.

OpenAtom appeared to be coordinating with Chinese firms to develop a viable alternative to US technologies, including for defense applications such as satellites, a report from Jamestown Foundation last month said.

OpenHarmony last year was the fastest-growing open-source operating system for smart devices, with more than 70 organizations contributing to it, and more than 460 hardware and software products built across finance, education, aerospace and industry, Huawei said in its annual report last year.

Key OpenHarmony developers include Shenzhen Kaihong Digital (深圳開鴻數字), headed by Wang Chenglu (王成錄), a former Huawei employee known as Harmony’s “godfather,” and Chinasoft.

Both have worked on infrastructure software, at Tianjin Port and for mines in China’s top coal-producing province, Shaanxi.

CHIP WAR: Tariffs on Taiwanese chips would prompt companies to move their factories, but not necessarily to the US, unleashing a ‘global cross-sector tariff war’ US President Donald Trump would “shoot himself in the foot” if he follows through on his recent pledge to impose higher tariffs on Taiwanese and other foreign semiconductors entering the US, analysts said. Trump’s plans to raise tariffs on chips manufactured in Taiwan to as high as 100 percent would backfire, macroeconomist Henry Wu (吳嘉隆) said. He would “shoot himself in the foot,” Wu said on Saturday, as such economic measures would lead Taiwanese chip suppliers to pass on additional costs to their US clients and consumers, and ultimately cause another wave of inflation. Trump has claimed that Taiwan took up to

A start-up in Mexico is trying to help get a handle on one coastal city’s plastic waste problem by converting it into gasoline, diesel and other fuels. With less than 10 percent of the world’s plastics being recycled, Petgas’ idea is that rather than letting discarded plastic become waste, it can become productive again as fuel. Petgas developed a machine in the port city of Boca del Rio that uses pyrolysis, a thermodynamic process that heats plastics in the absence of oxygen, breaking it down to produce gasoline, diesel, kerosene, paraffin and coke. Petgas chief technology officer Carlos Parraguirre Diaz said that in

SUPPORT: The government said it would help firms deal with supply disruptions, after Trump signed orders imposing tariffs of 25 percent on imports from Canada and Mexico The government pledged to help companies with operations in Mexico, such as iPhone assembler Hon Hai Precision Industry Co (鴻海精密), also known as Foxconn Technology Group (富士康科技集團), shift production lines and investment if needed to deal with higher US tariffs. The Ministry of Economic Affairs yesterday announced measures to help local firms cope with the US tariff increases on Canada, Mexico, China and other potential areas. The ministry said that it would establish an investment and trade service center in the US to help Taiwanese firms assess the investment environment in different US states, plan supply chain relocation strategies and

Japan intends to closely monitor the impact on its currency of US President Donald Trump’s new tariffs and is worried about the international fallout from the trade imposts, Japanese Minister of Finance Katsunobu Kato said. “We need to carefully see how the exchange rate and other factors will be affected and what form US monetary policy will take in the future,” Kato said yesterday in an interview with Fuji Television. Japan is very concerned about how the tariffs might impact the global economy, he added. Kato spoke as nations and firms brace for potential repercussions after Trump unleashed the first salvo of