Taiwan’s semiconductor industry is meeting geopolitical pressure linked to the US’ concerns that most of the IC manufacturing is happening in Asia, but should still reach a mutually beneficial compromise with Washington, a former Taiwan Semiconductor Manufacturing Co (TSMC, 台積電) executive said yesterday.

Konrad Young (楊光磊), a former TSMC R&D director, told a forum hosted by the newly established national think tank Research Institute for Democracy, Society, and Emerging Technology (DSET) in Taipei that the semiconductor industry is facing risks from US-China trade tensions-driven “geopolitics 2.0.”

According to Young, “geopolitics 2.0” is a contemporary version of what he called “geopolitics 1.0,” which took place in the 1980s when the US, feeling threatened by Japan, sought to dismantle its dominance in the semiconductor industry.

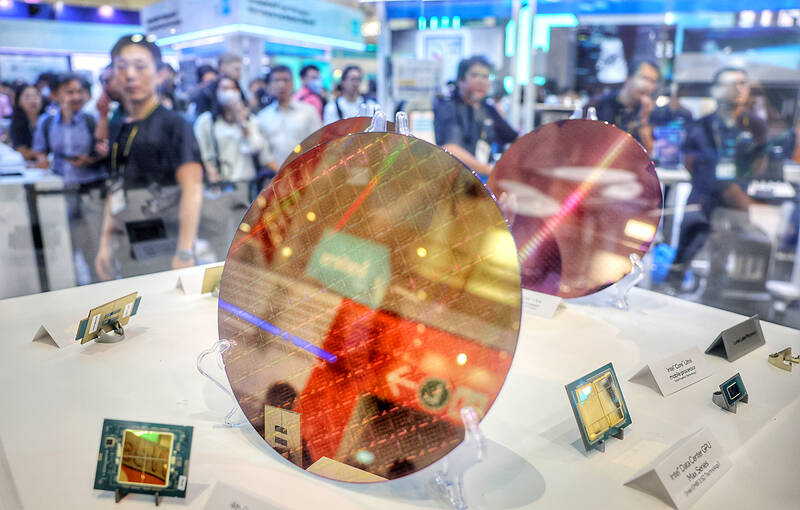

Photo: CNA

“The risk of geopolitics 2.0 also comes from the US [amid its trade frictions with China], in which there is concern that Taiwan might lose its competitive edge when [Taiwan’s companies] are asked to set up factories there,” he said.

“Recently I’ve heard that the American government is also asking [Taiwanese companies’] research and development to be moved to the US, which makes it more disconcerting,” he added.

However, Young pointed out that in the 1980s tensions arose because Japan’s products could replace what the US was producing, which meant there was little risk of Washington harming itself when it battered Japan.

“What Taiwan is facing today is different,” Young said. “American companies, including the world’s top IC companies such as Qualcomm Inc and Nvidia Corp, still need TSMC; they don’t have many alternative options.”

So the US government would not take actions that result in mutually assured destruction, Young said.

“It is now seeking relatively safe, alternative solutions, of which asking TSMC to manufacture in the US is one, but it won’t stop there, as this is still not comfortable enough for the US,” he argued, adding that comfort would be assured when the US can manage risks, an apparent one of which would be a disconnected supply chain caused by a possible war in Asia.

The US would also try to support its own companies such as Intel Corp to go into foundry business, he said.

But Young believed the hurdle of replacing Taiwan in the foundry business would be huge for the US, “much more difficult” than how it took on Japan in the 1980s.

Japan’s products were, like the US, produced in the IDM (integrated device manufacturer) model, Young said. IDM model is one that a semiconductor company designs, manufactures, and sells integrated circuits all by itself.

“Japan’s IDM model was cost-based so it was easy to be hurt by an exchange rate change,” he said, understandably referring to the 1985 Plaza Accord that triggered a large appreciation of the yen.

“Also daily life then was probably not affected by IC that much, which is different from today’s world where a high percentage of our products require chips,” he added.

Young said Taiwan should convince the US that there can be a win-win solution with the two countries occupying different but complementary segments in the IC industry.

“The US is strong in advanced research, for instance, and Taiwan can work with them on that, but mutually harmful approach should be avoided,” he advised.

Young also called for cooperation with non-US countries such as Europe, Japan, Southeast Asia, and even the Middle East that have been investing in the industry to broaden the alliance and maintain Taiwan’s edge.

When an apartment comes up for rent in Germany’s big cities, hundreds of prospective tenants often queue down the street to view it, but the acute shortage of affordable housing is getting scant attention ahead of today’s snap general election. “Housing is one of the main problems for people, but nobody talks about it, nobody takes it seriously,” said Andreas Ibel, president of Build Europe, an association representing housing developers. Migration and the sluggish economy top the list of voters’ concerns, but analysts say housing policy fails to break through as returns on investment take time to register, making the

‘SILVER LINING’: Although the news caused TSMC to fall on the local market, an analyst said that as tariffs are not set to go into effect until April, there is still time for negotiations US President Donald Trump on Tuesday said that he would likely impose tariffs on semiconductor, automobile and pharmaceutical imports of about 25 percent, with an announcement coming as soon as April 2 in a move that would represent a dramatic widening of the US leader’s trade war. “I probably will tell you that on April 2, but it’ll be in the neighborhood of 25 percent,” Trump told reporters at his Mar-a-Lago club when asked about his plan for auto tariffs. Asked about similar levies on pharmaceutical drugs and semiconductors, the president said that “it’ll be 25 percent and higher, and it’ll

NOT TO WORRY: Some people are concerned funds might continue moving out of the country, but the central bank said financial account outflows are not unusual in Taiwan Taiwan’s outbound investments hit a new high last year due to investments made by contract chipmaker Taiwan Semiconductor Manufacturing Co (TSMC, 台積電) and other major manufacturers to boost global expansion, the central bank said on Thursday. The net increase in outbound investments last year reached a record US$21.05 billion, while the net increase in outbound investments by Taiwanese residents reached a record US$31.98 billion, central bank data showed. Chen Fei-wen (陳斐紋), deputy director of the central bank’s Department of Economic Research, said the increase was largely due to TSMC’s efforts to expand production in the US and Japan. Investments by Vanguard International

WARNING SHOT: The US president has threatened to impose 25 percent tariffs on all imported vehicles, and similar or higher duties on pharmaceuticals and semiconductors US President Donald Trump on Wednesday suggested that a trade deal with China was “possible” — a key target in the US leader’s tariffs policy. The US in 2020 had already agreed to “a great trade deal with China” and a new deal was “possible,” Trump said. Trump said he expected Chinese President Xi Jinping (習近平) to visit the US, without giving a timeline for his trip. Trump also said that he was talking to China about TikTok, as the US seeks to broker a sale of the popular app owned by Chinese firm ByteDance Ltd (字節跳動). Trump last week said that he had