The nation’s initial public offering (IPO) activity would remain buoyant in the second half of the year, after a rapid pickup in the first half, judging by the number of deals and money raised, consultancy firm Ernst & Young Taiwan (EY Taiwan) said in a semi-annual report released on Thursday.

The first six months saw 27 IPO deals at the Taiwan Stock Exchange (TWSE) and Taipei Exchange (TPEX) markets and together they raised NT$18.4 billion (US$568.78 million), EY Taiwan said, adding that the amount raised more than doubled compared with the same period last year.

The robust showings came even though the global number of IPOs shrank 15 percent from a year earlier to 532 and the money they raised fell 17 percent to US$51.7 billion, EY Taiwan said in the report.

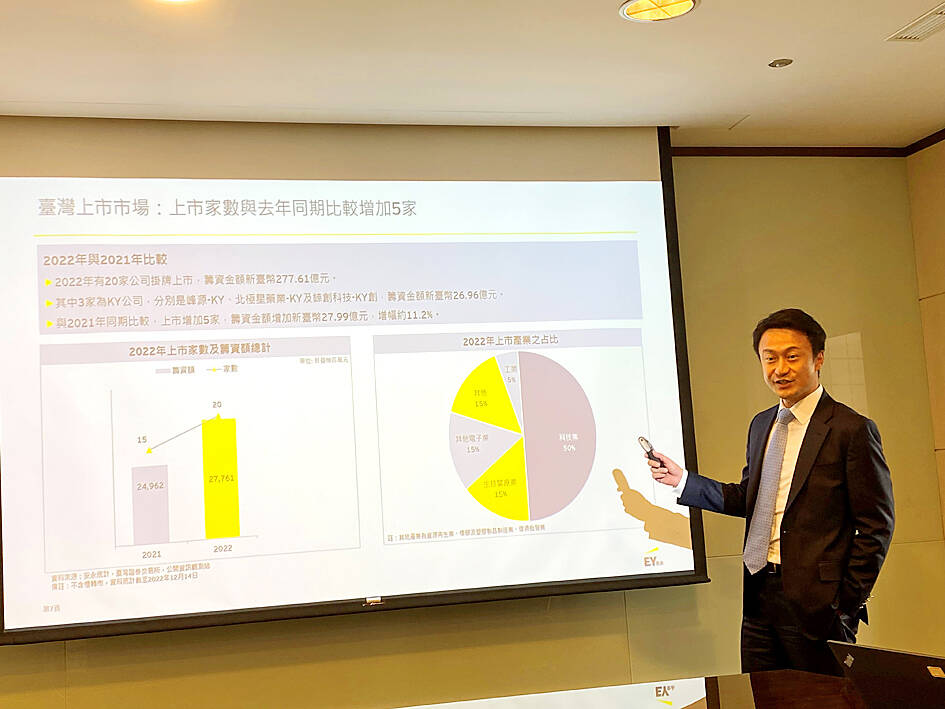

Photo: Clare Cheng, Taipei Times

The markets for Hong Kong and China’s A-shares fared worse, as they reported only 72 IPOs, which raised US$6.2 billion, it showed.

The data represented a decline of 64 percent and 81 percent by measure of deals and funding respectively.

Biotechnology and tech companies underpinned Taiwan’s capital markets and would continue to lend support in the second half, EY Taiwan said.

The mainboard gained 16 new listings that raised a total of NT$12.22 billion, or an increase of seven deals and NT$5.74 billion from a year earlier, it said.

Taichung-based sports shoemaker Lai Yih Group (來億) had the largest IPO with NT$3.3 billion, accounting for 27 percent of the overall amount, it said.

Yunlin-based SuperAlloy Industrial Co (巧新), which supplies forged wheels for major automobile manufacturers including Tesla, Ford and Toyota, was second, raising NT$1.72 billion, or a 14.08 percent share, it added.

The Taipei Exchange added 11 listings, which bagged NT$6.19 billion combined, a drastic increase of 252.33 percent from a year earlier, it said.

Among them, drug maker Alar Pharmaceuticals Inc (昱展) raised the most money at NT$1.68 billion, followed by Jiu Han System Technology Co’s (巨漢) NT$.102 billion, it said.

Additionally, there were 28 emerging stock listings, dominated by firms from biotechnology, information services and industry sectors, it said.

Taiwan’s IPO activity had to do with eager capital inflows to local shares, EY Taiwan said, adding that foreign fund inflows amounted to NT$379 billion last month alone, as investors at home and abroad sought to take part in the artificial intelligence boom.

That explains why the TAIEX has repeatedly made records in recent months, EY Taiwan said.

Investor zeal would be sustained given that 20 firms have filed to list in the TWSE or the TPEX, the consultancy said.

EARLY TALKS: Measures under consideration include convincing allies to match US curbs, further restricting exports of AI chips or GPUs, and blocking Chinese investments US President Donald Trump’s administration is sketching out tougher versions of US semiconductor curbs and pressuring key allies to escalate their restrictions on China’s chip industry, an early indication the new US president plans to expand efforts that began under former US president Joe Biden to limit Beijing’s technological prowess. Trump officials recently met with their Japanese and Dutch counterparts about restricting Tokyo Electron Ltd and ASML Holding NV engineers from maintaining semiconductor gear in China, people familiar with the matter said. The aim, which was also a priority for Biden, is to see key allies match China curbs the US

The popular Taiwan Semiconductor Manufacturing Co (TSMC, 台積電) arbitrage trade might soon see a change in dynamics that could affect the trading of the US listing versus the local one. And for anyone who wants to monetize the elevated premium, Goldman Sachs Group Inc highlights potential trades. A note from the bank’s sales desk published on Friday said that demand for TSMC’s Taipei-traded stock could rise as Taiwan’s regulator is considering an amendment to local exchange-traded funds’ (ETFs) ownership. The changes, which could come in the first half of this year, could push up the current 30 percent single-stock weight limit

PROTECTION: The investigation, which takes aim at exporters such as Canada, Germany and Brazil, came days after Trump unveiled tariff hikes on steel and aluminum products US President Donald Trump on Saturday ordered a probe into potential tariffs on lumber imports — a move threatening to stoke trade tensions — while also pushing for a domestic supply boost. Trump signed an executive order instructing US Secretary of Commerce Howard Lutnick to begin an investigation “to determine the effects on the national security of imports of timber, lumber and their derivative products.” The study might result in new tariffs being imposed, which would pile on top of existing levies. The investigation takes aim at exporters like Canada, Germany and Brazil, with White House officials earlier accusing these economies of

Teleperformance SE, the largest call-center operator in the world, is rolling out an artificial intelligence (AI) system that softens English-speaking Indian workers’ accents in real time in a move the company claims would make them more understandable. The technology, called accent translation, coupled with background noise cancelation, is being deployed in call centers in India, where workers provide customer support to some of Teleperformance’s international clients. The company provides outsourced customer support and content moderation to global companies including Apple Inc, ByteDance Ltd’s (字節跳動) TikTok and Samsung Electronics Co Ltd. “When you have an Indian agent on the line, sometimes it’s hard