A boom in artificial intelligence (AI) would increase banks’ dependence on big US tech firms, creating new risks for the industry, European banking executives said.

Excitement around using AI in financial services — widely used already for detecting fraud and money-laundering — has soared since the launch of OpenAI’s viral chatbot ChatGPT in late 2022 as banks examine ways to deploy generative AI.

However, at a gathering of fintech executives in Amsterdam last week, some expressed concerns that the amount of computing power needed to develop AI capabilities would make banks rely even more on small number of tech providers.

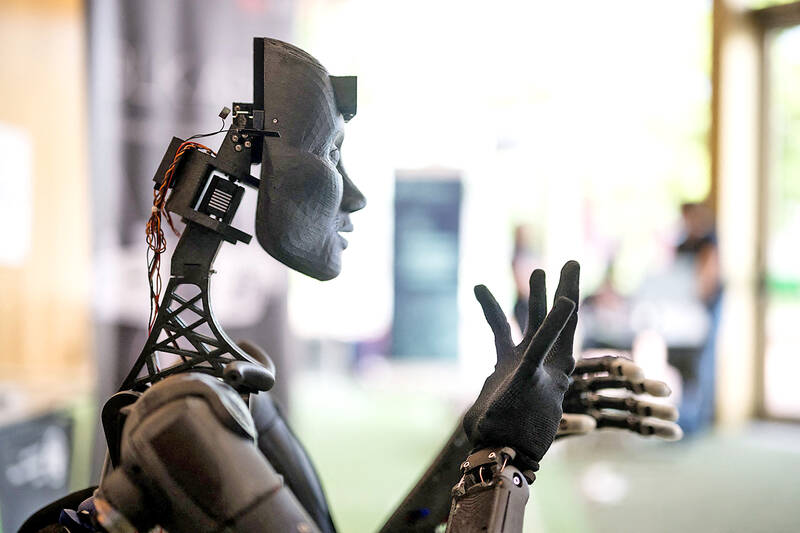

Photo: AFP

ING Groep NV chief analytics officer Bahadir Yilmaz, who is in charge of the Dutch bank’s AI work, said he expected to rely on Big Tech companies “more and more going forward” for infrastructure and machinery.

“You will always need them because sometimes the machine power that is needed for these technologies is huge. It’s also not really feasible for a bank to build this tech,” he said.

Banks’ dependency on a small number of tech companies was “one of the biggest risks,” Yilmaz said, emphasizing that European banks in particular needed to ensure they could move between different tech providers and avoid what he called “vendor lock-in.”

Britain last year proposed rules to regulate financial firms’ heavy reliance on external technology companies, such as Microsoft Corp, Google, IBM Corp and Amazon.com Inc.

Regulators say they are worried that problems at a single cloud computing company could potentially bring down services across many financial institutions.

“AI requires huge amounts of compute [computing power] and really the only way that you’re going to be able to access that compute sensibly is from Big Tech,” Joanne Hannaford, who leads technology strategy at Deutsche Bank AG’s corporate bank, told an audience at the Money20/20 conference earlier last week.

Hannaford said that there are requirements for the bank to notify regulators when they move data into the cloud, which could become much more complicated as the use of cloud computing increases.

Banks also need to communicate to regulators the risk of not leveraging cloud computing’s power, which would be an opportunity cost, she added.

AI was top of the agenda at the Amsterdam conference.

The CEO of French AI start-up Mistral AI, seen as France’s answer to OpenAI, told attendees there were “synergies” between its generative AI products and financial services.

“We see a lot of opportunities in creating analysis and monitoring information ... which is really something that bankers like to do,” Arthur Mensch said.

ING is testing an AI chatbot currently used for 2.5 percent of incoming customer service chats. Asked how long it would be until the chatbot could handle half or more of customer service conversations, Yilmaz said within a year.

In its first statement on AI, the EU’s securities watchdog last week said that banks and investment firms cannot shirk boardroom responsibility and have a legal obligation to protect customers when using AI.

It warned that the technology is likely to have significant impact on retail investor protection.

The US dollar was trading at NT$29.7 at 10am today on the Taipei Foreign Exchange, as the New Taiwan dollar gained NT$1.364 from the previous close last week. The NT dollar continued to rise today, after surging 3.07 percent on Friday. After opening at NT$30.91, the NT dollar gained more than NT$1 in just 15 minutes, briefly passing the NT$30 mark. Before the US Department of the Treasury's semi-annual currency report came out, expectations that the NT dollar would keep rising were already building. The NT dollar on Friday closed at NT$31.064, up by NT$0.953 — a 3.07 percent single-day gain. Today,

‘SHORT TERM’: The local currency would likely remain strong in the near term, driven by anticipated US trade pressure, capital inflows and expectations of a US Fed rate cut The US dollar is expected to fall below NT$30 in the near term, as traders anticipate increased pressure from Washington for Taiwan to allow the New Taiwan dollar to appreciate, Cathay United Bank (國泰世華銀行) chief economist Lin Chi-chao (林啟超) said. Following a sharp drop in the greenback against the NT dollar on Friday, Lin told the Central News Agency that the local currency is likely to remain strong in the short term, driven in part by market psychology surrounding anticipated US policy pressure. On Friday, the US dollar fell NT$0.953, or 3.07 percent, closing at NT$31.064 — its lowest level since Jan.

The New Taiwan dollar and Taiwanese stocks surged on signs that trade tensions between the world’s top two economies might start easing and as US tech earnings boosted the outlook of the nation’s semiconductor exports. The NT dollar strengthened as much as 3.8 percent versus the US dollar to 30.815, the biggest intraday gain since January 2011, closing at NT$31.064. The benchmark TAIEX jumped 2.73 percent to outperform the region’s equity gauges. Outlook for global trade improved after China said it is assessing possible trade talks with the US, providing a boost for the nation’s currency and shares. As the NT dollar

The Financial Supervisory Commission (FSC) yesterday met with some of the nation’s largest insurance companies as a skyrocketing New Taiwan dollar piles pressure on their hundreds of billions of dollars in US bond investments. The commission has asked some life insurance firms, among the biggest Asian holders of US debt, to discuss how the rapidly strengthening NT dollar has impacted their operations, people familiar with the matter said. The meeting took place as the NT dollar jumped as much as 5 percent yesterday, its biggest intraday gain in more than three decades. The local currency surged as exporters rushed to