China has set up its third planned state-backed investment fund to boost its semiconductor industry, with a registered capital of 344 billion yuan (US$47.5 billion), a filing with a government-run companies’ registry showed.

Chinese chip shares rose, with the CES CN Semiconductor Index rallying more than 3 percent and set to log the biggest one-day gain in more than a month.

The third phase of the fund, also known as the “Big Fund,” was officially established on Friday and registered under the Beijing Municipal Administration for Market Regulation, National Enterprise Credit Information Publicity System, a government-run credit information agency, data showed.

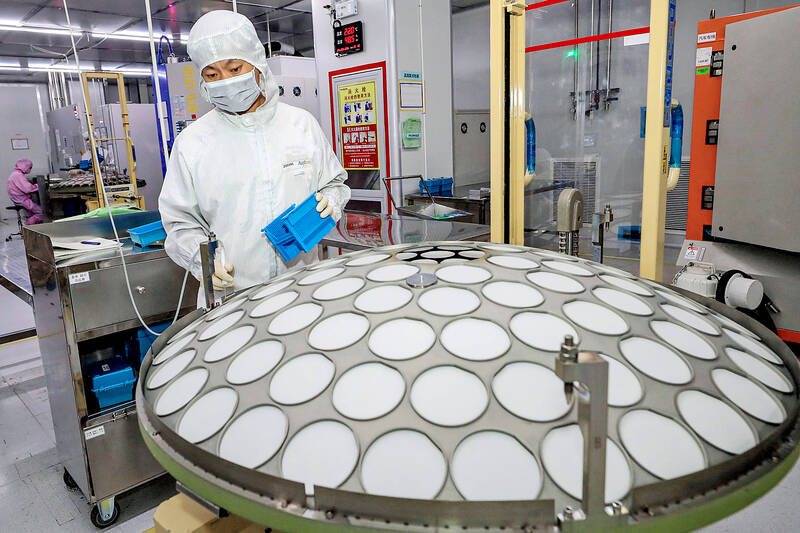

Photo: AFP

It was also the largest of the three funds launched by the China Integrated Circuit Industry Investment Fund.

Its biggest shareholder is the Chinese Ministry of Finance, with a 17 percent stake and paid-in capital of 60 billion yuan, followed by China Development Bank Capital, with a 10.5 percent stake, said Tianyancha (天眼查), a Chinese companies’ information database company.

Seventeen other entities are listed as investors, including five major Chinese banks: Industrial and Commercial Bank of China (中國工商銀行), China Construction Bank (中國建設銀行), Agricultural Bank of China (中國農業銀行), Bank of China (中國銀行) and Bank of Communications (交通銀行), with each contributing about 6 percent of the total capital.

The first phase of the fund was established in 2014, with registered capital of 138.7 billion yuan, and the second phase was in 2019, with 204 billion yuan.

The Big Fund has provided financing to China’s two biggest chip foundries, Semiconductor Manufacturing International Corp (中芯國際) and Hua Hong Semiconductor Ltd (華虹半導體), as well as to Yangtze Memory Technologies Co (長江儲存), a maker of flash memory, and a number of smaller companies and funds.

One of the major areas the third phase of the fund would focus on is equipment for chip manufacturing, Reuters reported in September last year.

The Big Fund is also considering hiring at least two institutions to invest the capital from the third phase.

‘SWASTICAR’: Tesla CEO Elon Musk’s close association with Donald Trump has prompted opponents to brand him a ‘Nazi’ and resulted in a dramatic drop in sales Demonstrators descended on Tesla Inc dealerships across the US, and in Europe and Canada on Saturday to protest company chief Elon Musk, who has amassed extraordinary power as a top adviser to US President Donald Trump. Waving signs with messages such as “Musk is stealing our money” and “Reclaim our country,” the protests largely took place peacefully following fiery episodes of vandalism on Tesla vehicles, dealerships and other facilities in recent weeks that US officials have denounced as terrorism. Hundreds rallied on Saturday outside the Tesla dealership in Manhattan. Some blasted Musk, the world’s richest man, while others demanded the shuttering of his

ADVERSARIES: The new list includes 11 entities in China and one in Taiwan, which is a local branch of Chinese cloud computing firm Inspur Group The US added dozens of entities to a trade blacklist on Tuesday, the US Department of Commerce said, in part to disrupt Beijing’s artificial intelligence (AI) and advanced computing capabilities. The action affects 80 entities from countries including China, the United Arab Emirates and Iran, with the commerce department citing their “activities contrary to US national security and foreign policy.” Those added to the “entity list” are restricted from obtaining US items and technologies without government authorization. “We will not allow adversaries to exploit American technology to bolster their own militaries and threaten American lives,” US Secretary of Commerce Howard Lutnick said. The entities

Minister of Finance Chuang Tsui-yun (莊翠雲) yesterday told lawmakers that she “would not speculate,” but a “response plan” has been prepared in case Taiwan is targeted by US President Donald Trump’s reciprocal tariffs, which are to be announced on Wednesday next week. The Trump administration, including US Secretary of the Treasury Scott Bessent, has said that much of the proposed reciprocal tariffs would focus on the 15 countries that have the highest trade surpluses with the US. Bessent has referred to those countries as the “dirty 15,” but has not named them. Last year, Taiwan’s US$73.9 billion trade surplus with the US

Prices of gasoline and diesel products at domestic gas stations are to fall NT$0.2 and NT$0.1 per liter respectively this week, even though international crude oil prices rose last week, CPC Corp, Taiwan (台灣中油) and Formosa Petrochemical Corp (台塑石化) said yesterday. International crude oil prices continued rising last week, as the US Energy Information Administration reported a larger-than-expected drop in US commercial crude oil inventories, CPC said in a statement. Based on the company’s floating oil price formula, the cost of crude oil rose 2.38 percent last week from a week earlier, it said. News that US President Donald Trump plans a “secondary