Nvidia Corp on Wednesday overshot Wall Street estimates, as its profit skyrocketed bolstered by its dominance in chipmaking, which has made the company an icon of the artificial intelligence (AI) boom.

Its net income rose more than sevenfold from US$2.04 billion a year earlier to US$14.88 billion in its first quarter. Revenue more than tripled from US$7.19 billion the previous year to US$26.04 billion.

“The next industrial revolution has begun,” Nvidia CEO Jensen Huang (黃仁勳) said on a conference call with analysts.

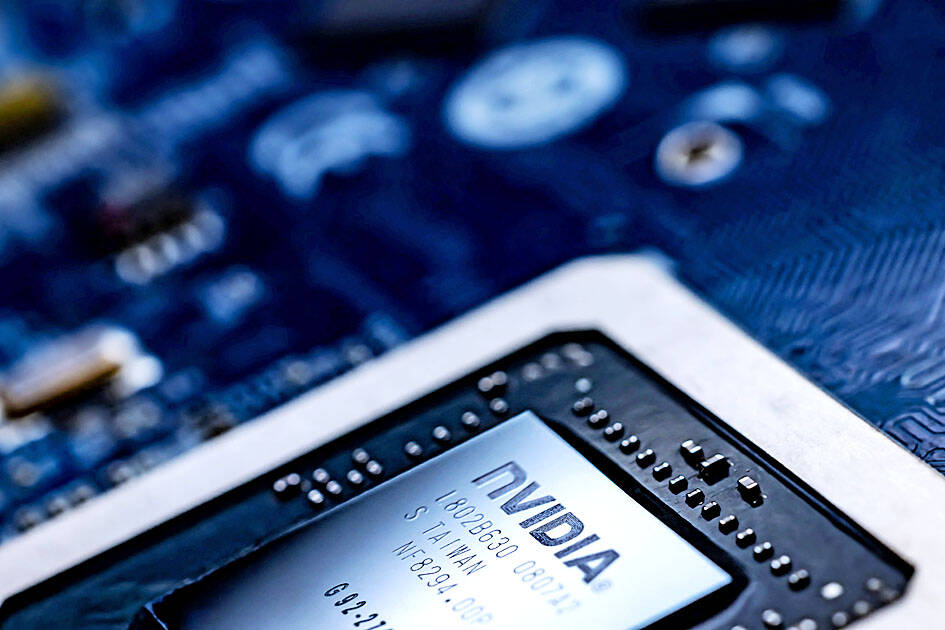

Photo by Joel Saget, AFP

Companies buying Nvidia chips would use them to build a new type of data center, designed to produce a new commodity: AI, Huang said, calling them “AI factories.”

Training AI models is becoming a faster process, as they learn to become “multimodal” — that is, capable of understanding text, speech, images, video and 3D data — and able to “reason and plan,” Huang added.

The company reported earnings per share — adjusted to exclude one-time items — of US$6.12, well above the US$5.60 that Wall Street analysts had expected, FactSet said.

Nvidia also announced a 10-for-1 stock split, a move that it said would make its shares more accessible to employees and investors.

The company increased its dividend from US$0.04 a share to US$0.10.

Nvidia shares rose 6 percent in after-hours trading to US$1,006.89 on Wednesday. The stock has risen more than 200 percent in the past year.

The company now boasts the third-highest market value on Wall Street, behind only Microsoft Corp and Apple Inc.

“Nvidia defies gravity again,” Emarketer analyst Jacob Bourne said of the quarterly report.

While many tech companies are eager to reduce their dependence on Nvidia, which has achieved a level of hardware dominance in AI rivaling that of earlier computing pioneers such as Intel Corp, “they’re not quite there yet,” Bourne said.

Demand for generative AI systems that can compose documents, make images and serve as increasingly lifelike personal assistants has fueled astronomical sales of Nvidia’s specialized AI chips over the past year.

Tech giants Amazon.com Inc, Google, Meta Platforms Inc and Microsoft Corp have signaled that they would need to spend more in coming months on the chips and data centers needed to train and operate their AI systems.

What happens after that could be another matter.

Some analysts believe that the breakneck race to build those huge data centers would eventually peak, potentially spelling trouble for Nvidia in the aftermath.

“The biggest question that remains is how long this runway is,” Third Bridge analyst Lucas Keh said.

AI workloads in the cloud would eventually shift from training to inference, or the more daily task of processing fresh data using already trained AI systems, Keh said.

Inference does not require the level of power provided by Nvidia’s expensive top-of-the-line chips, which would open up market opportunities for chipmakers offering less powerful, but also less costly, alternatives, Keh added.

When that happens, “Nvidia’s dominant market share position will be tested,” Keh said.

With this year’s Semicon Taiwan trade show set to kick off on Wednesday, market attention has turned to the mass production of advanced packaging technologies and capacity expansion in Taiwan and the US. With traditional scaling reaching physical limits, heterogeneous integration and packaging technologies have emerged as key solutions. Surging demand for artificial intelligence (AI), high-performance computing (HPC) and high-bandwidth memory (HBM) chips has put technologies such as chip-on-wafer-on-substrate (CoWoS), integrated fan-out (InFO), system on integrated chips (SoIC), 3D IC and fan-out panel-level packaging (FOPLP) at the center of semiconductor innovation, making them a major focus at this year’s trade show, according

DEBUT: The trade show is to feature 17 national pavilions, a new high for the event, including from Canada, Costa Rica, Lithuania, Sweden and Vietnam for the first time The Semicon Taiwan trade show, which opens on Wednesday, is expected to see a new high in the number of exhibitors and visitors from around the world, said its organizer, SEMI, which has described the annual event as the “Olympics of the semiconductor industry.” SEMI, which represents companies in the electronics manufacturing and design supply chain, and touts the annual exhibition as the most influential semiconductor trade show in the world, said more than 1,200 enterprises from 56 countries are to showcase their innovations across more than 4,100 booths, and that the event could attract 100,000 visitors. This year’s event features 17

SEMICONDUCTOR SERVICES: A company executive said that Taiwanese firms must think about how to participate in global supply chains and lift their competitiveness Taiwan Semiconductor Manufacturing Co (TSMC, 台積電) yesterday said it expects to launch its first multifunctional service center in Pingtung County in the middle of 2027, in a bid to foster a resilient high-tech facility construction ecosystem. TSMC broached the idea of creating a center two or three years ago when it started building new manufacturing capacity in the US and Japan, the company said. The center, dubbed an “ecosystem park,” would assist local manufacturing facility construction partners to upgrade their capabilities and secure more deals from other global chipmakers such as Intel Corp, Micron Technology Inc and Infineon Technologies AG, TSMC said. It

EXPORT GROWTH: The AI boom has shortened chip cycles to just one year, putting pressure on chipmakers to accelerate development and expand packaging capacity Developing a localized supply chain for advanced packaging equipment is critical for keeping pace with customers’ increasingly shrinking time-to-market cycles for new artificial intelligence (AI) chips, Taiwan Semiconductor Manufacturing Co (TSMC, 台積電) said yesterday. Spurred on by the AI revolution, customers are accelerating product upgrades to nearly every year, compared with the two to three-year development cadence in the past, TSMC vice president of advanced packaging technology and service Jun He (何軍) said at a 3D IC Global Summit organized by SEMI in Taipei. These shortened cycles put heavy pressure on chipmakers, as the entire process — from chip design to mass