A Taiwanese company is to invest an estimated US$30 million to build an electric bus manufacturing and assembly plant in Paraguay, according to a memorandum of understanding (MOU) signed in Taipei yesterday.

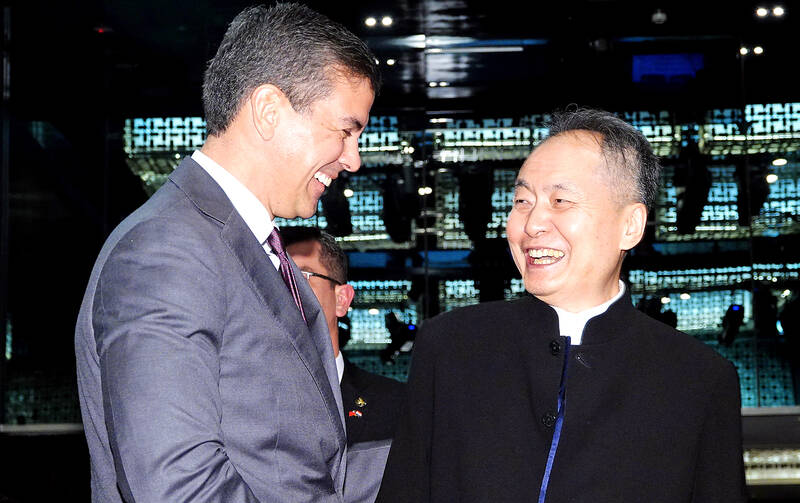

Speaking at the signing ceremony, visiting Paraguayan President Santiago Pena said the MOU would not only pave the way for assembling electric buses in Paraguay, but also provide “the possibility of changing the lives of millions of Paraguayans” who commute to work.

There is “no better place” than Paraguay to develop electric vehicles in Latin America as it is a large producer of renewable energy, Pena said, adding that he looked forward to seeing Paraguay play “a leading role” in energy transition in the region.

Photo: Pang Shao-tang, Taipei Times

Master Transportation Bus Manufacturing Ltd (成運汽車) chairman Wu Ting-fa (吳定發) said the project’s goal was to “enhance the development of public transportation in Paraguay” and would create an estimated 2,600 local jobs.

Through the investment, the company would eventually seek to expand its presence from Paraguay to other members of the Southern Common Market, also known as Mercosur, a trade bloc comprised of Paraguay, Brazil, Argentina and other South American nations.

According to the MOU, the bus manufacturer is to establish the first fast-charging bus chassis and body manufacturing plant in Paraguay, and assist in bringing a Taiwan-developed intelligent transportation system to the South American nation.

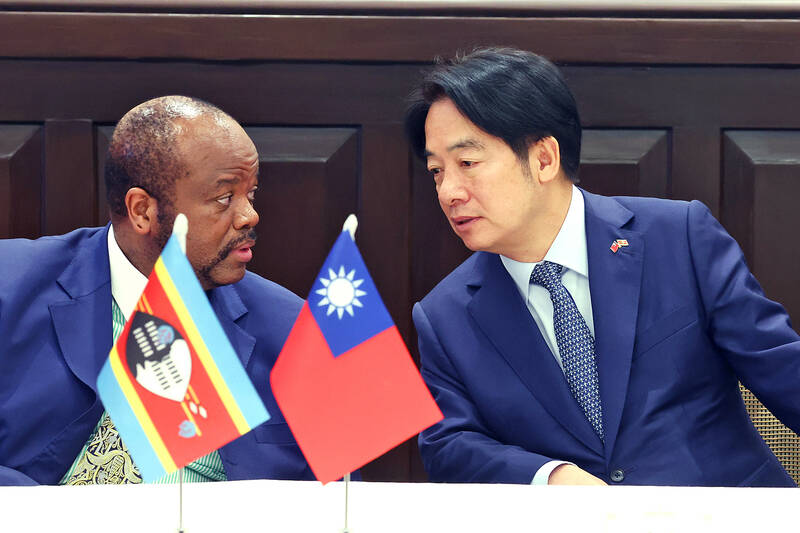

Photo: CNA

Master Transportation general manager Wu Zhong-xi (吳忠錫) said at the ceremony that batteries and other key electric bus technologies would be imported from Taiwan and assembled in the planned factory.

The company is expecting to invest US$30 million in the project and would receive tax incentives and other support from the Paraguayan government, he said, declining to provide additional details.

Though the company has yet to determine whether the electric bus factory would be built in the capital Asuncion or Ciudad del Este, Paraguay’s second-biggest city, it hopes that mass production could begin at the planned factory by the end of next year.

Negotiations on the MOU began in July last year when Pena traveled to Taiwan and visited the manufacturer’s depot in New Taipei City.

Separately, the central bank yesterday signed a MOU with the Central Bank of Eswatini, pledging to forge closer ties and boost cooperation, it said in a statement.

Under the MOU, the two banks would conduct fieldwork and case studies together, as well as share other relevant information, the statement said.

Taiwan's central bank said in the statement that the deal was inked by its governor, Yang Chin-long (楊金龍), and Philemon Mnisi, governor of Eswatini's central bank. The pledge was witnessed by President William Lai (賴清德) and King Mswati III of Eswatini.

The MOU came after the Taiwan Stock Exchange and the Taiwan Carbon Solution Exchange on March 4 signed a separate MOU with the Eswatini Stock Exchange, focusing on sharing information related to financial technology and business experience, as well as establishing a framework to combat climate change.

The US dollar was trading at NT$29.7 at 10am today on the Taipei Foreign Exchange, as the New Taiwan dollar gained NT$1.364 from the previous close last week. The NT dollar continued to rise today, after surging 3.07 percent on Friday. After opening at NT$30.91, the NT dollar gained more than NT$1 in just 15 minutes, briefly passing the NT$30 mark. Before the US Department of the Treasury's semi-annual currency report came out, expectations that the NT dollar would keep rising were already building. The NT dollar on Friday closed at NT$31.064, up by NT$0.953 — a 3.07 percent single-day gain. Today,

‘SHORT TERM’: The local currency would likely remain strong in the near term, driven by anticipated US trade pressure, capital inflows and expectations of a US Fed rate cut The US dollar is expected to fall below NT$30 in the near term, as traders anticipate increased pressure from Washington for Taiwan to allow the New Taiwan dollar to appreciate, Cathay United Bank (國泰世華銀行) chief economist Lin Chi-chao (林啟超) said. Following a sharp drop in the greenback against the NT dollar on Friday, Lin told the Central News Agency that the local currency is likely to remain strong in the short term, driven in part by market psychology surrounding anticipated US policy pressure. On Friday, the US dollar fell NT$0.953, or 3.07 percent, closing at NT$31.064 — its lowest level since Jan.

The New Taiwan dollar and Taiwanese stocks surged on signs that trade tensions between the world’s top two economies might start easing and as US tech earnings boosted the outlook of the nation’s semiconductor exports. The NT dollar strengthened as much as 3.8 percent versus the US dollar to 30.815, the biggest intraday gain since January 2011, closing at NT$31.064. The benchmark TAIEX jumped 2.73 percent to outperform the region’s equity gauges. Outlook for global trade improved after China said it is assessing possible trade talks with the US, providing a boost for the nation’s currency and shares. As the NT dollar

The Financial Supervisory Commission (FSC) yesterday met with some of the nation’s largest insurance companies as a skyrocketing New Taiwan dollar piles pressure on their hundreds of billions of dollars in US bond investments. The commission has asked some life insurance firms, among the biggest Asian holders of US debt, to discuss how the rapidly strengthening NT dollar has impacted their operations, people familiar with the matter said. The meeting took place as the NT dollar jumped as much as 5 percent yesterday, its biggest intraday gain in more than three decades. The local currency surged as exporters rushed to