Taipei Times (TT): How do you see banking activity across Asia this year?

Jan Metzger: On a macro level, the region’s fundamentals are strong and Asia’s GDP growth levels are the envy of the world. Citi is bullish on the growth prospects in Asia where large multinational companies look to expand their presence, capture new market segments and build new global supply chains.

Asia in many ways is the time machine to the future. It is home to a young population, a growing middle class and increasingly affluent consumers. There are also many start-ups and unicorns. These companies and well-established ones have rising needs for capital market financing and strategic merger and acquisition (M&A) advice.

Photo courtesy of Citi

Citi has been in Asia for nearly 120 years and in possession of competitive edges in supporting companies with cross-border business needs. The history enables us to grow deep understanding of the markets in which we operate with an exceptional network of local talent.

For example, we helped WT Microelectronics (文曄), a leading Taiwan-based electronic components distributor, become a global player through the US$3.8 billion acquisition of Canada-based Future Electronics. We served as its sole book runner in its US$341 million offering of global depository receipts (GDRs) in April this year. The offering drew tremendous interest from global investors, who are positive about WT Microelectronics’ long-term competitive advantages in the electronic components distribution ecosystem.

TT: What are your views about Taiwan?

Metzger: We are also bullish on Taiwan, which is a key market for Citi in Asia. This should come as little surprise given that it manufactures more than 60 percent of the world’s semiconductors. It is home to world-class companies whom we support with their capital raising, advisory needs and across our services and markets businesses.

Taiwanese companies play an important part in the megatrends driven by artificial intelligence, 5G, autonomous driving and energy transition in the coming years. The market has a great talent pool, technical expertise and strong market growth potential.

TT: How will Citi differentiate itself from other local and foreign banks here?

Metzger: We have been in Taiwan for 60 years and have been delivering the entire firm to our clients in each of the more than 95 markets where Citi has an on-the-ground presence, including the local market.

Our priority is to effectively and consistently harness the power of Citi’s talent, expertise and global reach to serve and support large and mid-sized companies wherever they do business and help advance their strategic objectives.

If you look at our track record in Taiwan, you would notice the diversified solutions we offer to our clients across M&A advisory, equity and debt capital raisings in a wide range of industries.

Notably, we have many repeat clients in the past decade, which demonstrates our position as the most trusted partner with a deep understanding of companies and markets to help clients achieve their transformational goals.

In fact, no other bank has a physical presence in 95 markets globally and supports a Taiwan client base of 800-plus international enterprises, nearly 1,000 small and medium-sized enterprises, and 100-plus top domestic enterprises and financial institutions.

TT: Related data showed Citi is the top player in terms of equity underwriting and investment banking in Asia. How will you keep the momentum going?

Metzger: Equity issuance has been active in the region — particularly in India, South Korea and Taiwan — which accounted for the bulk of the transactions last quarter.

Citi managed to stay relevant, thanks to its pan-Asia footprint, on-the-ground expertise and longstanding capabilities. For instance, we have helped clients in Taiwan to raise more than US$20 billion from global capital markets since 2020.

We also maintain active strategic dialogues with clients across many areas to support local companies with their global aspirations. We are not only their day-to-day corporate banking partner, but also their strategic partner of choice when they discuss global mergers and acquisitions, and related financing in the form of loans, GDRs and Euro-convertible bonds (ECBs), among other things.

TT: What are your observations regarding geopolitical tensions, global supply chain realignment and the macroeconomic dynamics that would inevitably have influences on Taiwan?

Metzger: Those issues are both old and new. They highlight the need of a banking partner with experience and, most importantly, with a truly global network and local expertise to help clients address the dynamic and evolving uncertainties across the value chain.

Globally we have been in business for more than 200 years during which time Citi has been supporting clients in Asia for more than 120 years. If you look back at different times in history, Citi has been managing clients’ risk profiles and helping them navigate through these issues. That is really core to what Citi delivers.

TT: How is Citi helping clients in the pursuit of environmental, social and governance (ESG), as well as net-zero carbon emissions?

Metzger: We are working together with our clients toward a low-carbon and sustainable economy. Over the past year, Citi supported clients in Taiwan to pursue their sustainability targets by providing financial solutions for sustainable development, such as sustainability-linked loans and ESG-linked foreign exchange operations.

Last year, Citi acted as the sole global coordinator, joint book runner and green structuring bank for Taiwan Cement Corp’s (台泥) concurrent US$385 million GDRs and US$420 million green ECBs offerings. The combo issuance represented the largest concurrent equity and convertible bond issuance in Asia in the past two years. The green ECB tranche marked the first green convertible bond issuance in Taiwan. As the green structuring bank, Citi Taiwan gave advice on the establishment of its inaugural green financing framework.

We also offer suppliers embracing sustainability the opportunity to boost liquidity and cash flow by discounting approved client receivables at preferred rates. Our clients work with third-party verifiers to independently audit, verify and track suppliers against predefined sustainability goals. Citi then rewards suppliers who meet sustainability targets with preferential discount rates.

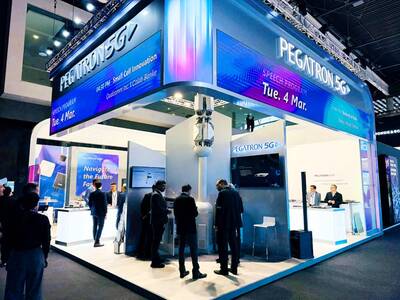

‘DECENT RESULTS’: The company said it is confident thanks to an improving world economy and uptakes in new wireless and AI technologies, despite US uncertainty Pegatron Corp (和碩) yesterday said it plans to build a new server manufacturing factory in the US this year to address US President Donald Trump’s new tariff policy. That would be the second server production base for Pegatron in addition to the existing facilities in Taoyuan, the iPhone assembler said. Servers are one of the new businesses Pegatron has explored in recent years to develop a more balanced product lineup. “We aim to provide our services from a location in the vicinity of our customers,” Pegatron president and chief executive officer Gary Cheng (鄭光治) told an online earnings conference yesterday. “We

It was late morning and steam was rising from water tanks atop the colorful, but opaque-windowed, “soapland” sex parlors in a historic Tokyo red-light district. Walking through the narrow streets, camera in hand, was Beniko — a former sex worker who is trying to capture the spirit of the area once known as Yoshiwara through photography. “People often talk about this neighborhood having a ‘bad history,’” said Beniko, who goes by her nickname. “But the truth is that through the years people have lived here, made a life here, sometimes struggled to survive. I want to share that reality.” In its mid-17th to

LEAK SOURCE? There would be concern over the possibility of tech leaks if TSMC were to form a joint venture to operate Intel’s factories, an analyst said Taiwan Semiconductor Manufacturing Co (TSMC, 台積電) yesterday stayed mum after a report said that the chipmaker has pitched chip designers Nvidia Corp, Advanced Micro Devices Inc and Broadcom Inc about taking a stake in a joint venture to operate Intel Corp’s factories. Industry sources told the Central News Agency (CNA) that the possibility of TSMC proposing to operate Intel’s wafer fabs is low, as the Taiwanese chipmaker has always focused on its core business. There is also concern over possible technology leaks if TSMC were to form a joint venture to operate Intel’s factories, Concord Securities Co (康和證券) analyst Kerry Huang (黃志祺)

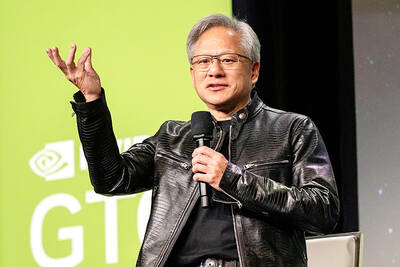

‘MAKE OR BREAK’: Nvidia shares remain down more than 9 percent, but investors are hoping CEO Jensen Huang’s speech can stave off fears that the sales boom is peaking Shares in Nvidia Corp’s Taiwanese suppliers mostly closed higher yesterday on hopes that the US artificial intelligence (AI) chip designer would showcase next-generation technologies at its annual AI conference slated to open later in the day. The GPU Technology Conference (GTC) in California is to feature developers, engineers, researchers, inventors and information technology professionals, and would focus on AI, computer graphics, data science, machine learning and autonomous machines. The event comes at a make-or-break moment for the firm, as it heads into the next few quarters, with Nvidia CEO Jensen Huang’s (黃仁勳) keynote speech today seen as having the ability to