Berkshire Hathaway Inc’s cash pile hit yet another record as billionaire investor Warren Buffett confronted a dearth of big-ticket deals. Operating earnings also rose, buoyed by his collection of insurance businesses.

The firm’s hoard increased to US$189 billion at the end of the first quarter, topping the record it set at year-end. The company also reported first-quarter operating earnings of US$11.2 billion, versus US$8.07 billion for the same period a year earlier.

Buffett, 93, has long decried a lack of meaningful deals that would give the firm a shot at “eye-popping” results. Even as the company ramped up acquisitions over the past few years, including a US$11.6 billion deal to buy Alleghany Corp and its purchase of shares in Occidental Petroleum Corp, Berkshire has struggled to find sizable deals. That has left Buffett with more cash — what he called an unrivaled mountain of capital — than he and his investing deputies could quickly deploy.

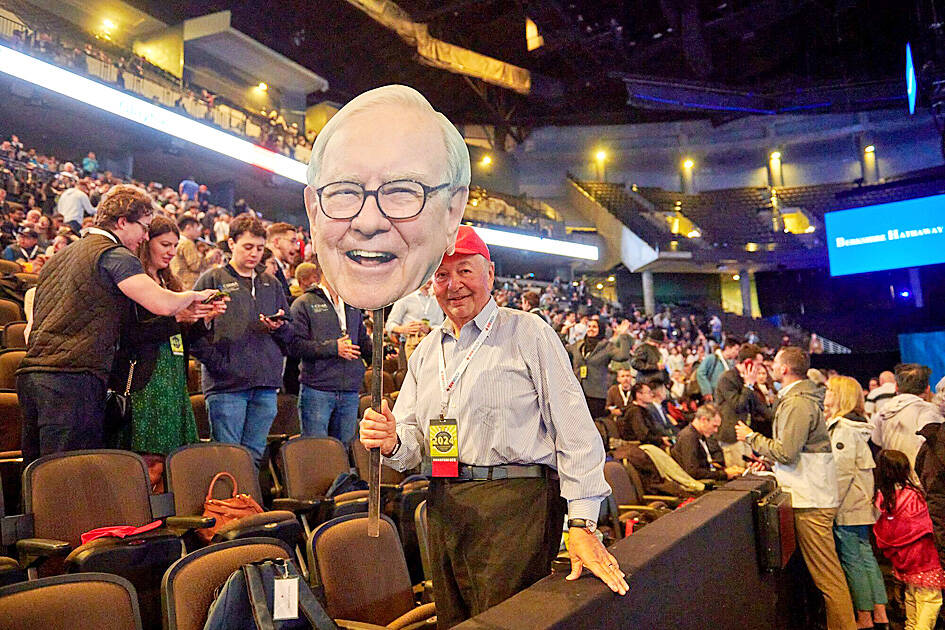

Photo: Bloomberg

As Berkshire’s annual meeting launched in Omaha, Nebraska, on Saturday, Buffett said that “it’s a fair assumption” that its cash pile would hit US$200 billion at the end of this quarter with few opportunities for needle-moving acquisitions on the horizon.

“We’d love to spend it, but we won’t spend it unless we think we’re doing something that has very little risk and can make us a lot of money,” he told the crowd of thousands.

The company hopes for an “occasional big opportunity,” he added, later saying that it is looking at an investment in Canada.

Still, having such a vast sum of cash in an increasingly “complicated and intertwined” world where more can go wrong could allow the firm to step in when opportunities present themselves, Buffett said.

Berkshire wants to be ready to act when that happens, he said.

The company sold some of its Apple Inc shares in the quarter, reporting a US$135.4 billion stake at the end of March, down from US$174.3 billion at the end of last year. Apple has been hit by a drumbeat of negative news, including a US$2 billion antitrust fine, slumping sales in China and the scrapping of a decade-long car project.

Despite the sale, Buffett praised Apple, saying it is an “even better” business than two others it owns shares in — American Express Co and Coca-Cola Co.

Apple would likely remain its top holding by the end of the year, Buffett said.

Berkshire also sold its position in Paramount Global at a loss, Buffett said, adding that he was responsible for the investment.

The company has faced challenges as viewers shifted from traditional TV to online offerings and is the subject of takeover talks.

In the absence of deals, Berkshire has turned to buying back its own shares. It spent about US$2.6 billion doing that in the first quarter, the company said in its earnings statement on Saturday.

With businesses including railroad, retail, construction and energy, Berkshire is closely watched as a litmus test for US economic health, particularly amid elevated inflation and interest rates.

Earnings at the company’s collection of insurance businesses jumped to US$2.6 billion, compared with US$911 million in the same period last year, thanks to improved results at its vehicle insurer Geico Corp, fewer catastrophes and an increase in insurance investment income. The conglomerate’s BNSF Railway Co reported an 8.3 percent decline in earnings from the prior period, which Berkshire said was down to “unfavorable changes in business mix,” as well as lower fuel surcharge revenues.

Berkshire reported US$12.7 billion in earnings attributable to shareholders for the first quarter, compared with US$35.5 billion for the same period a year earlier, largely due to lower investment income.

Buffett advised shareholders against relying on the firm’s net income figures because they include the swings of its stock portfolio value and do not reflect the performance of its vast group of businesses.

Berkshire’s annual meeting drew thousands of Buffett devotees. It is the first without Charlie Munger, Berkshire’s vice chairman and Buffett’s long-time investing partner, who died at the age of 99 in November last year.

The US dollar was trading at NT$29.7 at 10am today on the Taipei Foreign Exchange, as the New Taiwan dollar gained NT$1.364 from the previous close last week. The NT dollar continued to rise today, after surging 3.07 percent on Friday. After opening at NT$30.91, the NT dollar gained more than NT$1 in just 15 minutes, briefly passing the NT$30 mark. Before the US Department of the Treasury's semi-annual currency report came out, expectations that the NT dollar would keep rising were already building. The NT dollar on Friday closed at NT$31.064, up by NT$0.953 — a 3.07 percent single-day gain. Today,

‘SHORT TERM’: The local currency would likely remain strong in the near term, driven by anticipated US trade pressure, capital inflows and expectations of a US Fed rate cut The US dollar is expected to fall below NT$30 in the near term, as traders anticipate increased pressure from Washington for Taiwan to allow the New Taiwan dollar to appreciate, Cathay United Bank (國泰世華銀行) chief economist Lin Chi-chao (林啟超) said. Following a sharp drop in the greenback against the NT dollar on Friday, Lin told the Central News Agency that the local currency is likely to remain strong in the short term, driven in part by market psychology surrounding anticipated US policy pressure. On Friday, the US dollar fell NT$0.953, or 3.07 percent, closing at NT$31.064 — its lowest level since Jan.

The New Taiwan dollar and Taiwanese stocks surged on signs that trade tensions between the world’s top two economies might start easing and as US tech earnings boosted the outlook of the nation’s semiconductor exports. The NT dollar strengthened as much as 3.8 percent versus the US dollar to 30.815, the biggest intraday gain since January 2011, closing at NT$31.064. The benchmark TAIEX jumped 2.73 percent to outperform the region’s equity gauges. Outlook for global trade improved after China said it is assessing possible trade talks with the US, providing a boost for the nation’s currency and shares. As the NT dollar

The Financial Supervisory Commission (FSC) yesterday met with some of the nation’s largest insurance companies as a skyrocketing New Taiwan dollar piles pressure on their hundreds of billions of dollars in US bond investments. The commission has asked some life insurance firms, among the biggest Asian holders of US debt, to discuss how the rapidly strengthening NT dollar has impacted their operations, people familiar with the matter said. The meeting took place as the NT dollar jumped as much as 5 percent yesterday, its biggest intraday gain in more than three decades. The local currency surged as exporters rushed to