Major Chinese electric carmaker BYD Co (比亞迪) yesterday reported lower-than-expected revenue for the first quarter of the year, as an aggressive domestic price war and Western regulatory pressure weighed on the company’s growth.

BYD posted an operating revenue of 124.94 billion yuan (US$17.25 billion) for the first three months of the year, up 3.97 percent from a year ago, according to a stock exchange filing.

Bloomberg analysts had predicted a quarterly revenue of 132.53 billion yuan.

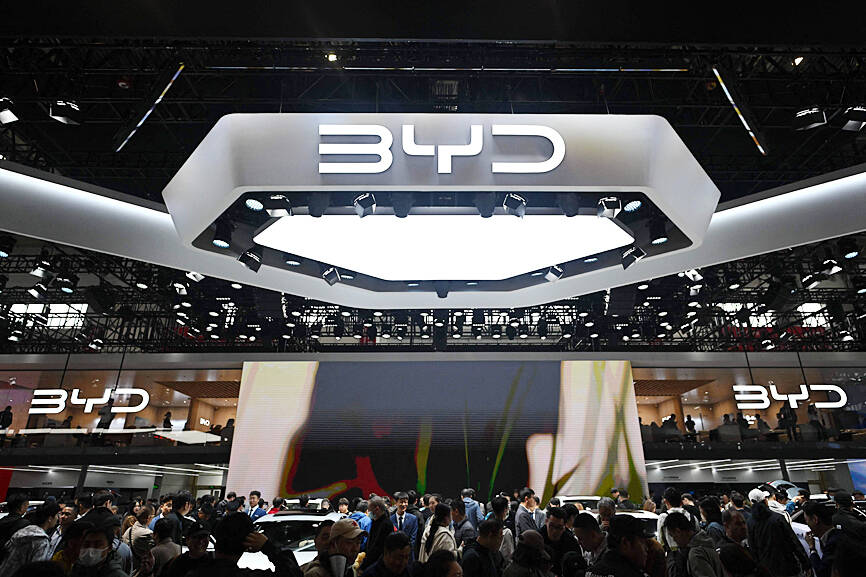

Photo: Pedro Pardo, AFP

The Shenzhen-based company is moving quickly overseas — including into Southeast Asian countries but also further afield in Latin America and Europe — as a price war continues to be waged in China, the world’s largest automotive market.

BYD overtook Elon Musk’s Tesla Inc in the fourth quarter of last year to become the world’s top seller of electric vehicles (EVs). Tesla reclaimed that title in the first quarter of this year, but BYD remains firmly on top in its home market.

The Chinese automaker recorded a record annual profit of 30 billion yuan last year.

Its profit in the first quarter was 4.57 billion yuan, up 10.62 percent from a year ago, BYD said.

BYD said its research and development and marketing expenses had shot up in the first quarter due to an "increase in advertising and exhibition expenses and depreciation and amortization", as well as higher "material consumption."

China has led the global transition to electric vehicles, with almost 1 in 3 cars on Chinese roads set to be electric by 2030, according to the International Energy Agency’s annual Global EV Outlook published last week.

There are a staggering 129 EV brands in China, but just 20 have managed to achieve a domestic market share of one percent or more, according to data compiled by Bloomberg.

Rival brands have sought in recent months to undercut each other’s prices, offering customers built-in gadgets and trendy customisation options at lower and lower pricetags.

Meanwhile, European regulators are raising the alarm on what they describe as Chinese industrial "overcapacity" created by excessive state subsidies, which could flood global markets with cheap vehicles.

The EU launched an investigation last year into the subsidies, which it said had given Chinese

Semiconductor business between Taiwan and the US is a “win-win” model for both sides given the high level of complementarity, the government said yesterday responding to tariff threats from US President Donald Trump. Home to the world’s largest contract chipmaker, Taiwan Semiconductor Manufacturing Co (TSMC, 台積電), Taiwan is a key link in the global technology supply chain for companies such as Apple Inc and Nvidia Corp. Trump said on Monday he plans to impose tariffs on imported chips, pharmaceuticals and steel in an effort to get the producers to make them in the US. “Taiwan and the US semiconductor and other technology industries

SMALL AND EFFICIENT: The Chinese AI app’s initial success has spurred worries in the US that its tech giants’ massive AI spending needs re-evaluation, a market strategist said Chinese artificial intelligence (AI) start-up DeepSeek’s (深度求索) eponymous AI assistant rocketed to the top of Apple Inc’s iPhone download charts, stirring doubts in Silicon Valley about the strength of the US’ technological dominance. The app’s underlying AI model is widely seen as competitive with OpenAI and Meta Platforms Inc’s latest. Its claim that it cost much less to train and develop triggered share moves across Asia’s supply chain. Chinese tech firms linked to DeepSeek, such as Iflytek Co (科大訊飛), surged yesterday, while chipmaking tool makers like Advantest Corp slumped on the potential threat to demand for Nvidia Corp’s AI accelerators. US stock

The US Federal Reserve is expected to announce a pause in rate cuts on Wednesday, as policymakers look to continue tackling inflation under close and vocal scrutiny from US President Donald Trump. The Fed cut its key lending rate by a full percentage point in the final four months of last year and indicated it would move more cautiously going forward amid an uptick in inflation away from its long-term target of 2 percent. “I think they will do nothing, and I think they should do nothing,” Federal Reserve Bank of St Louis former president Jim Bullard said. “I think the

SUBSIDIES: The nominee for commerce secretary indicated the Trump administration wants to put its stamp on the plan, but not unravel it entirely US President Donald Trump’s pick to lead the agency in charge of a US$52 billion semiconductor subsidy program declined to give it unqualified support, raising questions about the disbursement of funds to companies like Intel Corp and Taiwan Semiconductor Manufacturing Co (台積電). “I can’t say that I can honor something I haven’t read,” Howard Lutnick, Trump’s nominee for commerce secretary, said of the binding CHIPS and Science Act awards in a confirmation hearing on Wednesday. “To the extent monies have been disbursed, I would commit to rigorously enforcing documents that have been signed by those companies to make sure we get