Smartphone chip designer MediaTek Inc (聯發科) yesterday said it estimates that revenue would expand at an annual rate of about 15 percent this year, as a proliferation of generative artificial intelligence (AI) applications for premium smartphones are fueling demand for its flagship smartphone chips.

It expects its smartphone chip revenue to outgrow the company’s average growth rate this year, benefiting primarily from the higher average selling price of its flagship smartphone chips and market share gains.

The flagship chip revenue is to soar 50 percent year-on-year this year, MediaTek told an investor conference yesterday.

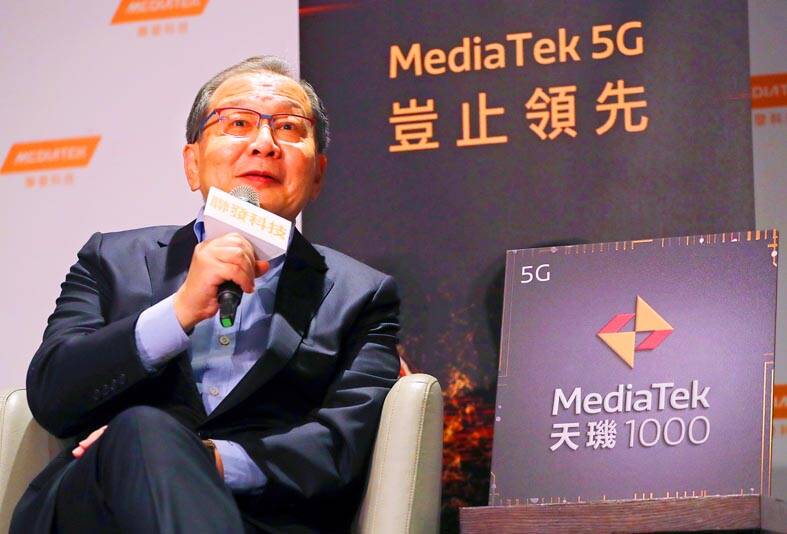

Photo: CNA

As a whole, this year’s gross margin is expected to be between 46 percent and 49 percent, compared with 47.8 percent last year, MediaTek said.

“We think mid-teens percentage growth is a very achievable number,” MediaTek CEO Rick Tsai (蔡力行) said during the conference, referring to the company’s revenue growth target for this year.

“The driving force really is the move toward high-end phones — flagship or premium phones. The trend provides the driving force for us to expand our total addressable market,” he added.

In China, MediaTek aims to seize a 30 percent share of the premium smartphones running on Android this year, Tsai said, referring to the company’s strong product portfolio.

The global top three smartphones ranked by AI performance are all powered by Mediatek’s new flagship smartphone chip, Dimensity 9300, he said.

The company expects more smartphones powered by Dimensity 9300 and Dimensity 8300 chips to hit the market later this quarter, MediaTek said.

Its next-generation flagship chip, Dimensity 9400, is on track to launch in the second half of this year, MediaTek added.

MediaTek yesterday also showed its ambition to build a presence in the market of rapidly growing AI accelerators used in data centers.

It would be reasonable for the company to vie for a 10 percent share of the market valued at US$40 billion by 2028, as it intends to be a major player, MediaTek said.

The total addressable market for AI accelerators used in data centers would total US$12 billion this year, it added.

As the smartphone chip restocking cycle is drawing to an end this quarter, MediaTek expects revenue this quarter to be flat or to decline by 9 percent sequentially to NT$121.4 billion to NT$133.5 billion (US$3.73 billion to US$4.10 billion), compared with NT$133.46 billion in the first quarter.

Smartphone chips are the biggest revenue contributor to MediaTek, accounting for 61 percent last quarter.

Gross margin this quarter is expected to be in the range of 45.5 percent to 48.5 percent, from 47.9 percent last quarter, excluding a one-time item, the company said.

MediaTek yesterday reported quarterly net profit of NT$31.6 billion during the January-to-March period, surging 87.4 percent year-on-year from NT$16.89 billion. On a quarterly basis, net profit jumped 23.1 percent from NT$25.71 billion.

Earnings per share rose to NT$19.85 last quarter from NT$10.64 in the first quarter of last year and NT$16.15 in the fourth quarter last year.

Intel Corp chief executive officer Lip-Bu Tan (陳立武) is expected to meet with Taiwanese suppliers next month in conjunction with the opening of the Computex Taipei trade show, supply chain sources said on Monday. The visit, the first for Tan to Taiwan since assuming his new post last month, would be aimed at enhancing Intel’s ties with suppliers in Taiwan as he attempts to help turn around the struggling US chipmaker, the sources said. Tan is to hold a banquet to celebrate Intel’s 40-year presence in Taiwan before Computex opens on May 20 and invite dozens of Taiwanese suppliers to exchange views

Application-specific integrated circuit designer Faraday Technology Corp (智原) yesterday said that although revenue this quarter would decline 30 percent from last quarter, it retained its full-year forecast of revenue growth of 100 percent. The company attributed the quarterly drop to a slowdown in customers’ production of chips using Faraday’s advanced packaging technology. The company is still confident about its revenue growth this year, given its strong “design-win” — or the projects it won to help customers design their chips, Faraday president Steve Wang (王國雍) told an online earnings conference. “The design-win this year is better than we expected. We believe we will win

Chizuko Kimura has become the first female sushi chef in the world to win a Michelin star, fulfilling a promise she made to her dying husband to continue his legacy. The 54-year-old Japanese chef regained the Michelin star her late husband, Shunei Kimura, won three years ago for their Sushi Shunei restaurant in Paris. For Shunei Kimura, the star was a dream come true. However, the joy was short-lived. He died from cancer just three months later in June 2022. He was 65. The following year, the restaurant in the heart of Montmartre lost its star rating. Chizuko Kimura insisted that the new star is still down

While China’s leaders use their economic and political might to fight US President Donald Trump’s trade war “to the end,” its army of social media soldiers are embarking on a more humorous campaign online. Trump’s tariff blitz has seen Washington and Beijing impose eye-watering duties on imports from the other, fanning a standoff between the economic superpowers that has sparked global recession fears and sent markets into a tailspin. Trump says his policy is a response to years of being “ripped off” by other countries and aims to bring manufacturing to the US, forcing companies to employ US workers. However, China’s online warriors