Gudeng Equipment Co Ltd (家碩科技), a supplier of semiconductor equipment and components used in advanced chip manufacturing processes, yesterday said it has tentatively set a price of NT$216.8 per share for its debut on the Taipei Exchange next month at the earliest.

The price represents about a 15 percent premium compared with the auction price of NT$188.52 a share, which was based on the average trading price of the company’s shares on the Emerging Stock Market over a 30-day period before the auction.

Investors would be able to buy Gudeng Equipment shares through an auction or via subscription. Yuanta Securities Co (元大證券) is underwriting the initial public offering (IPO).

Photo: CNA

Gudeng Equipment offers automotive extreme ultraviolet lithography (EUV) pod surface inspection tools, a critical tool for EUV pod quality management.

Gudeng Equipment is 47.19 percent owned by Gudeng Precision Industrial Co (家登精密), the sole EUV pod supplier to Taiwan Semiconductor Manufacturing Co (TSMC, 台積電).

TSMC was the world’s first chipmaker to utilize EUV tools in producing an advanced version of its 7-nanometer chips in 2019 and now on more advanced chips.

Gudeng Equipment gave a bullish view about the company’s business prospects as a significant expansion in capital spending by the world’s major chipmakers on advanced technologies would provide a boon to the company, chairman Bill Chiu (邱銘乾) told investors on Monday.

“We are to benefiting from the AI [artificial intelligence] boom as more companies are joining the ranks of AMD and Nvidia in developing AI chips,” Chiu said.

Global semiconductor equipment spending on front-end facilities is expected to grow 21 percent year-on-year this year to US$92 billion, with Taiwan continuing to be the biggest spender, SEMI has forecast.

For Gudeng Equipment, China is to be a new growth engine as Chinese chipmakers are racing to produce advanced chips, Chiu said.

China accounted for a mere 3 percent of the company’s total revenue last year, while Taiwan contributed about 70 percent and the US 13 percent.

Since a key customer operates chip manufacturing facilities in Ireland, Gudeng Equipment has also started shipping equipment to that nation.

To cope with rising demand, Gudeng Equipment is planning to build a new factory in Tainan later this year, it said.

Gudeng Equipment last year posted a net profit of NT$228 million, up 12.32 percent from NT$203 million in 2022. Gross margin improved to 49 percent last year from 43 percent the previous year.

Revenue grew 15.24 percent year-on-year to NT$1.21 billion last year from NT$1.05 billion.

It was late morning and steam was rising from water tanks atop the colorful, but opaque-windowed, “soapland” sex parlors in a historic Tokyo red-light district. Walking through the narrow streets, camera in hand, was Beniko — a former sex worker who is trying to capture the spirit of the area once known as Yoshiwara through photography. “People often talk about this neighborhood having a ‘bad history,’” said Beniko, who goes by her nickname. “But the truth is that through the years people have lived here, made a life here, sometimes struggled to survive. I want to share that reality.” In its mid-17th to

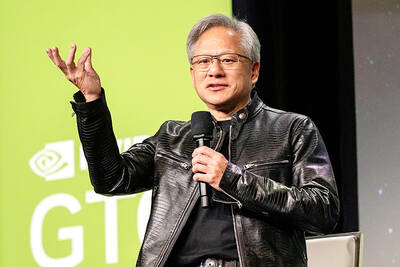

‘MAKE OR BREAK’: Nvidia shares remain down more than 9 percent, but investors are hoping CEO Jensen Huang’s speech can stave off fears that the sales boom is peaking Shares in Nvidia Corp’s Taiwanese suppliers mostly closed higher yesterday on hopes that the US artificial intelligence (AI) chip designer would showcase next-generation technologies at its annual AI conference slated to open later in the day. The GPU Technology Conference (GTC) in California is to feature developers, engineers, researchers, inventors and information technology professionals, and would focus on AI, computer graphics, data science, machine learning and autonomous machines. The event comes at a make-or-break moment for the firm, as it heads into the next few quarters, with Nvidia CEO Jensen Huang’s (黃仁勳) keynote speech today seen as having the ability to

NEXT GENERATION: The company also showcased automated machines, including a nursing robot called Nurabot, which is to enter service at a Taichung hospital this year Hon Hai Precision Industry Co (鴻海精密) expects server revenue to exceed its iPhone revenue within two years, with the possibility of achieving this goal as early as this year, chairman Young Liu (劉揚偉) said on Tuesday at Nvidia Corp’s annual technology conference in San Jose, California. AI would be the primary focus this year for the company, also known as Foxconn Technology Group (富士康科技集團), as rapidly advancing AI applications are driving up demand for AI servers, Liu said. The production and shipment of Nvidia’s GB200 chips and the anticipated launch of GB300 chips in the second half of the year would propel

The battle for artificial intelligence supremacy hinges on microchips, but the semiconductor sector that produces them has a dirty secret: It is a major source of chemicals linked to cancer and other health problems. Global chip sales surged more than 19 percent to about US$628 billion last year, according to the Semiconductor Industry Association, which forecasts double-digit growth again this year. That is adding urgency to reducing the effects of “forever chemicals” — which are also used to make firefighting foam, nonstick pans, raincoats and other everyday items — as are regulators in the US and Europe who are beginning to