Japan yesterday approved as much as ¥590 billion (US$3.9 billion) in subsidies to chip venture Rapidus Corp, committing more money to its ambition to catch up in semiconductor manufacturing.

The additional funding will help Rapidus buy chipmaking equipment and also develop advanced back-end chipmaking processes, Japanese Minister of Economy, Trade and Industry Ken Saito told a news conference in Tokyo.

The amount is on top of ¥330 billion of public money the 19-month-old start-up has already received in its bid to mass produce chips in Japan’s Hokkaido Prefecture and compete with industry leaders Taiwan Semiconductor Manufacturing Co (TSMC, 台積電) and Samsung Electronics Co.

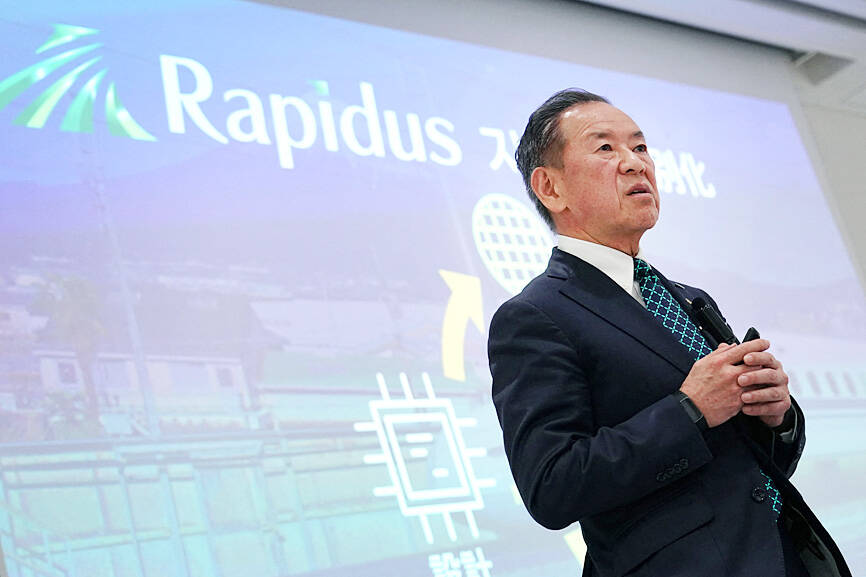

Photo: AFP

“The next-generation semiconductors Rapidus is working on are the most important technology that will dictate the future of Japanese industry and economic growth,” Saito said. “This fiscal year is extremely important for Rapidus.”

The sum is part of about ¥4 trillion Japan has earmarked over the past three years to regain some of its former chipmaking prowess, with Japanese Prime Minister Fumio Kishida targeting ¥10 trillion in financial support to chipmakers, along with the private sector.

Japan has committed billions of dollars into TSMC’s first factory in Kumamoto Prefecture, as well as to Micron Technology Inc’s expansion at its Hiroshima plant to make advanced DRAM.

Geopolitical tensions are spurring governments around the world to broaden domestic capabilities to make semiconductors, which are crucial for running vehicles, power plants and weapons systems, as well as consumer electronics.

The US has also pledged billions of dollars to chipmakers, but delays in licensing and subsidy allocations have held back factory construction plans.

Rapidus is teaming up with the country’s researchers in nanotechnology and materials to close the gap with TSMC in cutting-edge fabrication technology.

TSMC holds the biggest share of the world’s outsourced advanced chip production, with closest rival Samsung struggling for years to catch up.

As much as ¥536.5 billion of the newly approved subsidies will be used to install equipment for the pilot line at Rapidus’ Chitose plant, enlist researchers from IBM Corp, shorten turnaround times and build a production control system, the Japanese Ministry of Economy, Trade and Industry said.

The remaining ¥53.5 billion will be used to develop advanced packaging technologies to help combine multiple chips to generate more capabilities, it said.

Packaging is an area that is grabbing more attention as squeezing more transistors onto a single sliver of silicon gets increasingly costly.

Japan’s three decades of economic stagnation and loss of international competitiveness were caused in part by lack of understanding about the importance of semiconductors for digitalization, decarbonization and economic security, Saito said.

“It’s no exaggeration to say that chips are the foundation for this country’s industries and those of the world,” he said.

When an apartment comes up for rent in Germany’s big cities, hundreds of prospective tenants often queue down the street to view it, but the acute shortage of affordable housing is getting scant attention ahead of today’s snap general election. “Housing is one of the main problems for people, but nobody talks about it, nobody takes it seriously,” said Andreas Ibel, president of Build Europe, an association representing housing developers. Migration and the sluggish economy top the list of voters’ concerns, but analysts say housing policy fails to break through as returns on investment take time to register, making the

‘SILVER LINING’: Although the news caused TSMC to fall on the local market, an analyst said that as tariffs are not set to go into effect until April, there is still time for negotiations US President Donald Trump on Tuesday said that he would likely impose tariffs on semiconductor, automobile and pharmaceutical imports of about 25 percent, with an announcement coming as soon as April 2 in a move that would represent a dramatic widening of the US leader’s trade war. “I probably will tell you that on April 2, but it’ll be in the neighborhood of 25 percent,” Trump told reporters at his Mar-a-Lago club when asked about his plan for auto tariffs. Asked about similar levies on pharmaceutical drugs and semiconductors, the president said that “it’ll be 25 percent and higher, and it’ll

CHIP BOOM: Revenue for the semiconductor industry is set to reach US$1 trillion by 2032, opening up opportunities for the chip pacakging and testing company, it said ASE Technology Holding Co (日月光投控), the world’s largest provider of outsourced semiconductor assembly and test (OSAT) services, yesterday launched a new advanced manufacturing facility in Penang, Malaysia, aiming to meet growing demand for emerging technologies such as generative artificial intelligence (AI) applications. The US$300 million facility is a critical step in expanding ASE’s global footprint, offering an alternative for customers from the US, Europe, Japan, South Korea and China to assemble and test chips outside of Taiwan amid efforts to diversify supply chains. The plant, the company’s fifth in Malaysia, is part of a strategic expansion plan that would more than triple

Taiwanese artificial intelligence (AI) server makers are expected to make major investments in Texas in May after US President Donald Trump’s first 100 days in office and amid his rising tariff threats, Taiwan Electrical and Electronic Manufacturers’ Association (TEEMA, 台灣電子電機公會) chairman Richard Lee (李詩欽) said yesterday. The association led a delegation of seven AI server manufacturers to Washington, as well as the US states of California, Texas and New Mexico, to discuss land and tax issues, as Taiwanese firms speed up their production plans in the US with many of them seeing Texas as their top option for investment, Lee said. The