In an anonymous warehouse in southern England, engineers at Evolve Dynamics are working on technology that could help keep Ukraine’s reconnaissance drones in the sky even after Russia tries to jam them electronically.

It is a small but important part of an international effort by Ukraine’s allies to support its drone program, which Kyiv hopes will give it the edge over a much larger enemy with many more resources at its disposal.

Companies in dozens of countries have supplied drones and drone parts to Ukraine. Some, like Evolve Dynamics, are also focusing on technological advances designed to counter Russia’s powerful electronic warfare capabilities.

Photo: Reuters

By developing alternative radio link algorithms, it aims to make it harder for Russia to jam the signal from its surveillance drones, rendering them useless.

Both sides have bolstered deployment of electronic warfare systems, which can disrupt the frequencies that feed commands from the pilot to the drone, making them drop out of the sky or miss their target.

“It’s a constant ping-pong game between adversaries,” said Evolve Dynamics chief executive Mike Dewhirst, who estimates there have been 85 upgrades made to the company’s Sky Mantis drones over the past two-and-a-half years.

Photo: Reuters

The UK, a staunch ally of Kyiv since Russia launched its full-scale invasion in February 2022, said it was the largest supplier of drones to Ukraine, and is working with Latvia to lead a European coalition to step up production.

Other allies, such as Sweden, the Netherlands and Norway, have also provided Ukraine with combat drones.

Ukraine has nurtured its own private military start-ups to innovate and build up their domestic industry as the war enters its third year.

About 200 drone makers are now in the country, and the Ukrainian Ministry of Strategic Industries has said the nation could make as many as 2 million drones this year.

With Evolve Dynamics, whose reconnaissance drones in Ukraine spy on enemy movements, military units receive parts and software updates directly from the company, allowing them, where possible, to make the changes themselves.

“We’re adding technology to existing drones, modifying them. It might be a software change, a hardware change,” Dewhirst said.

Immediate communication between defense companies and soldiers might become a more common feature of warfare given the rapid technological innovation, some military experts said.

The trend could have implications for everything from procurement to training.

“The technology is moving very quickly. I would say maybe a six week learning cycle on the battlefield,” said Nick Reynolds, research fellow in land warfare at the Royal United Services Institute, a London-based defense think tank. “Our procurement systems are not optimized for this.”

Last month, a military unit in Ukraine asked Evolve Dynamics to change its technology to make it safer for the pilot.

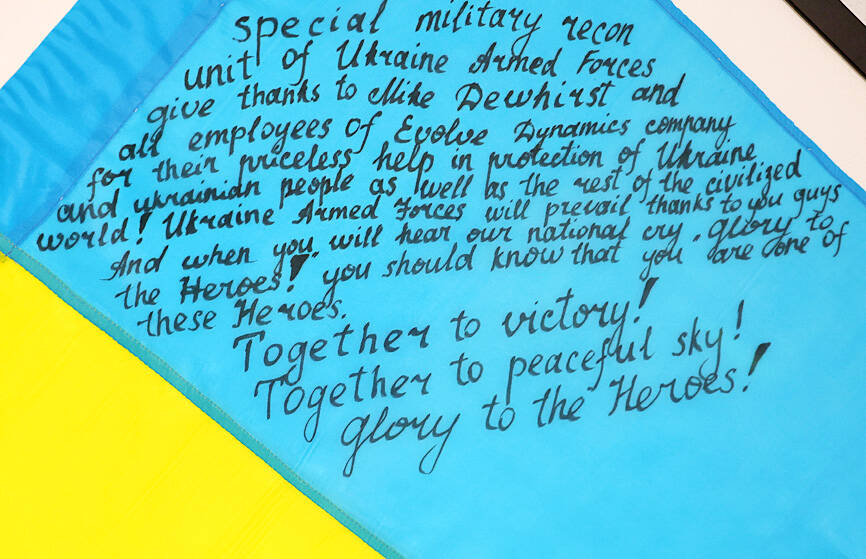

Working at the British site adorned with Ukrainian flags and messages of thanks from soldiers, staff worked out how to separate a drone’s radio box from its control.

Having sent instructions, the military unit were able to adopt the change within 24 hours of the request.

Dewhirst, who travels to Ukraine each month, decided to fund the modification after hearing that soldiers were going to pay for it themselves. Drone units in Ukraine often pay for their own equipment through private means or crowdfunding.

Dewhirst founded the company in 2014 when he was working with software engineers in Kyiv for a digital marketing start-up.

Evolve Dynamics has about 100 Sky Mantis surveillance drones flying in Ukraine, making it one of between five and 10 British significant suppliers of drones to Ukraine, the company said.

The UK has pledged to spend £325 million (US$410.26 million) to send 10,000 drones to Ukraine this year, and Evolve Dynamics hopes to win more of that work.

The privately owned company has supplied the British Royal Navy and some police forces, along with global oil and gas and wind turbine companies.

The US dollar was trading at NT$29.7 at 10am today on the Taipei Foreign Exchange, as the New Taiwan dollar gained NT$1.364 from the previous close last week. The NT dollar continued to rise today, after surging 3.07 percent on Friday. After opening at NT$30.91, the NT dollar gained more than NT$1 in just 15 minutes, briefly passing the NT$30 mark. Before the US Department of the Treasury's semi-annual currency report came out, expectations that the NT dollar would keep rising were already building. The NT dollar on Friday closed at NT$31.064, up by NT$0.953 — a 3.07 percent single-day gain. Today,

‘SHORT TERM’: The local currency would likely remain strong in the near term, driven by anticipated US trade pressure, capital inflows and expectations of a US Fed rate cut The US dollar is expected to fall below NT$30 in the near term, as traders anticipate increased pressure from Washington for Taiwan to allow the New Taiwan dollar to appreciate, Cathay United Bank (國泰世華銀行) chief economist Lin Chi-chao (林啟超) said. Following a sharp drop in the greenback against the NT dollar on Friday, Lin told the Central News Agency that the local currency is likely to remain strong in the short term, driven in part by market psychology surrounding anticipated US policy pressure. On Friday, the US dollar fell NT$0.953, or 3.07 percent, closing at NT$31.064 — its lowest level since Jan.

The New Taiwan dollar and Taiwanese stocks surged on signs that trade tensions between the world’s top two economies might start easing and as US tech earnings boosted the outlook of the nation’s semiconductor exports. The NT dollar strengthened as much as 3.8 percent versus the US dollar to 30.815, the biggest intraday gain since January 2011, closing at NT$31.064. The benchmark TAIEX jumped 2.73 percent to outperform the region’s equity gauges. Outlook for global trade improved after China said it is assessing possible trade talks with the US, providing a boost for the nation’s currency and shares. As the NT dollar

The Financial Supervisory Commission (FSC) yesterday met with some of the nation’s largest insurance companies as a skyrocketing New Taiwan dollar piles pressure on their hundreds of billions of dollars in US bond investments. The commission has asked some life insurance firms, among the biggest Asian holders of US debt, to discuss how the rapidly strengthening NT dollar has impacted their operations, people familiar with the matter said. The meeting took place as the NT dollar jumped as much as 5 percent yesterday, its biggest intraday gain in more than three decades. The local currency surged as exporters rushed to