The yen hit a 34-year low against the US dollar yesterday, just over a week after the Bank of Japan (BOJ) announced a much-anticipated interest rate hike in a shift away from years of ultra-loose monetary policy.

The Japanese currency weakened to ¥151.97 per US dollar, its lowest level since 1990, before recovering to about ¥151.35 later in the day.

The drop came after a top BOJ official suggested it would continue to pursue an accommodative policy, echoing previous comments from the central bank, but soon afterward, Japanese Minister of Finance Shunichi Suzuki said authorities would not hesitate to “take resolute action against excessive” foreign exchange moves — raising speculation of a government intervention to prop up the currency.

Photo: AFP

The BOJ last week took a step away from its unorthodox monetary stimulus program by hiking rates for the first time since 2007, but the yen has continued to slide.

Yesterday’s dip came after BOJ board member Naoki Tamura reportedly told business leaders in northern Japan that “slow, but steady progress” was needed on scaling back the central bank’s long-standing ultra-easy policy.

He repeated a line from a bank policy statement about financial conditions staying accommodative for now, which triggered fresh falls in the yen, Bloomberg News reported.

After the currency hit a 34-year low, Suzuki said the government was watching the situation closely.

“We’re monitoring market movements with a high sense of urgency. We will take resolute action against excessive moves, without ruling out any options,” Suzuki told reporters.

The Japanese government last intervened in markets to support the yen in October 2022, and on Monday a finance ministry currency diplomat also hinted that it could be on the cards again.

Further fueling speculation, BOJ officials held a rare meeting with the finance ministry and the Financial Services Agency (FSA) yesterday evening about “recent developments in financial markets,” a central bank spokesman said.

“The recent weakening of the yen cannot be said to be in line with fundamentals, and it is clear that speculative moves are behind the yen’s fall,” Japanese Vice Minister of Finance for International Affairs and top currency official Masato Kanda told reporters after the meeting.

“We will take appropriate action against excessive moves without ruling out any options,” he said.

Attending the meeting were Kanda, FSA Commissioner Teruhisa Kurita and BOJ head of policy Seiichi Shimizu.

ING Groep NV said in a note that foreign exchange markets would “test the verbal intervention of the last few days to see if there is more substance than just words.”

Royal Bank of Canada head of Asia foreign exchange strategy Alvin Tan (譚文泰) said that “intervention concerns” had capped the yen’s slide, but risks of further depreciation remain thanks to factors including “the yen’s sizeable yield disadvantage.”

Anna Bhobho, a 31-year-old housewife from rural Zimbabwe, was once a silent observer in her home, excluded from financial and family decisionmaking in the deeply patriarchal society. Today, she is a driver of change in her village, thanks to an electric tricycle she owns. In many parts of rural sub-Saharan Africa, women have long been excluded from mainstream economic activities such as operating public transportation. However, three-wheelers powered by green energy are reversing that trend, offering financial opportunities and a newfound sense of importance. “My husband now looks up to me to take care of a large chunk of expenses,

SECTOR LEADER: TSMC can increase capacity by as much as 20 percent or more in the advanced node part of the foundry market by 2030, an analyst said Taiwan Semiconductor Manufacturing Co (TSMC, 台積電) is expected to lead its peers in the advanced 2-nanometer process technology, despite competition from Samsung Electronics Co and Intel Corp, TrendForce Corp analyst Joanne Chiao (喬安) said. TSMC’s sophisticated products and its large production scale are expected to allow the company to continue dominating the global 2-nanometer process market this year, Chiao said. The world’s largest contract chipmaker is scheduled to begin mass production of chips made on the 2-nanometer process in its Hsinchu fab in the second half of this year. It would also hold a ceremony on Monday next week to

TECH CLUSTER: The US company’s new office is in the Shalun Smart Green Energy Science City, a new AI industry base and cybersecurity hub in southern Taiwan US chip designer Advanced Micro Devices Inc (AMD) yesterday launched an office in Tainan’s Gueiren District (歸仁), marking a significant milestone in the development of southern Taiwan’s artificial intelligence (AI) industry, the Tainan City Government said in a statement. AMD Taiwan general manager Vincent Chern (陳民皓) presided over the opening ceremony for the company’s new office at the Shalun Smart Green Energy Science City (沙崙智慧綠能科學城), a new AI industry base and cybersecurity hub in southern Taiwan. Facilities in the new office include an information processing center, and a research and development (R&D) center, the Tainan Economic Development Bureau said. The Ministry

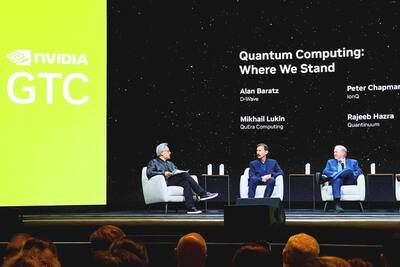

Nvidia is to open a quantum computing research lab in Boston, where it plans to collaborate with scientists from Harvard University and the Massachusetts Institute of Technology, Nvidia CEO Jensen Huang (黃仁勳) said on Thursday. Huang made the announcement at Nvidia’s annual software developer conference in San Jose, California, where the company held a day of events focused on quantum computing. Nvidia added the program after Huang in January said that useful quantum computers are 20 years away, comments that he sought to walk back on Thursday while joined onstage by executives from quantum computing firms. “This is the first event in history