The industrial production index dropped 1.1 percent year-on-year last month, as declines in traditional industries offset rising demand for artificial intelligence (AI) devices, servers, memory chips and flat-panel displays, the Ministry of Economic Affairs said yesterday.

Industrial production measures the change in the value of output produced by manufacturers, utilities and mines.

Last month, manufacturing output, which accounted for 95.39 percent of the industrial production index, dropped 1.2 percent annually, compared with the ministry’s projection of a decline 1.3 to 6.3 percent.

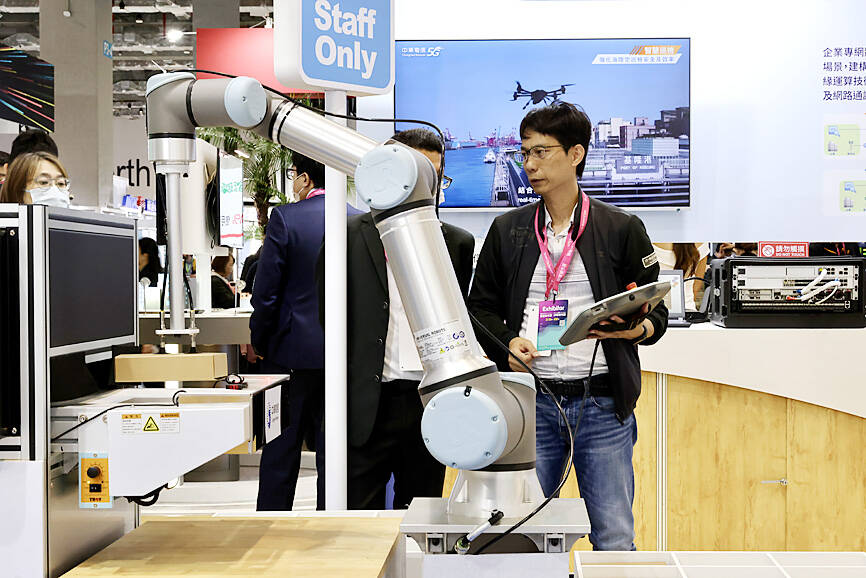

Photo: RITCHIE B. TONGO, EPA-EFE

“Manufacturing production was better than we expected last month as robust demand for emerging technologies mainly AI and high-performance computing (HPC) continued to drive demand for advanced chips,” Department of Statistics Deputy Director-General Huang Wei-jie (黃偉傑) said by telephone.

Commenting on reports that China has banned chips from Intel Corp and Advanced Micro Devices Inc in government PCs and servers, which could lead to order cutbacks on their chip supplier Taiwan Semiconductor Manufacturing Co (台積電), Huang said the impact remained to be seen.

This month, manufacturing output is expected to grow at an annual pace of between 1.5 and 6 percent, and grow between 5.3 and 6.9 percent annually this quarter, marking the first quarterly expansion since the third quarter of 2022, he said.

“The growth will continue over the remainder of the year, thanks to the improving global economic outlook driven by the resilient US economy,” benefiting Taiwanese manufacturers of chips, servers, electronic products and optical components, Huang said.

The production of electronic components, mainly semiconductors and displays, last month grew for a second consecutive month, up 9.8 percent annually, and expanded 10.11 percent during the first two months, as increased demand for AI and HPC devices, largely servers, boosted foundry companies’ 12-inch fab utilization, the ministry said.

The production of computers and optical components rose 3.86 percent annually last month, marking eight months of increases. In the first two months, computer and optical component production jumped 18.28 percent on the back of AI applications, cloud-computing services and camera lens upgrades, the ministry said.

Compared with the strong performance of the electronics industry, traditional industries were still struggling to emerge from a prolonged downturn.

The production of base metals, mostly steel, dropped 10 percent year-on-year last month, but expanded 3.78 percent during the first two months, thanks to inventory rebuilding demand and a lower comparison base, the ministry said.

The production of machine tools sank 10.41 percent last month, but increased 3.65 percent in the first two months also because of a lower comparison base.

The production of automotive products plummeted 19.48 percent last month but increased 8.82 percent in the first two months due to demand for electric vehicles and vehicle components.

The petrochemicals sector saw production decline 9.07 percent last month and drop 0.34 percent in the first two months as supply chain inventory remained high, the ministry said, adding that capacity expansion by foreign producers dampened demand for Taiwanese goods.

When an apartment comes up for rent in Germany’s big cities, hundreds of prospective tenants often queue down the street to view it, but the acute shortage of affordable housing is getting scant attention ahead of today’s snap general election. “Housing is one of the main problems for people, but nobody talks about it, nobody takes it seriously,” said Andreas Ibel, president of Build Europe, an association representing housing developers. Migration and the sluggish economy top the list of voters’ concerns, but analysts say housing policy fails to break through as returns on investment take time to register, making the

‘SILVER LINING’: Although the news caused TSMC to fall on the local market, an analyst said that as tariffs are not set to go into effect until April, there is still time for negotiations US President Donald Trump on Tuesday said that he would likely impose tariffs on semiconductor, automobile and pharmaceutical imports of about 25 percent, with an announcement coming as soon as April 2 in a move that would represent a dramatic widening of the US leader’s trade war. “I probably will tell you that on April 2, but it’ll be in the neighborhood of 25 percent,” Trump told reporters at his Mar-a-Lago club when asked about his plan for auto tariffs. Asked about similar levies on pharmaceutical drugs and semiconductors, the president said that “it’ll be 25 percent and higher, and it’ll

NOT TO WORRY: Some people are concerned funds might continue moving out of the country, but the central bank said financial account outflows are not unusual in Taiwan Taiwan’s outbound investments hit a new high last year due to investments made by contract chipmaker Taiwan Semiconductor Manufacturing Co (TSMC, 台積電) and other major manufacturers to boost global expansion, the central bank said on Thursday. The net increase in outbound investments last year reached a record US$21.05 billion, while the net increase in outbound investments by Taiwanese residents reached a record US$31.98 billion, central bank data showed. Chen Fei-wen (陳斐紋), deputy director of the central bank’s Department of Economic Research, said the increase was largely due to TSMC’s efforts to expand production in the US and Japan. Investments by Vanguard International

WARNING SHOT: The US president has threatened to impose 25 percent tariffs on all imported vehicles, and similar or higher duties on pharmaceuticals and semiconductors US President Donald Trump on Wednesday suggested that a trade deal with China was “possible” — a key target in the US leader’s tariffs policy. The US in 2020 had already agreed to “a great trade deal with China” and a new deal was “possible,” Trump said. Trump said he expected Chinese President Xi Jinping (習近平) to visit the US, without giving a timeline for his trip. Trump also said that he was talking to China about TikTok, as the US seeks to broker a sale of the popular app owned by Chinese firm ByteDance Ltd (字節跳動). Trump last week said that he had