Semiconductor equipment supplier Acter Group Co (聖暉) yesterday said it has secured record-high orders amounting to NT$31 billion, up 2 percent from last year, benefiting from an investment spree on new chip manufacturing facilities in China and Southeast Asia.

As Beijing aims to push for a chip self-sufficiency rate of 70 percent next year, Chinese chipmakers are showing strong ambition to build more facilities this year, Acter said.

About 30 new fabs, mostly less advanced, would be under construction by the second half of this year, it said.

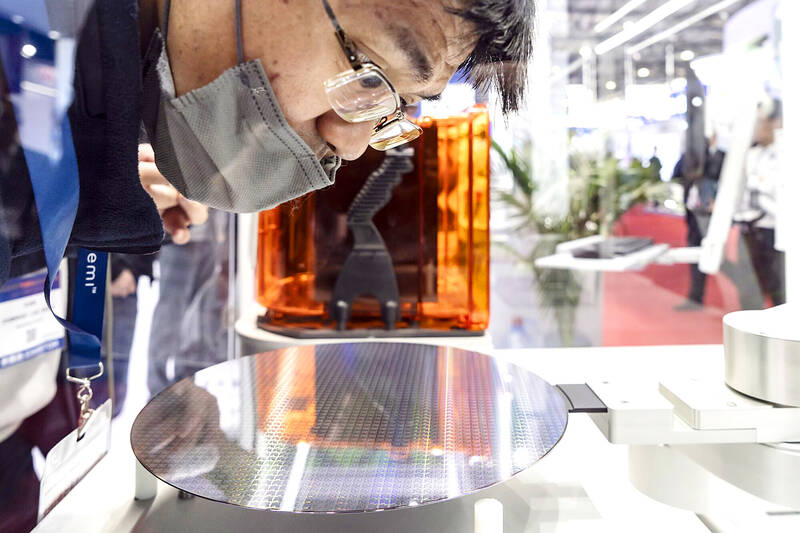

Photo: Bloomberg

“We have received more orders than we had anticipated. China continues to show strong demand,” Acter president Lai Ming-kun (賴銘崑) told an investors’ conference in Taipei. “Most Chinese fabs are to make chips on 16-nanometer technologies and other mature process technologies, as advanced equipment and materials are banned from being exported to China due to the US-China trade dispute.”

Southeast Asia would be another region with strong growth this year as Taiwanese electronics companies and chip packaging service providers are allocating production to Malaysia, Vietnam, Thailand and Indonesia to minimize risks of geopolitical tensions, Lai said.

Rapid demand in the region is the main reason behind the company’s optimism about this year’s revenue growth, the company said.

Customers plan to produce servers, printed circuit boards and other electronic components at new factories.

Three months ago, the clean room equipment supplier was neutral about this year’s outlook, it said.

Acter expects revenue this year to return to growth, after dipping 11 percent year-on-year to NT$25 billion (US$785.4 million) last year.

China was the biggest revenue contributor last year with a 49 percent share, followed by Taiwan at 42 percent and Southeast Asia at 9 percent, it said.

Acter is also looking at new business opportunities in Japan and India, Lai said.

Acter counts the world’s major foundry companies, including Taiwan Semiconductor Manufacturing Co (台積電), United Microelectronics Corp (聯電) and Semiconductor Manufacturing International Corp (中芯), among its customers.

Nova Technology Corp (朋億), an equipment manufacturing subsidiary of Acter, would have greater exposure to Japan this year, the company said.

Nova specializes in supplying high-purity chemical supply and dispensing systems, special gas supply systems and high-level wet-process equipment for cleaning.

The company is considering setting up a Japanese unit as two of its main customers are mulling building new plants there, it said.

The firm has secured record-high orders of NT$11 billion, with about 70 percent coming from Chinese customers and 20 percent from Taiwan, it said.

Nova expects revenue this year to reach NT$10 billion, up 9.4 percent from NT$9.14 billion last year.

TARIFF TRADE-OFF: Machinery exports to China dropped after Beijing ended its tariff reductions in June, while potential new tariffs fueled ‘front-loaded’ orders to the US The nation’s machinery exports to the US amounted to US$7.19 billion last year, surpassing the US$6.86 billion to China to become the largest export destination for the local machinery industry, the Taiwan Association of Machinery Industry (TAMI, 台灣機械公會) said in a report on Jan. 10. It came as some manufacturers brought forward or “front-loaded” US-bound shipments as required by customers ahead of potential tariffs imposed by the new US administration, the association said. During his campaign, US president-elect Donald Trump threatened tariffs of as high as 60 percent on Chinese goods and 10 percent to 20 percent on imports from other countries.

Taiwanese manufacturers have a chance to play a key role in the humanoid robot supply chain, Tongtai Machine and Tool Co (東台精機) chairman Yen Jui-hsiung (嚴瑞雄) said yesterday. That is because Taiwanese companies are capable of making key parts needed for humanoid robots to move, such as harmonic drives and planetary gearboxes, Yen said. This ability to produce these key elements could help Taiwanese manufacturers “become part of the US supply chain,” he added. Yen made the remarks a day after Nvidia Corp cofounder and chief executive officer Jensen Huang (黃仁勳) said his company and Taiwan Semiconductor Manufacturing Co (TSMC, 台積電) are jointly

United Microelectronics Corp (UMC, 聯電) expects its addressable market to grow by a low single-digit percentage this year, lower than the overall foundry industry’s 15 percent expansion and the global semiconductor industry’s 10 percent growth, the contract chipmaker said yesterday after reporting the worst profit in four-and-a-half years in the fourth quarter of last year. Growth would be fueled by demand for artificial intelligence (AI) servers, a moderate recovery in consumer electronics and an increase in semiconductor content, UMC said. “UMC’s goal is to outgrow our addressable market while maintaining our structural profitability,” UMC copresident Jason Wang (王石) told an online earnings

MARKET SHIFTS: Exports to the US soared more than 120 percent to almost one quarter, while ASEAN has steadily increased to 18.5 percent on rising tech sales The proportion of Taiwan’s exports directed to China, including Hong Kong, declined by more than 12 percentage points last year compared with its peak in 2020, the Ministry of Finance said on Thursday last week. The decrease reflects the ongoing restructuring of global supply chains, driven by escalating trade tensions between Beijing and Washington. Data compiled by the ministry showed China and Hong Kong accounted for 31.7 percent of Taiwan’s total outbound sales last year, a drop of 12.2 percentage points from a high of 43.9 percent in 2020. In addition to increasing trade conflicts between China and the US, the ministry said