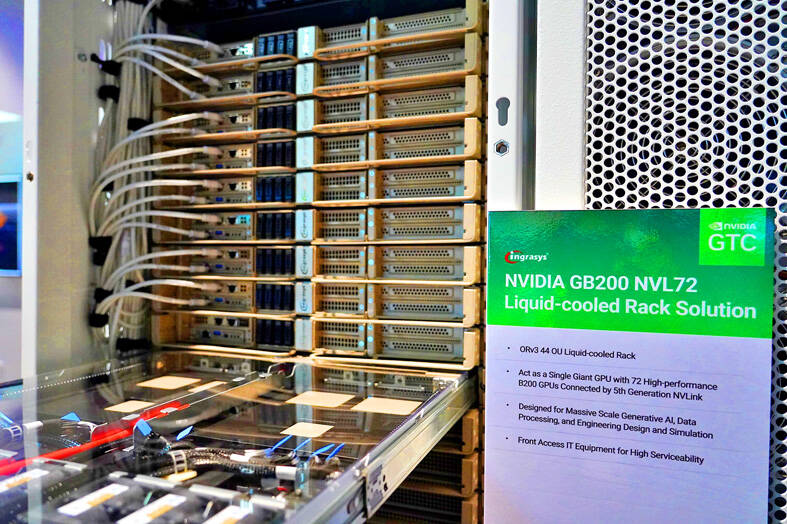

Hon Hai Technology Group (鴻海科技集團) yesterday showcased its latest liquid-cooled server racks at Nvidia Corp’s developers’ conference in San Jose, California, with the products aimed at helping customers build artificial intelligence (AI) data centers.

The racks are developed by Hon Hai subsidiary Ingrasys Technology Inc (鴻佰科技) and support Nvidia’s new GB200 flagship chip, Hon Hai said in a statement.

To fuel a new wave of generative AI applications, Ingrasys is leveraging the Nvidia GB200 NVL72, a next-generation AI liquid-cooled rack solution, Hon Hai said.

Photo courtesy of Hon Hai Technology Group via CNA

“Our collaboration with Nvidia helps us deliver the latest accelerated computing technologies to our customers so they can build AI-powered data centers to suit a wide range of applications,” Ingrasys president Benjamin Ting (丁肇邦) said.

Complementing Ingrasys’ rack solution is an advanced liquid-cooling technology, which Hon Hai has been working on for at least five years to address heat management issues for server or data center operators.

Liquid cooling and high-speed switch manufacturing are keys to enhancing graphics processing unit performance, as they help improve the performance of AI servers and optimize power consumption, eventually reducing operational costs for customers, Hon Hai chairman Young Liu (劉揚偉) said last week.

Wiwynn Corp (緯穎), a supplier of cloud infrastructure for data centers, also displayed its latest AI server racks based on the Nvidia GB200 NVL72 system, along with its rack-level liquid-cooling management system, at the developers conference.

The company would continue collaborating with Nvidia to develop optimized and sustainable solutions for data centers in the generative AI era, Wiwynn chief executive officer Sunlai Chang (張順來) said in a separate statement.

When an apartment comes up for rent in Germany’s big cities, hundreds of prospective tenants often queue down the street to view it, but the acute shortage of affordable housing is getting scant attention ahead of today’s snap general election. “Housing is one of the main problems for people, but nobody talks about it, nobody takes it seriously,” said Andreas Ibel, president of Build Europe, an association representing housing developers. Migration and the sluggish economy top the list of voters’ concerns, but analysts say housing policy fails to break through as returns on investment take time to register, making the

‘SILVER LINING’: Although the news caused TSMC to fall on the local market, an analyst said that as tariffs are not set to go into effect until April, there is still time for negotiations US President Donald Trump on Tuesday said that he would likely impose tariffs on semiconductor, automobile and pharmaceutical imports of about 25 percent, with an announcement coming as soon as April 2 in a move that would represent a dramatic widening of the US leader’s trade war. “I probably will tell you that on April 2, but it’ll be in the neighborhood of 25 percent,” Trump told reporters at his Mar-a-Lago club when asked about his plan for auto tariffs. Asked about similar levies on pharmaceutical drugs and semiconductors, the president said that “it’ll be 25 percent and higher, and it’ll

NOT TO WORRY: Some people are concerned funds might continue moving out of the country, but the central bank said financial account outflows are not unusual in Taiwan Taiwan’s outbound investments hit a new high last year due to investments made by contract chipmaker Taiwan Semiconductor Manufacturing Co (TSMC, 台積電) and other major manufacturers to boost global expansion, the central bank said on Thursday. The net increase in outbound investments last year reached a record US$21.05 billion, while the net increase in outbound investments by Taiwanese residents reached a record US$31.98 billion, central bank data showed. Chen Fei-wen (陳斐紋), deputy director of the central bank’s Department of Economic Research, said the increase was largely due to TSMC’s efforts to expand production in the US and Japan. Investments by Vanguard International

WARNING SHOT: The US president has threatened to impose 25 percent tariffs on all imported vehicles, and similar or higher duties on pharmaceuticals and semiconductors US President Donald Trump on Wednesday suggested that a trade deal with China was “possible” — a key target in the US leader’s tariffs policy. The US in 2020 had already agreed to “a great trade deal with China” and a new deal was “possible,” Trump said. Trump said he expected Chinese President Xi Jinping (習近平) to visit the US, without giving a timeline for his trip. Trump also said that he was talking to China about TikTok, as the US seeks to broker a sale of the popular app owned by Chinese firm ByteDance Ltd (字節跳動). Trump last week said that he had